Vanguard Emerging Markets Govt Bd ETF

Latest Vanguard Emerging Markets Govt Bd ETF News and Updates

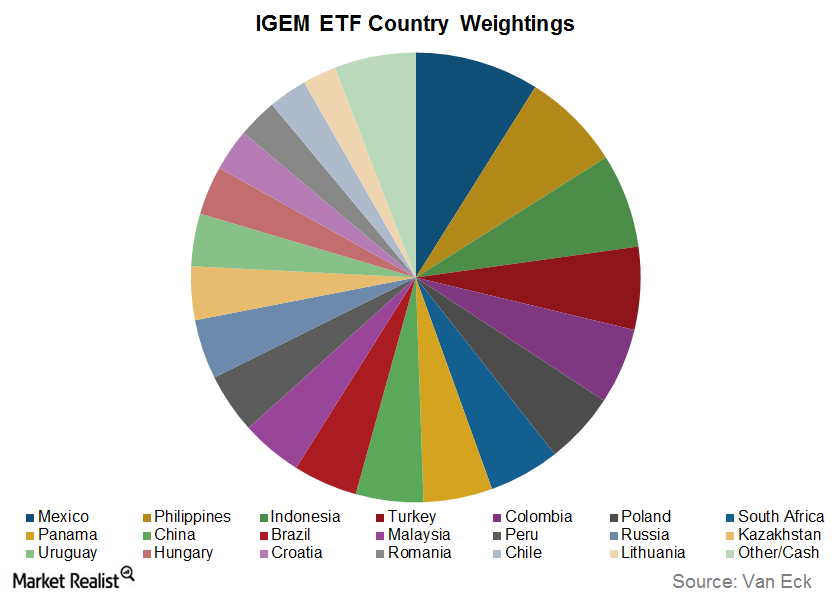

Inclusion of Chinese Onshore Bonds in Global Indexes

In March 2017, Citi’s fixed income indexes decided to include onshore Chinese bonds (EMB) (PCY) in its three government bond indexes.

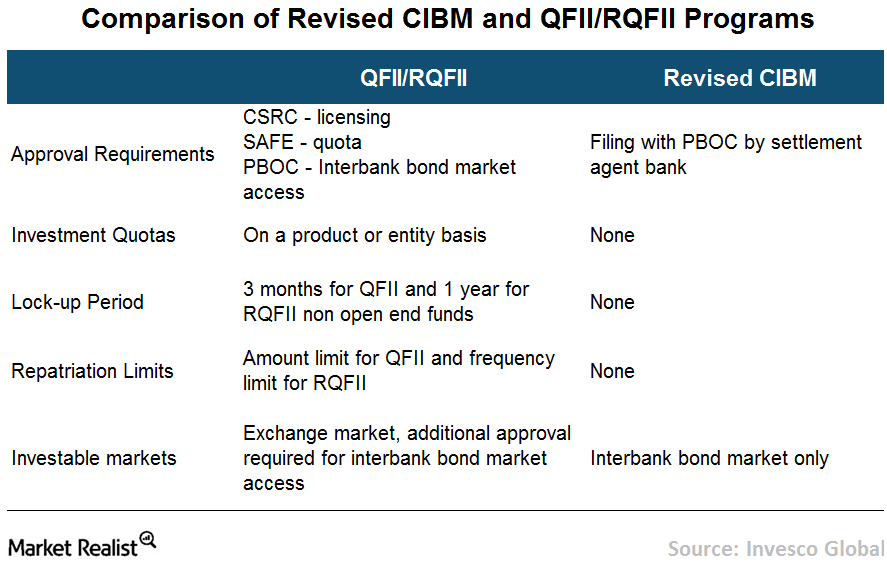

China’s Baby Steps to Open Its Onshore Bond Market

The opening of China’s onshore bond market (EMB) (PCY) was a gradual process that included a number of cautious measures.

