Cheapest and Most Undervalued Stocks That Could Outperform in 2022

While there are pockets of overvaluation, some underperforming stocks in 2021 look undervalued heading into 2022. Here are four such stocks.

Dec. 30 2021, Published 8:16 a.m. ET

Overall, 2021 turned out to be another good year for the U.S. stock market. There has been a glaring gap between the top and bottom performers. While there are pockets of overvaluation, some underperformers in 2021 look undervalued as we head into 2022.

Looking at the forward PE multiples of S&P 500 companies, most energy and material companies trade below their long-term trading multiples. While they might appear undervalued, the valuation of cyclical companies can be confusing since their multiples bottom near the cyclical peaks.

There are four cheap and undervalued stocks to buy for 2022.

The following four stocks look undervalued based on the context of their long-term growth potential.

- Meta Platforms

- Paysafe

- Peloton

- General Motors

All of these stocks are off their 2021 highs. Peloton and Paysafe are down sharply for the year.

What makes Meta Platforms an undervalued stock?

Baird analyst Colin Sebastian has selected Meta Platforms and Amazon as his top picks for 2022. For 2021, he selected Alphabet, which was the top-performing FAANG stock for 2021.

There are valid reasons why Meta Platforms stock looks undervalued. It's the cheapest FAANG stock and its valuations are at a discount to the long-term averages. The company’s pivot towards metaverse is an underappreciated opportunity. The strong network effect of the company’s social media platforms is also undervalued.

PSFE stock valuation

Paysafe appears to be among the cheapest fintech stocks.

Paysafe stock has had a turbulent ride and is now a penny stock. It was among the most high-profile SPAC mergers of 2021 and merged with a blank-check company sponsored by Bill Foley. The stock trades at an NTM EV-to-EBITDA multiple of 11.7x, which looks attractive.

There are concerns about the company’s short-term outlook. However, it has a reasonably strong long-term growth outlook and a high-margin business. The next round of growth for the company will come from international expansion and the iGaming market. While Paysafe’s top line isn't growing as fast as other fintech names, at the current prices, it appears to be among the cheapest and most undervalued stocks to buy for 2022.

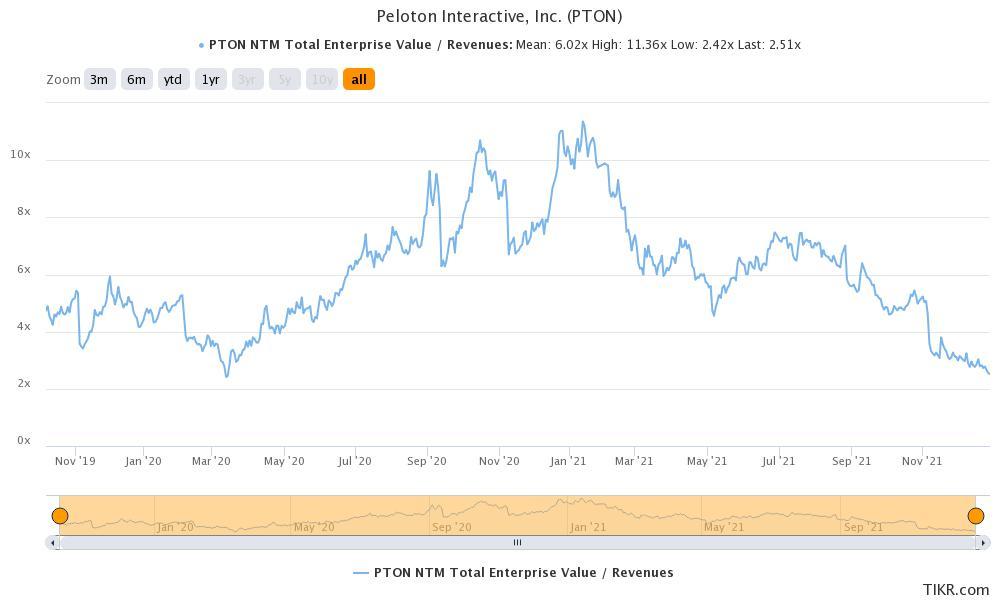

Peloton stock looks undervalued after the crash.

Overall, 2021 has been a terrible year for Peloton and it’s the worst-performing stock of the Nasdaq 100. It was a perfect storm for the company in 2021 and nothing went right. From slowing growth, supply chain issues, a fatal accident, the resultant recall, and finally bad publicity, everything that could go wrong did go wrong for Peloton in 2021.

Looking forward to 2022, Peloton stock looks like an attractive and undervalued bet. Macquarie analyst Paul Golding is among those who find the stock attractive. The stock trades at an NTM EV-to-sales multiple of 2.5x, which is the lowest since the March 2020 lows.

There are still challenges for Peloton and it needs to rebuild the battered brand. However, at the current prices, it looks undervalued with an attractive risk-reward.

General Motors stock could outperform in 2022.

In 2021, General Motors (GM) stock underperformed Ford, whose market cap surged above GM for the first time in five years. GM stock looks relatively undervalued at the current prices. Markets aren't fully appreciating the company’s EV and autonomous plans, which makes it a re-rating candidate.