Robinhood Is Laying Off Almost a Quarter of Its Employees

Robinhood is laying off almost a quarter of its employees in its second round of layoffs in 2022. Is Robinhood going out of business?

Aug. 3 2022, Published 5:07 a.m. ET

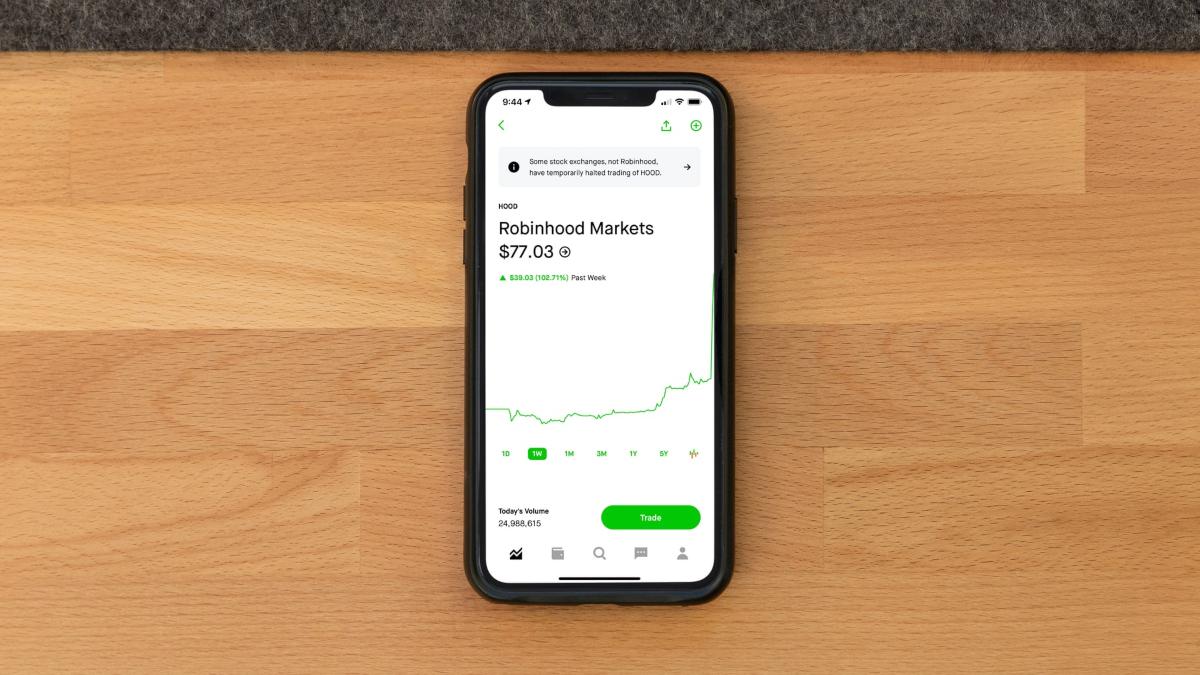

When Robinhood (NYSE: HOOD), the popular retail trading app that went public in 2021, reported its Q2 2022 earnings on Aug. 2, it also announced that it would be trimming its workforce by 23 percent. The company laid off 9 percent of its employees in April as well. Is Robinhood going out of business?

Robinhood’s earnings were largely in line with estimates. Whereas its revenue of $318 million was a tad short of the $321 million analysts were expecting, its per-share loss of 34 cents was below the 37 cents they predicted. However, analysts had tepid expectations from the company.

Robinhood’s revenue is falling

In 2022's second quarter, Robinhood's revenue rose 6 percent sequentially but fell 44 percent year-over-year (it saw record revenue in 2021's second quarter). In the three quarters prior, however, its revenue fell sequentially.

Robinhood's assets under custody also fell by 31 percent year-over-year to $64.2 billion, and its MAU (monthly active user) count has fallen every quarter since Q2 2021, when it peaked at 21 million. In Q2 2022, its MAU count was only 14 million.

Robinhood has announced more layoffs

Robinhood is laying off 23 percent of its workforce, mainly from operations, support, and marketing. The company explained that it overhired in 2021, anticipating continued growth. Like FAANG companies, Shopify, and Oracle, Robinhood seems to be now realizing that the turbo-charged growth it saw in 2021 isn't sustainable.

Robinhood’s growth is slowing but it's not going out of business

Robinhood reported $6 billion in cash at the end of June, and its market cap stood around $8 billion. Earlier in 2022, its market cap fell below its cash on hand, implying that markets valued its core business as worthless. And the SEC might soon order Robinhood to change its business model to one where it doesn't charge customers directly for stock trades.

The company could be an acquisition target, though: in May, FTX founder Sam Bankman-Fried took a 7.6 percent stake in Robinhood. Bankman-Fried and FTX have been bailing out some smaller cryptocurrency companies amid turmoil in the market. (Given Robinhood’s dual share structure, founders Vladimir Tenev and Baiju Bhatt would need to be on board for any deal.)

What troubles does Robinhood face?

Robinhood’s troubles are mostly related to growth stocks and meme cryptos crashing. Inflation has also held back a lot of retail investors from trading, though some long-term, less speculative market players, such as Warren Buffett, are investing more. Incidentally, Buffett has been quite critical of Robinhood.