Will Amazon Initiate Dividends in 2021 as Bezos Departs as CEO?

When will Amazon (AMZN) pay dividends and will Jeff Bezos’ departure as the CEO impact the decision?

March 1 2021, Updated 12:44 p.m. ET

Despite U.S. tech giants' mammoth profits, they have been frugal with their dividends. Looking at the FAANG companies (Facebook, Apple, Amazon, Netflix, and Alphabet), only Apple pays a dividend. Amazon CEO Jeff Bezos is set to relinquish his post later this year. He will transition to the role of executive chairman. Many investors wonder when Amazon (AMZN) will pay dividends and whether Bezos’ departure as the CEO will impact the decision.

When it comes to returns from stocks, investors get two income streams. One is of course the dividends that the companies pay. The second part is capital appreciation, which in most cases accounts for the bulk of the returns.

Amazon's stock performance

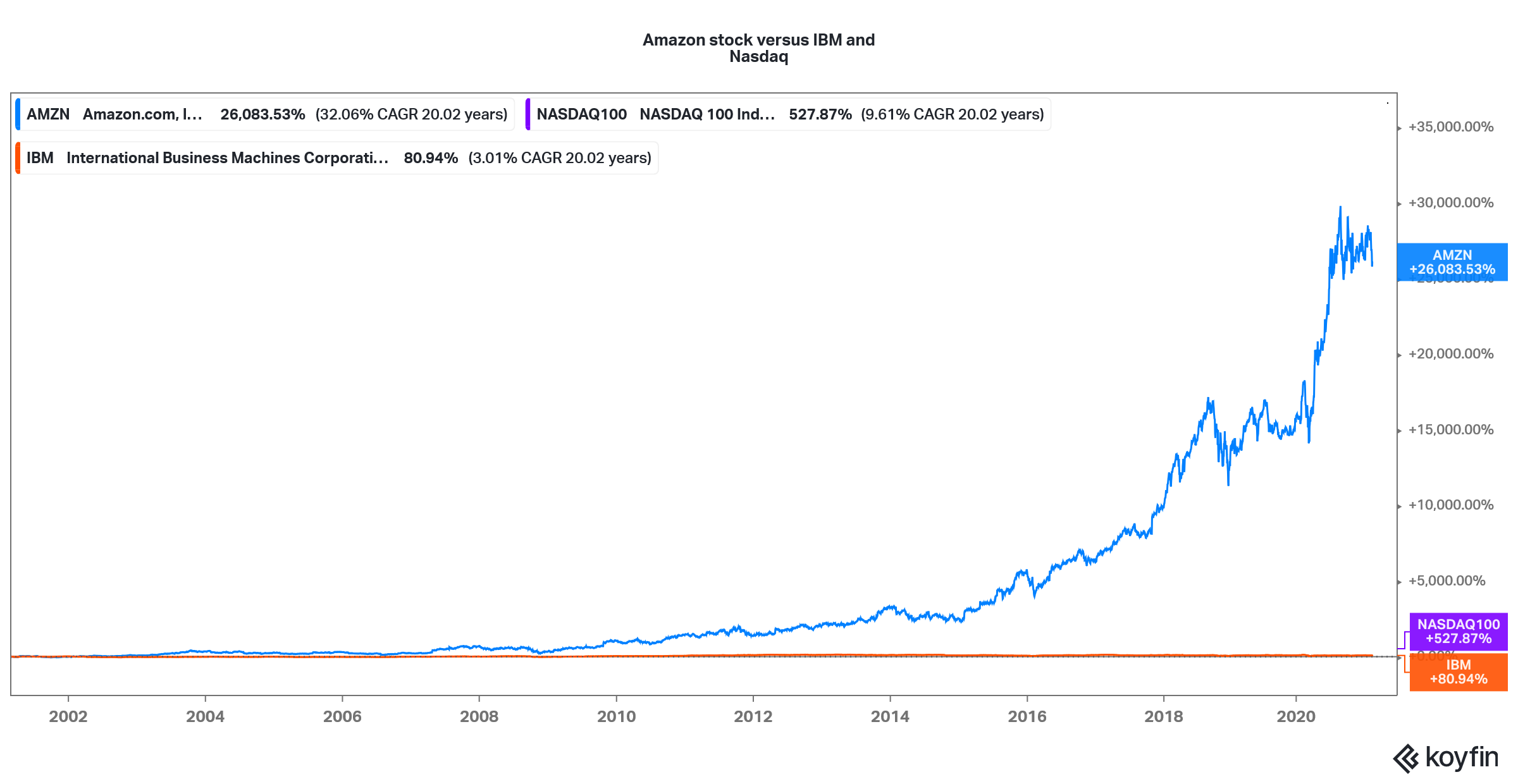

While Amazon doesn't currently pay a dividend, the appreciation in its stock price has more than made up for the lack of a dividend. AMZN stock has delivered a CAGR of over 32 percent over the last 20 years. This is more than three times the 9.6 percent CAGR that the tech-heavy Nasdaq 100 Index has delivered.

Amazon stock versus IBM and Nasdaq 100

To get a sense of how compounding works, in absolute terms, AMZN stock has risen by 26,083 percent over the last 20 years compared to a 528 percent increase in the Nasdaq 100 Index.

IBM, which currently has a splendid dividend yield of 5 percent, has only increased by 81 percent over that period. Even if we add all the dividends that IBM stockholders earned over the last 20 years, the total returns would be nowhere near what Amazon has delivered.

U.S. tech companies are averse to dividends

Even Apple didn't pay any dividends between 1996 and 2012. At the time, Steve Jobs was the company’s CEO and Apple was focusing on reviving its growth. In 2011, Tim Cook, Apple’s current CEO, took over from Jobs. Within a year of Cook's appointment, he restored the dividend and also announced a buyback program.

Activist investors including Carl Icahn have also been instrumental in Apple increasing its shareholder payouts. Since 2012, Apple has been paying regular dividends and announcing massive buybacks to keep its cash kitty from bloating more.

