A Guide to Understanding Undervalued Stocks and How to Find Them

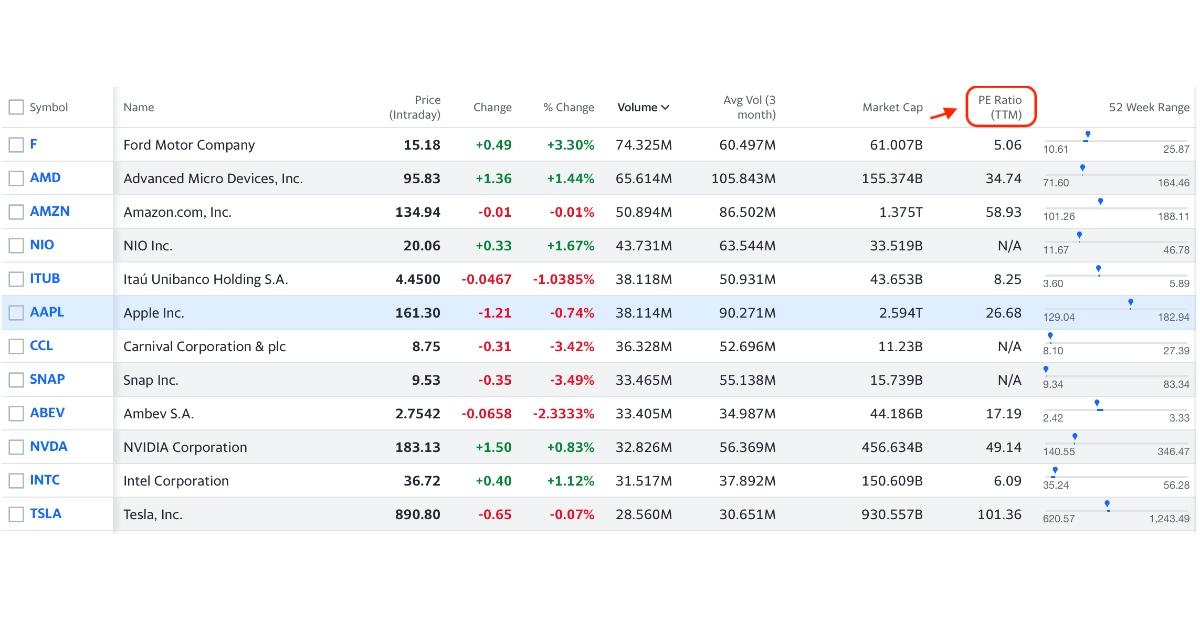

One way to find undervalued stocks is by looking at a company's PE (price-to-earnings) ratio. You can also look at the stock's performance and market cap.

Aug. 3 2022, Published 10:58 p.m. ET

Before you begin investing in the stock market, it’s a good idea to learn about the different categories stocks can fall under, with undervalued stocks being one of them. Undervalued stocks are priced lower than what the market believes is fair, and are usually profitable given your investment is in it for the long term.

Whether you’re new to investing in stocks or are looking to shift gears and try something new, read on to learn all about undervalued stocks and how you can find them. We'll break down how you can look at a company's PE ratio, EPS, market cap, and stock performance to determine if it's undervalued. Keep reading for all of the details.

What are undervalued stocks?

Undervalued stocks are stocks that trade at a lower price than what the market assumes is fair. You should think of an undervalued stock as a valuable item going on sale. For example, let’s say you went to the store to purchase a pair of Gucci shoes for $2,000 and found out that by simply returning the following day, you could buy them at half the price, making them only $1,000.

While the shoes will still hold their value, you’ll be able to buy them at a discounted price. The concept behind undervalued stocks is similar to this scenario. You’re essentially buying stocks at a lower price than what the market believes they're worth.

Here are a few steps you can take to help you identify and invest in undervalued stocks.

If your interest in undervalued stocks has recently grown, then you’ll want to pay close attention to the steps outlined below. The steps will help you identify when a stock is priced lower than it should be.

Study PE ratios for stocks in the same industry.

The PE ratio is a metric used to compare a stock’s current price to its profits. Simply put, it helps you determine if the company has valued its stock appropriately, or if it's priced too high or too low. When comparing a stock’s PE ratio with that of another in the same industry, if you find it's lower, it could signal that it's an undervalued stock.

How is the PE ratio calculated?

The PE ratio can be calculated by dividing the price per share, or the price a company's stock is trading at, by the EPS (earnings per share).

*PE ratio = Price of a company’s stock/earnings per share

The EPS can be calculated by dividing a company’s net income by the number of shares a company has outstanding. Companies generally report their earnings every quarter, or four times a year, and serve as a good way to measure their profitability.

Here’s an example. Let’s say you’re interested in buying Company A’s stock, which is priced at $20 per share. Company A also earns about $200,000 annually. Since going public, Company A has issued 50,000 shares of stock. To calculate the EPS, you would divide the company’s annual earnings ($200,000) by the number of outstanding shares (50,000), and you get an EPS of 4.

