WisdomTree Emerging Market Local Debt Fund

Latest WisdomTree Emerging Market Local Debt Fund News and Updates

Improving Economies Make Strong Case for EM Local Debt

As the emerging market local debt assets (EBND) (ELD) continue to evolve and expand, investors are increasingly looking for opportunities in the space to enhance returns.

What’s Driving Emerging Markets Local Currency Debt?

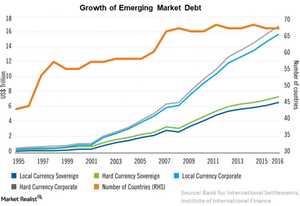

During the past two decades, EM (emerging markets) local debt has evolved to become the largest and most liquid debt market within the emerging market bond space.

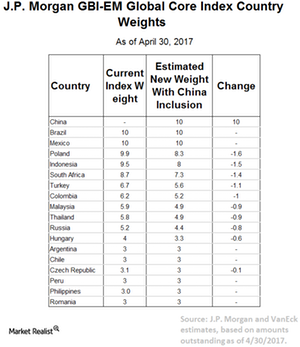

What Difference Does Index Inclusion Make?

Government bond yields in China are higher than its Asian counterparts such as South Korea and Singapore and much higher than major developed markets.

How Higher Inflows to China Could Impact Other Emerging Markets

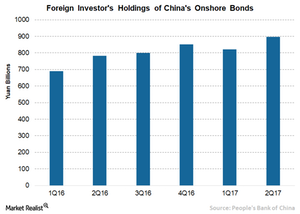

With the onset of reforms, foreign holdings in China’s onshore bond (EMB) (PCY) market is gradually increasing.

China’s Onshore Bond Market Reforms

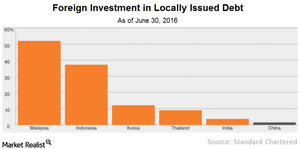

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

The Rally in Emerging Market Debt

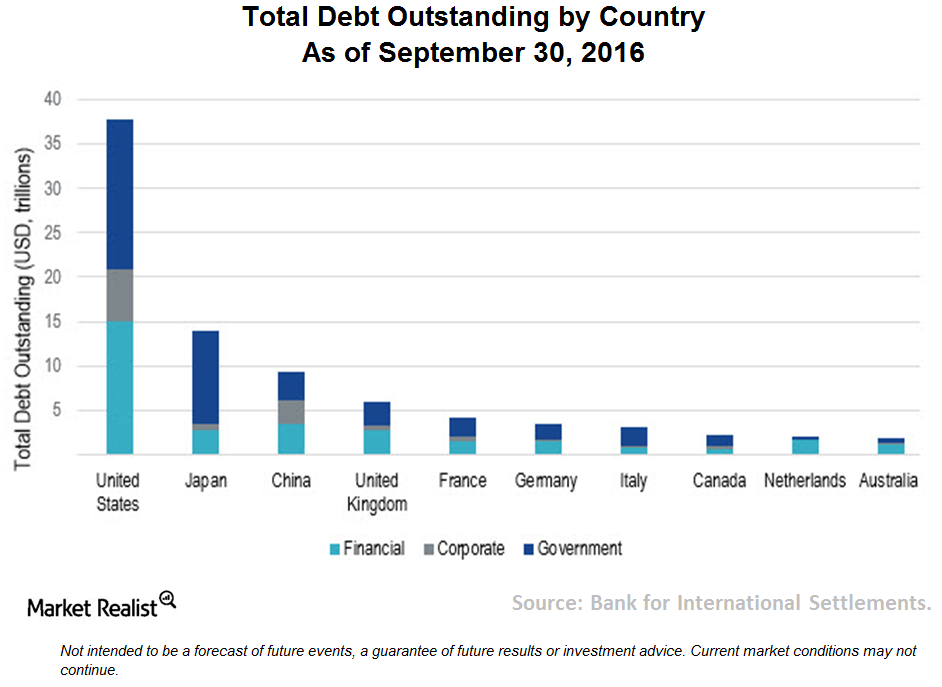

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.