In general, U.S. tech companies have been averse to dividends and have chosen to spend the cash on growth including through mergers and acquisitions. Also, they have been more conducive to Adhoc stock buybacks instead of regular dividends.

Can Amazon pay dividends?

For any company to be paying dividends, it should be sustainably profitable and generating healthy free cash flows. Amazon posted a net income of $21.3 billion in 2020. Its free cash flows were $31 billion in 2020 compared to $25.8 billion in 2019. Even after accounting for principal repayments of finance leases and financing obligations, Amazon generated free cash flows of $20.3 billion in 2020.

Amazon had total cash and cash equivalents including restricted cash of $42.3 billion at the end of 2020 compared to $36.4 billion at the end of 2019. Clearly, from a sustainable earnings and free cash flow perspective, Amazon has the firepower to initiate the dividend.

Why Amazon doesn't pay dividends

Markets have different expectations from different companies. Investors in mature industries, banks, and utility companies expect them to share most of their profits as shareholder payouts—either in the form of dividends or buybacks.

However, investors have different expectations from high-growth companies, especially in the tech industry. For example, while Tesla is now a net debt negative company after the massive stock issuances in 2020, no one expects it to initiate a dividend anytime soon.

When eBay initiated its dividend in 2019 under pressure from funds that wanted it to increase stockholder payout, many people were critical of the company and saw it as a sign that it has run out of growth and investment ideas.

Particularly, Jeff Bezos hasn't been a fan of dividends and share buybacks. Although Amazon has done some stock repurchases in the past, they are quite low considering the company’s size. Instead, Bezos has been looking at acquisitions and growth. Amazon is spending heavily on growth in some international markets like India.

Will Amazon pay dividends in 2021?

Bezos will be Amazon's executive chairman. Sooner or later, the company might face pressure from some activist investors to consider a dividend or a big buyback. So far, the returns from AMZN stock have been phenomenal and investors haven’t been keen on a dividend.

However, the stock has sagged for the last six months. If the stock continues to sag for another year, we could see demands for shareholder payouts. Some might even push the company for a stock split like Tesla and Apple did in 2020.