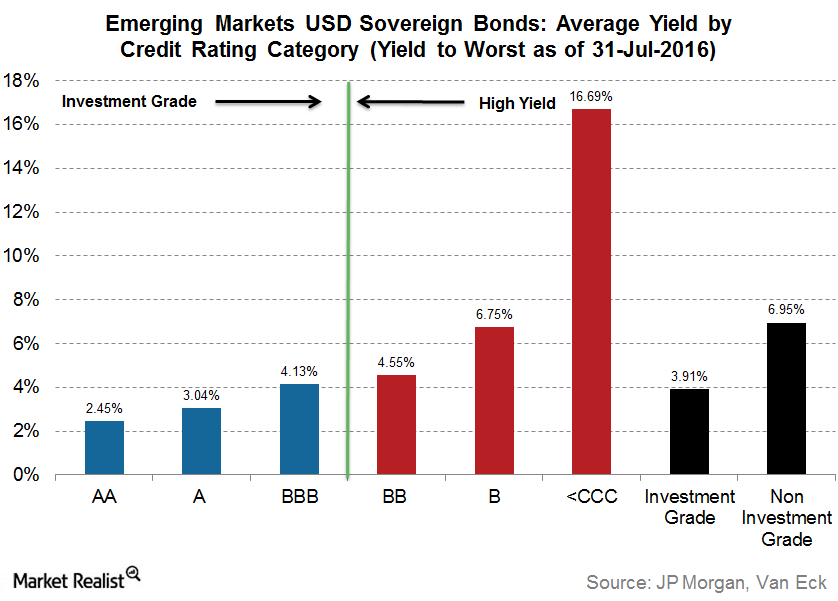

Quality May Provide Attractive Risk-Adjusted Returns

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.

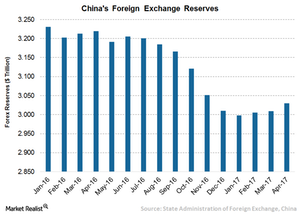

Could China Attract Higher Inflows after Bond Market Reforms?

The yuan remains a focus of attention of the international community and a key risk for China’s macroeconomic stability in recent years.

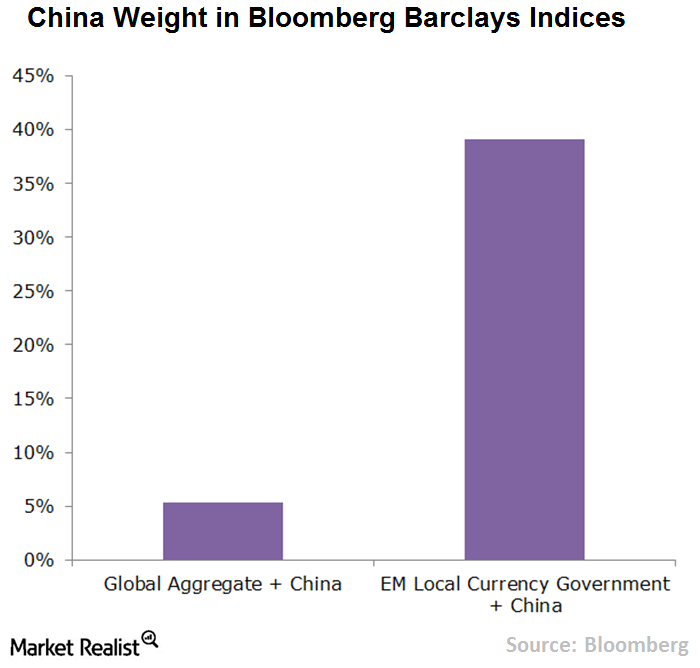

What Difference Does Index Inclusion Make?

