Bond Market Reform Is a Priority for Policymakers

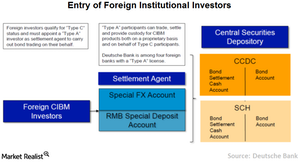

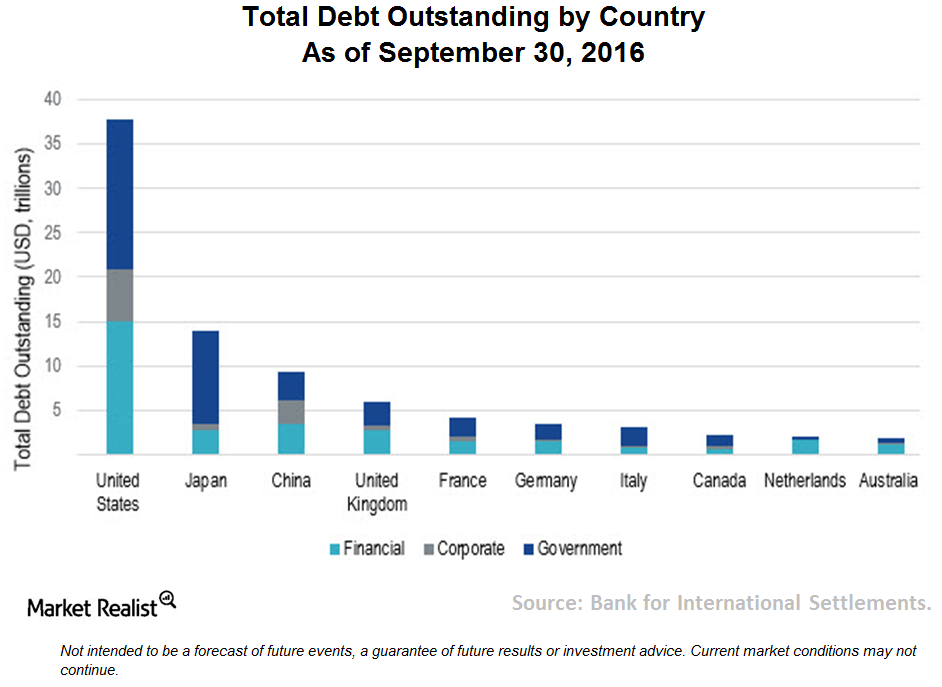

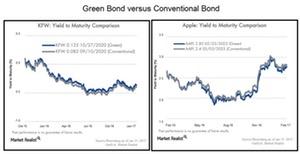

In the third and final phase of bond (EMB) reforms that began after 2015, the substantial activities of the market were open to global investors.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.