Why Investors Should Buy Tilray Stock Before Reddit Traders Take Note

Tilray has fallen sharply over the last month. However, TLRY looks like a good marijuana stock to buy. The stock's forecast looks positive.

Sept. 21 2021, Published 1:51 p.m. ET

Marijuana stocks have looked weak over the last month and Tilray (TLRY) stock has lost 16 percent during this period. What’s the forecast for TLRY stock and is it a good marijuana stock to buy now?

In the first quarter of 2021, there was a sharp rally in Tilray stock as Reddit traders triggered a short squeeze. This was before the company merged with Aphria. However, Tilray stock subsequently fell as the spike led to a juicy merger arbitrage between Tilray and Aphria.

Why Tilray stock is going down

Tilray stock has been going down due to the macro weakness in the marijuana industry as well as company-specific factors. Looking at the marijuana sector ETFs, the AdvisorShares Pure US Cannabis ETF (MSOS) is down 10 percent over the last month. TLRY has fallen more than marijuana ETFs amid concerns about dilution.

Tilray intends to issue more shares to fund its growth, especially through inorganic acquisitions. In the first quarter of 2021, several companies went on a share-selling spree amid the Reddit frenzy. Also, over the last year, several electric vehicle companies have issued more shares and NIO filed for a new share sale in September.

When the stock market sentiments were overtly bullish, many share issuances were celebrated and markets saw them as a sign of “growth.” However, over the last few months, markets have turned apprehensive of companies issuing shares in a frenzy. Growth optimism has been overshadowed by dilution fears.

TLRY stock forecast

Tilray’s average target price of $16.75 represents an upside potential of almost 50 percent over current prices. Among the 10 analysts polled by TipRanks, three rate TLRY as a buy, while the remaining seven analysts rate it as a hold.

Why Tilray looks like a good marijuana stock to buy now

There are several reasons why Tilray looks like a good marijuana stock to buy now. First, the merger with Aphria has created a marijuana powerhouse with globally diversified operations. The company expects to realize significant synergies from the merger.

Also, Tilray has made a foray into the U.S. marijuana market through its investment in MedMen. Tilray intends to post revenues of $4 billion by fiscal 2024. A large part of the revenues could come through acquisitions. However, the company also intends to grow organically and is looking to almost double the retail market share in Canada to 30 percent by fiscal 2024.

While President Biden’s election win raised hopes of marijuana legalization, the administration has been busy with other things. However, legalization should happen eventually. Keeping marijuana criminalized at the federal level isn't helping as more U.S. states legalize adult-use marijuana.

Also, by legalizing marijuana, the government could help bring marijuana sales from the illegal market to the legal system. It would also help the government raise more taxes.

TLRY looks like an undervalued jewel.

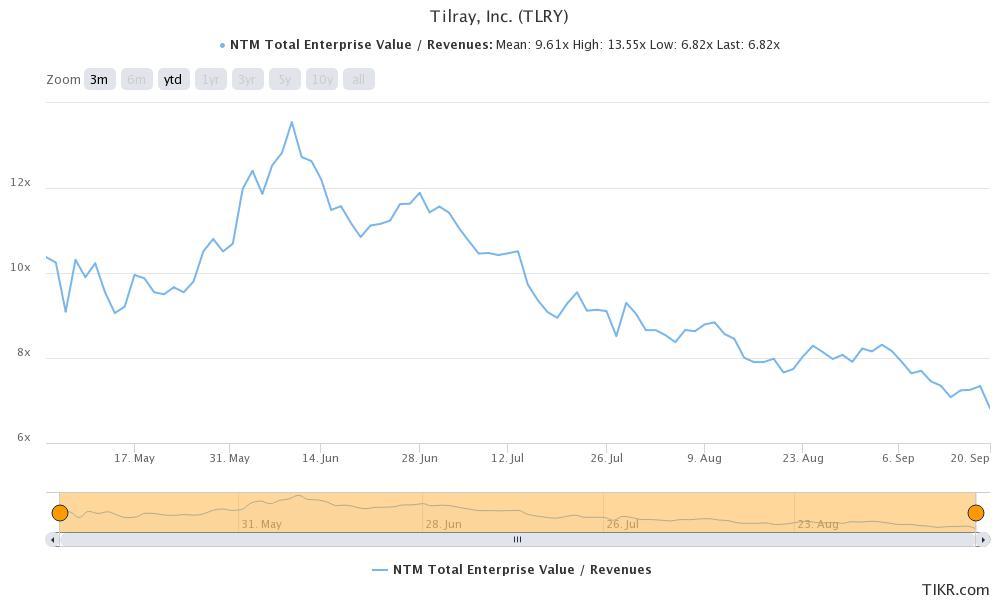

Tilray currently trades an NTM EV-to-sales multiple of 6.82x, which happens to be the lowest level since the merger. The valuations look attractive and TLRY stock looks like a good buy at these prices.

Could Reddit target Tilray stock again?

According to the data from Fintel, the FINRA short volume ratio in Tilray stock was 57 percent on Sept. 20. The short volume ratio is higher than some of the other names that are currently popular on Reddit group WallStreetBets. It won’t be surprising if Reddit traders rediscover \their love for TLRY stock soon and attempt another short squeeze in the marijuana stock.

Any possible short squeeze notwithstanding, Tilray appears to be one of the best marijuana stocks to buy now and bet on a rebound in the industry.