After the Tilray Merger, Aphria Stockholders Will See a Change in Their Portfolios

What happened to Aphria stock after the Tilray merger? The merger has already been completed after some delay, and Aphria shares had a name change.

June 3 2021, Updated 9:31 a.m. ET

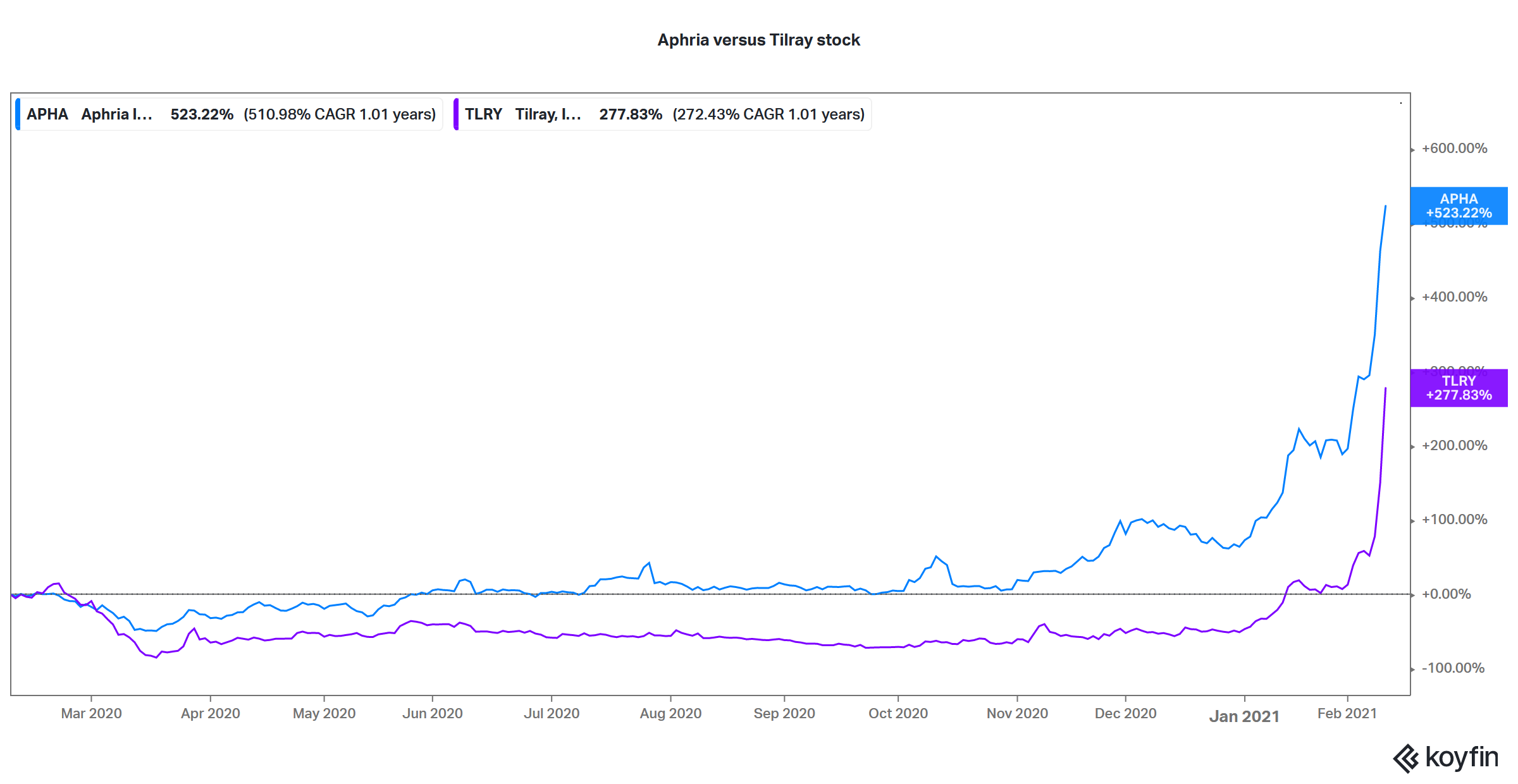

On Dec. 16, 2020, Aphria (APHA) and Tilray (TLRY) announced a merger that has created the world’s largest cannabis company. Both stocks jumped after the announcement as markets welcomed consolidation in an industry marred by perennial losses. Many investors are now wondering what happened to Aphria and Tilray stocks after the merger.

The merger between Aphria and Tilray was completed on May 3, 2021. The transaction was structured as a reverse acquisition, where Aphria acquired Tilray. After the merger completion, the new entity trades under Tilray’s ticker symbol, “TLRY” on both the US and Canadian stock exchanges.

In a press release, Tilray said that the combined entity had proforma revenue of $685 million in the last year. This includes gross revenue of $232 million from the sales of adult-use marijuana. Recreational marijuana sales are expected to soar if marijuana is legalized at the federal level in the U.S., a real possibility now that Democrats control the Senate.

Did the merger with Tilray affect Aphria’s stock price?

As part of the deal, Aphria paid a premium of 23 percent over Tilray’s Dec. 15 closing price. Generally, when a company decides to buy another at a premium, the acquiring company's stock price falls. This was the case when Salesforce acquired Slack. However, in the case of Aphria and Tilray, both stocks rose after the merger news.

What happened to Aphria stock after the Tilray merger?