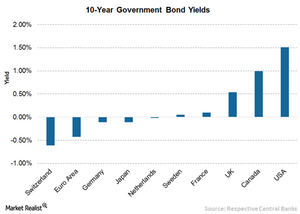

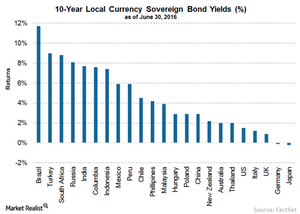

Government bond yields in China are higher than its Asian counterparts such as South Korea and Singapore and much higher than major developed markets.

China’s Onshore Bond Market Reforms

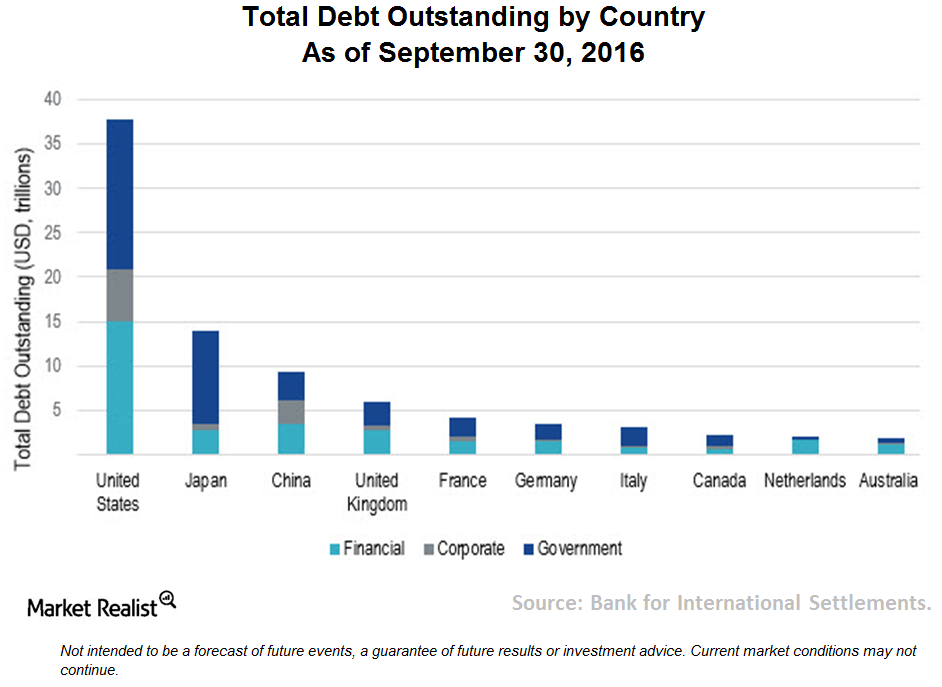

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

Emerging Market Bonds: Higher Yields Could Reflect Higher Risks

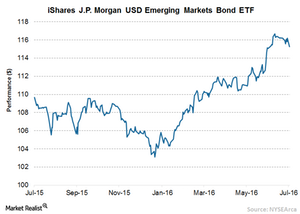

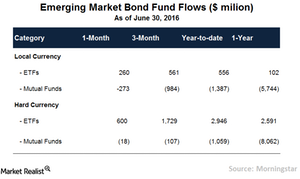

Emerging market bonds have been doing extremely well over the past couple of months. EM debt funds have been in the green for seven consecutive weeks.

Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

Intense Search for Yield Leads to Emerging Market Debt

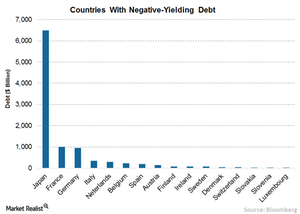

Under the current uncertain economic circumstances, investors flocked to emerging market debts in search of higher yields.

Central and Eastern Europe Have the Brexit Blues

In the long term, Eastern Europe is largely affected by the United Kingdom’s exit from the European Union because of its strong trade links.

How Negative Rates Intensify the Hunt for Yield

By early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index1 trading below 1%.

Time to Look at Emerging Market Debt

Global emerging markets (“EM”) debt, both hard and local currency, rebounded strongly in June after a significant retracement in May.