Now that you have the EPS, you can calculate the PE ratio. If the company is selling its shares at $20 each, you would divide 20 by the EPS, which is 4. Your answer is 5 and represents a fairly low PE ratio for the company you're considering investing in.

With a PE ratio of 5, this figure implies that it would take the company five years at the current price and profit levels to pay back all of its shareholders in full.

As a rule of thumb, if you're going to use the PE ratio to compare a company’s stock, only choose those in the same industry. While you can calculate the PE ratio yourself, the easiest way to determine a stock’s PE ratio is to use platforms such as Yahoo Finance that lay out all of a stock’s details.

Now, although a high PE ratio might indicate that a company has overvalued its stock, it could also mean there's potential for the company to grow. In the event you come across a stock with a negative PE ratio, it means it isn't profitable at that time.

Here are some key takeaways on the PE ratio and EPS.

According to author and investor Phil Town, “It’s much better to look at the growth of EPS over time as well as EPS compared to cash flow rather than taking EPS as face value.”

Akshat Shrivastava, who has 1.14 million subscribers on YouTube and is a partner at the investment firm Next EsVentures, says that “if the PE ratio is less than 30 go buy a stock” and “if the PE ratio is more than 30, it’s overvalued, don’t buy it.”

Now, although PE ratios can help an investor decide whether a stock is undervalued or overpriced, it's only one of several things you should use when searching for undervalued stocks. Therefore, you shouldn't rely solely on the PE ratio.

Another way to decipher whether a stock is undervalued is by looking at a company’s market cap.

The market capitalization or market cap will help you determine what a stock is worth. While many finance platforms tell you exactly what a company’s market cap is, you can calculate the number yourself. To do this, you would need to multiply the current price of the stock by the total number of shares currently held.

When using a company’s market cap to determine whether a stock is undervalued, you would need to look at the current stock price and compare it to the stock price of its competitors. If the company is valuable and is offering its stock at a much lower price than that of its competitors, this might indicate it's undervalued.

For example, let’s say you wanted to invest in Meta Inc., formerly known as Facebook. It would be wise to compare the company’s PE ratio and market cap with that of Snapchat, Twitter, LinkedIn, and any other tech platforms that offer similar services and are growing at a similar rate.

A company’s stock performance can also help determine if it's undervalued.

If a company’s stock is gradually trending upward and has a fairly low PE ratio, it could be an indicator that it's undervalued. Many investors will use the price-to-earnings growth ratio (PEG) when trying to decide if a company’s stock is priced lower than it should be.

The PEG uses a company’s PE ratio and divides it by the growth rate of its earnings, according to Investopedia. Generally, the lower the PEG ratio is, “the more the stock may be undervalued.”

The selection of undervalued stocks is constantly changing.

The list of undervalued stocks is always changing. Therefore, you’ll want to consider things like the market cap, the PE ratio, and the stock’s overall performance when trying to weed out undervalued stocks. For example, back in mid-July 2022, Netflix stock was presumed to be undervalued after its stock price fell and the company lost subscribers.

With a PE ratio below its competitors, The Motley Fool considered this stock to be undervalued at the time.

Around the same time, U.S. News highlighted these stocks as being undervalued:

- Exxon Mobil Corp. (XOM)

- Pfizer Inc. (PFE)

- AbbVie Inc. (ABBV)

- Bank of America Corp. (BAC)

- Merck & Co. Inc. (MRK)

- Broadcom Inc. (AVGO)

- Comcast Corp. (CMCSA)

While these stocks may still be undervalued at the time of this writing, it’s important to understand that the price per share can fluctuate, which could result in the stock becoming appropriately valued. Therefore, you’ll want to use the steps outlined above, your own judgment, and possibly some advice from a skilled financial adviser or stockbroker as you begin searching for undervalued stocks.

Why should you invest in undervalued stocks?

Undervalued stocks give you the ability to purchase shares of a company’s stock at a price that's lower than what they're actually worth. If the company is profitable and has growth potential, the price per share could gradually increase, which would allow you to collect a return on your investment.

Warren Buffett thinks that undervalued stocks are a good deal.

Warren Buffett is arguably one of the world’s most successful investors to date. As the CEO of Berkshire Hathaway, Buffett has a net worth of $102 billion. It isn't a secret why many investors flock to Buffett for investment advice.

CNBC shared that during a 2004 Berkshire Hathaway annual meeting, Buffett said, “When stock can be bought below a business’s value it is probably the best use of cash.”

Consider these factors before investing in undervalued stocks.

While investing in undervalued stocks makes sense, it’s a good idea to choose companies you’re familiar with or at least understand how they generate profits. If you buy stock in a company and you have no clue about how it operates or makes money, it could put you at risk of investing in something that doesn’t have a bright future.

When you decide to invest in a company that interests you, you’re likely to have a clearer understanding of where it's headed and the chances of being able to withstand its competition.