Why Investors Should Choose APHA Over TLRY Before the Merger

While there's some merger arbitrage in the Tilray (TLRY) and Aphria (APHA) merger, investors should buy APHA stock instead of TLRY.

March 5 2021, Published 9:16 a.m. ET

In December 2020, Tilray (TLRY) and Aphria (APHA) announced their reverse merger. Tilray would acquire Aphria and the new entity would trade under the "TLRY" ticker symbol. The merger is expected to close in the second quarter of 2021. Is there a merger arbitrage opportunity in the TLRY-APHA merger and which of the two stocks should you buy now?

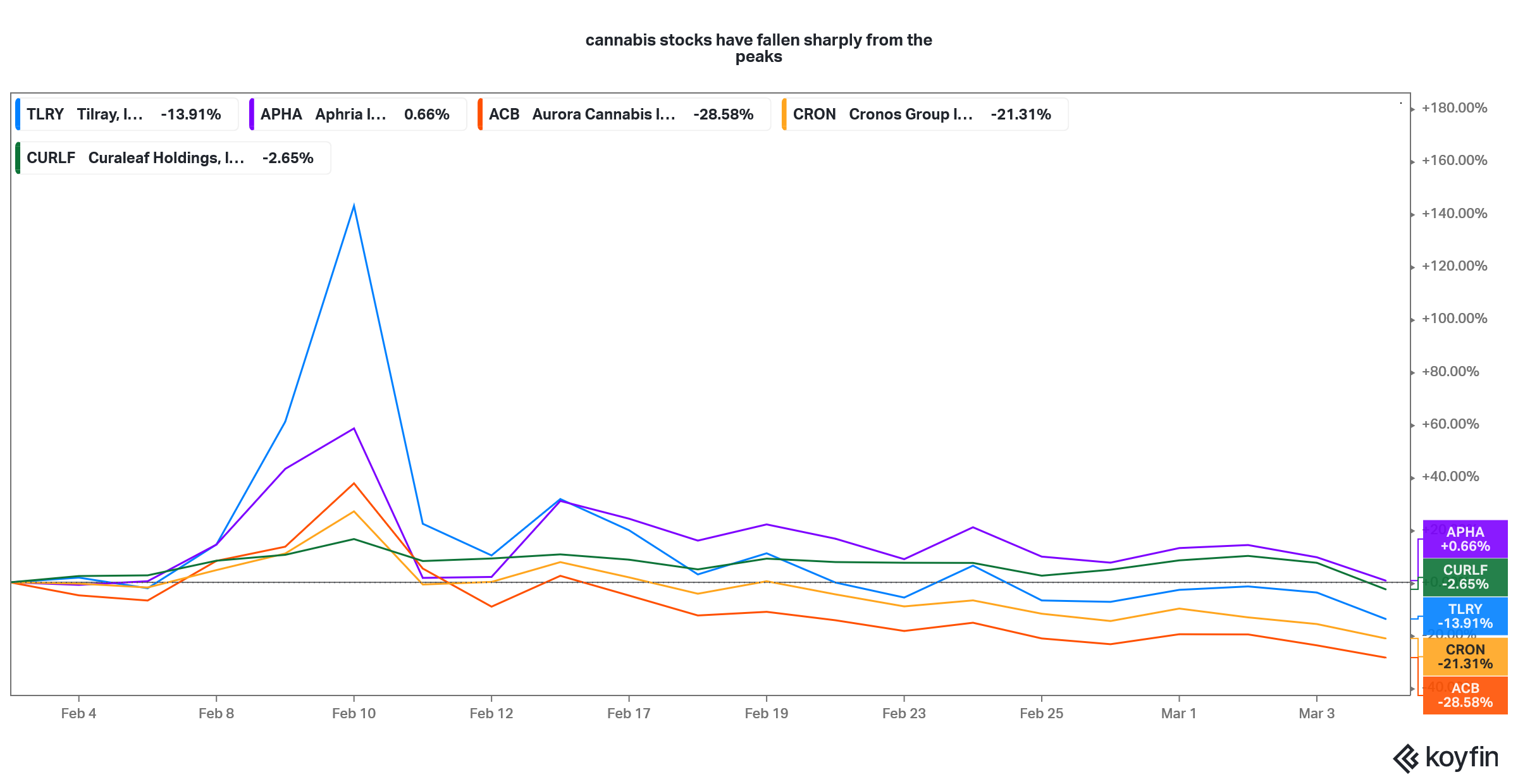

There has been a massive sell-off in all marijuana stocks. Tilray and Aphria have lost 66 percent and 48 percent, respectively, from their peaks. Looking at other marijuana companies, Aurora Cannabis and Cronos Group are down 50 percent and 39 percent, respectively, from their 52-week highs.

Why marijuana stocks are falling

There has been a sharp rally in marijuana stocks since the November 2020 U.S. presidential election. Joe Biden was elected as the 46th U.S. president. Marijuana stocks continued to rally after the Georgia runoff. Green energy is the other prominent sector that has been rallying since the presidential election.

Cannabis stocks have fallen sharply from their peaks

Markets expect the Biden administration to have a more favorable approach towards green energy and marijuana legalization. There are already signs that the administration means business. However, the valuations of marijuana and green energy stocks soared after the rally. These stocks seem to be taking a breather and settling near their fundamental value.

TLRY-APHA merger arbitrage

Subreddit group WallStreetBets targeted short sellers in TLRY stock, which triggered a short squeeze and the stock surged. There wasn’t a similar spike in APHA stock, which presented a juicy merger opportunity. At one point in February, APHA stock was trading at around 0.41x what TLRY was trading.

According to the merger terms, after the merger between TLRY and APHA, APHA stockholders would get 0.8381 TLRY stock for every APHA stock that they are holding. However, APHA stock was trading at half of what it should trade based on the merger ratio. Alternatively, TLRY was trading at twice what it should have based on the merger ratio.

Eventually, the latter turned out to be true and TLRY stock has fallen steeply from its February highs. While APHA stock has also fallen, it has fallen less than TLRY. As a result, APHA now trades at 0.7377x of TLRY based on the March 4 closing prices. That’s still a merger arbitrage opportunity although not as juicy as we had in February.

Is TLRY or APHA a better stock to buy before the merger?

Based on the merger arbitrage, it’s a no-brainer that APHA looks like a better stock to buy before it merges with TLRY. No matter how the two stocks trade before the merger, on the merger date, APHA stockholders would receive 0.8381 TLRY stock for every one APHA stock that they hold.

That said, we also need to look at the fundamentals of these two companies separately. While there shouldn’t be much regulatory hurdle for the merger given the fragmented nature of the marijuana industry, we should also evaluate these companies separately for any eventuality related to the merger.

Tilray versus Aphria valuation

APHA posted an adjusted net profit in the most recent quarter, while TLRY turned EBITDA positive in the quarter. Based on this metric, APHA looks better. Aphria’s top line is also growing at a fast pace compared to TLRY.

Finally, looking at the valuation, APHA trades at an NTM EV-to-EBITDA multiple of 9x compared to 14.4x for TLRY. Overall, based on the standalone fundamentals as well as the merger arbitrage, APHA looks like a better stock to buy compared to TLRY.