While Tilray investors have kept their shares after the merger, Aphria stockholders received 0.8381 Tilray shares for each Aphria share that they held. However, it's worth noting that Aphria stockholders were the majority owners, with a 62 percent stake in the combined entity. Aphria has stopped trading and all Aphria shares are now converted to Tilray shares.

The merger had got delayed due to the delay in approval from Tilray shareholders. However, the company lowered the quorum requirement for the shareholder meeting and it was eventually approved overwhelmingly towards the end of April.

Merger arbitrage in the Aphria-Tilray merger

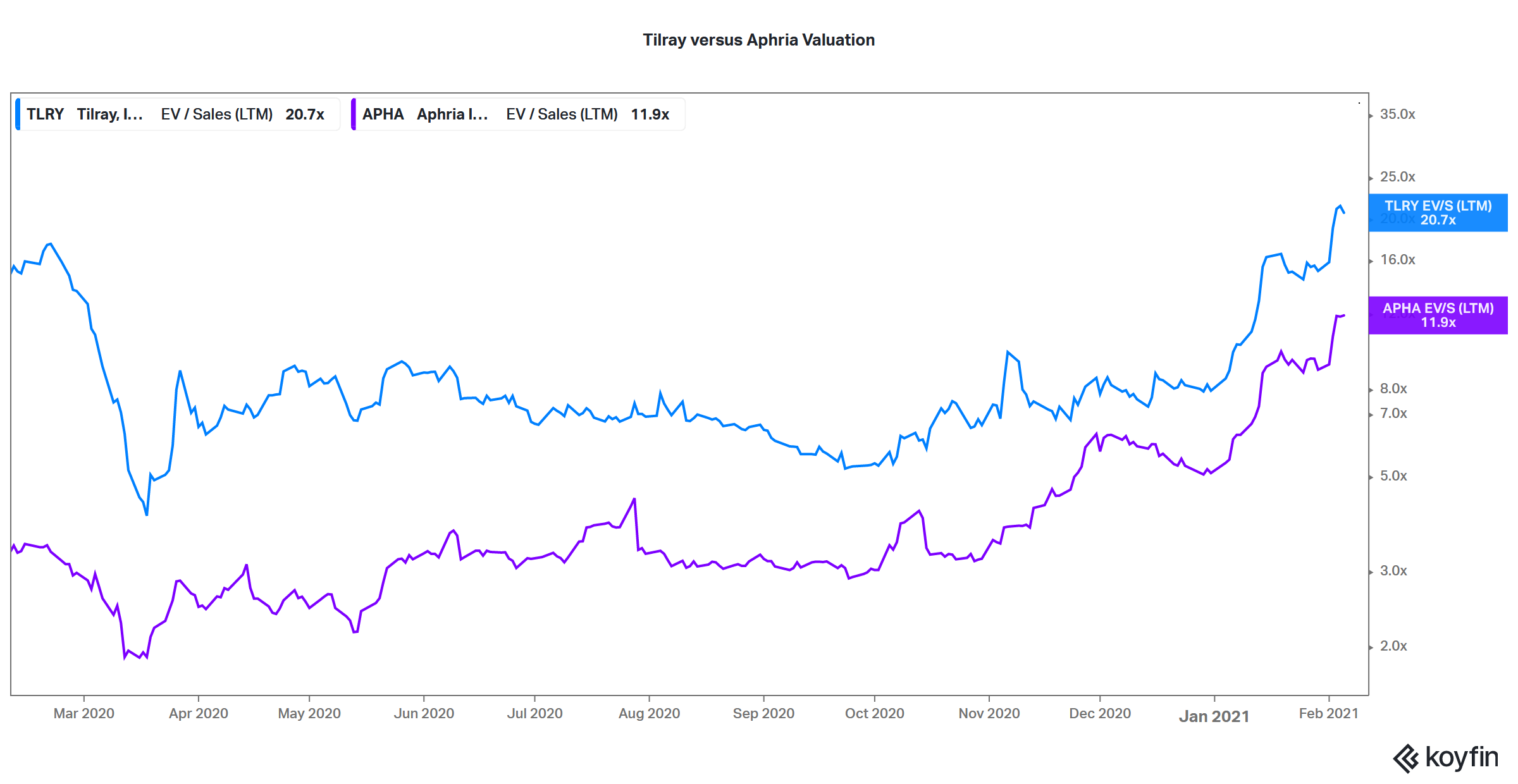

Theoretically, Aphria stock should have traded at 0.8381 times what Tilray traded at before the merger. However, there was an arbitrage opportunity before the merger. For instance, Aphria stock was trading around 0.4115 times Tilray on Feb. 10—less than half of what it should be trading at based on the merger terms.

Aphria stock on Stocktwits

On Stocktwits, a user named tyler3535 has argued that Tilray would have to lose half of its value based on the merger ratio. Meanwhile, oldmaninvestor has pointed out that Aphria stock should be trading at $56.82 based on that ratio, more than twice what the stock is currently trading at.

Is Tilray stock a buy?

Tilray stock has fallen sharply from the peaks. However, it looks a good buy now given the strong fundamentals of the new entity. Cannabis stocks have been on a fire over the last few trading sessions amid renewed hopes of marijuana legalization. Even Amazon has supported the federal legalization of marijuana. Also, after the merger, Tilray has diversified operations and hopes to realize significant synergies from the merger.