China’s Onshore Bond Market Reforms

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

May 30 2017, Updated 1:15 p.m. ET

VanEck

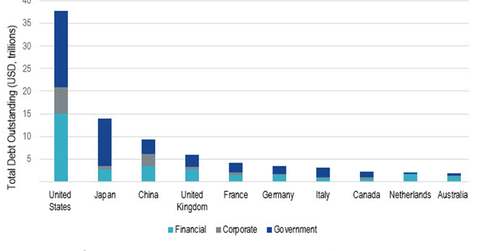

A somewhat incredible fact of global bond markets is that the third largest market in the universe is not included in any major index. The exclusion of China from global bond indices has merit; the onshore Chinese bond market was, until several years ago, closed to foreign investors. Through a very deliberate, and directionally consistent process of liberalization, onshore Chinese bonds may become a significant weight in many, or most, global bond portfolios within the next two years. The impact on emerging markets bond indices and fund weightings will be even more significant.

The onshore Chinese bond market in total has a market value of approximately US$9 trillion, placing it third between Japan (US$14 trillion) and the United Kingdom (US$6 trillion), according to the Bank for International Settlements.

Market Realist

China has opened up its onshore bond market

China’s onshore bond market (EMLC) (EMAG) (IGEM), consisting of locally denominated and issued bonds, is larger than the offshore bond market. It offers a number of opportunities for global investors seeking higher yields and diversification benefits.

Easing restrictions

Until recently, people outside of China were not allowed to invest in China’s onshore bond (LEMB) (ELD) market, also known as CIBM (China Interbank Bond Market). That was mainly to control capital outflows and thwart downward pressure on the renminbi. However, in order to develop a mature and liquid bond market and attract foreign capital, China provided bond market access to foreign investors in February 2016. The revised rules allowed foreign investments in the onshore bond market without restrictions on repatriation, trading quotas, and lockup periods.

Attractive opportunities

The opening up of China’s onshore bond (PCY) (VWOB) market could offer attractive avenues to global investors in the months ahead due to their higher yields and low correlations to developed countries’ bonds. As a result, global capital could see a higher allocation to the Chinese market at the expense of other countries, including emerging markets. The process could gain further strength with the inclusion of onshore Chinese bonds in global indexes.