ALTU SPAC Stock Forecast: Looks Like a Buy Now Under $10

Altitude Acquisition Corp. (ALTU) stock has fallen by 31 percent from its highs. Should you buy ALTU SPAC stock before it finds a merger target?

March 24 2021, Published 10:28 a.m. ET

Altitude Acquisition Corp. (ALTU) is a SPAC led by CEO Gary Teplis and Chairman Gavin Isaacs. The blank-check company raised about $300 million in a December 2020 IPO and sold 30 million units for $10 apiece. Should you buy ALTU stock before it finds a merger target?

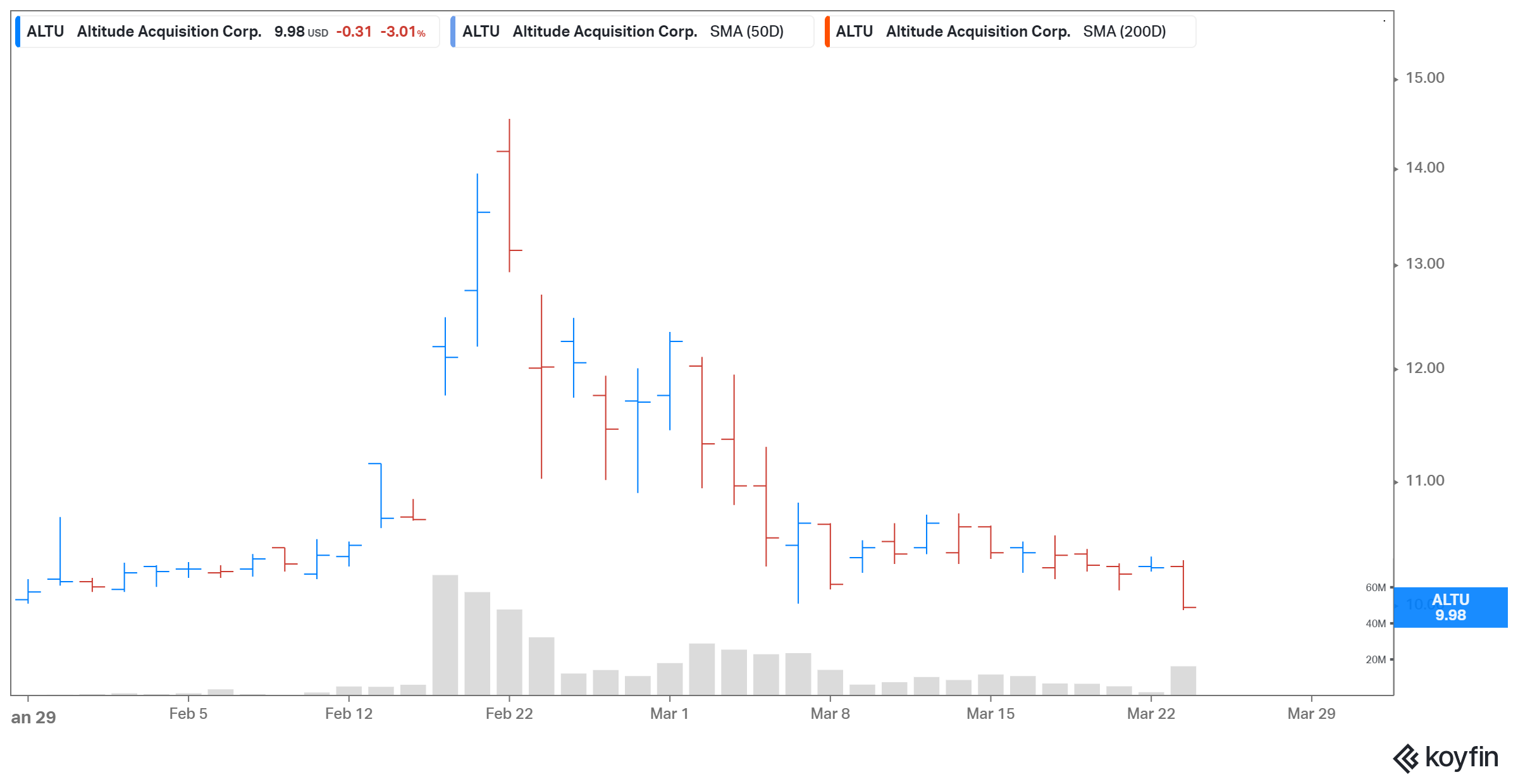

The ALTU SPAC was formed to merge with private travel-related companies. On March 23, ALTU stock fell 3 percent and closed at $9.98, which represents a 0.2 percent discount to its IPO price.

ALTU SPAC stock is falling.

After closing at an all-time high of $14.54 last month, ALTU stock has fallen nearly 31.4 percent. The stock is falling due to broader market sell-off as investors rebalance their portfolios because of changing macroeconomic factors like interest rates.

Blank-check companies' stock prices are correcting after their speculative run. For example, Chamath Palihapitiya’s Social Capital Hedosophia Holdings IV (IPOD), which is yet to announce a merger target, has fallen by 23 percent over the last month. Churchill Capital Corp IV (CCIV), which is scheduled to take EV maker Lucid Motors public, and Star Peak Energy Transition Corp. (STPK), which is scheduled to take energy storage specialist Stem public, have fallen by 16 percent and 24 percent over the last month, respectively.

Various SPACs are still trading under $10. AF Acquisition Corp. (AFAQU) is trading at $9.77, while Archimedes Tech SPAC Partners Co. (ATSPU) is trading at $9.87.

ALTU Stock Price

Which company will ALTU merge with?

ALTU is looking to merge with a travel-related company with an enterprise value of $1 billion or more. In the prospectus, the SPAC said, “We intend to focus on travel, travel technology and travel-related businesses with an enterprise value of $1 billion or more with either business-to-business (“B2B”) or business-to-consumer (“B2C”) focuses, that have compelling growth opportunities with strong underlying demand drivers.”

On Feb. 18, Bloomberg reported that ALTU SPAC is in discussions to take Boeing-backed Aerion public at a valuation of about $3 billion. Aerion manufactures supersonic planes. In 2023, the company expects to manufacture its supersonic jet, the AS2, with plans to bring it to market in 2027.

ALTU SPAC stock looks like a good buy.

ALTU SPAC stock looks like a good buy for investors seeking bargain SPAC opportunities. If the merger discussions are successful, ALTU shareholders could own a piece of Aerion, which is part of a lucrative market. The business jets market is expected to reach $38 billion by 2030 compared to $18.8 billion in 2020. Also, Boeing's support for Aerion shows that it has a strong product. However, investors should note that ALTU stock is a speculative bet until the merger deal closes.

Best aviation SPAC stocks

LinkedIn co-founder Reid Hoffman and former Accenture executive Michael Spellacy are excited about the aviation industry's prospects. Hoffman’s blank-check company Reinvent Technology Partners (RTP) is taking Joby Aviation public, while Archer is going public via Spellacy’s blank-check company, Atlas Crest Investment Corp. (ACIC). At $10.35 per share, RTP SPAC stock trades at a 39.1 percent discount to its recent peak. At $10.34 per share, ACIC stock trades at a 44.4 percent discount.