Buy ACIC Stock Before the Archer Merger, Bet on Urban Air Mobility

ACIC stock has fallen by 40 percent from its highs. What’s the forecast for the ACIC SPAC before it merges with Archer?

March 12 2021, Published 9:15 a.m. ET

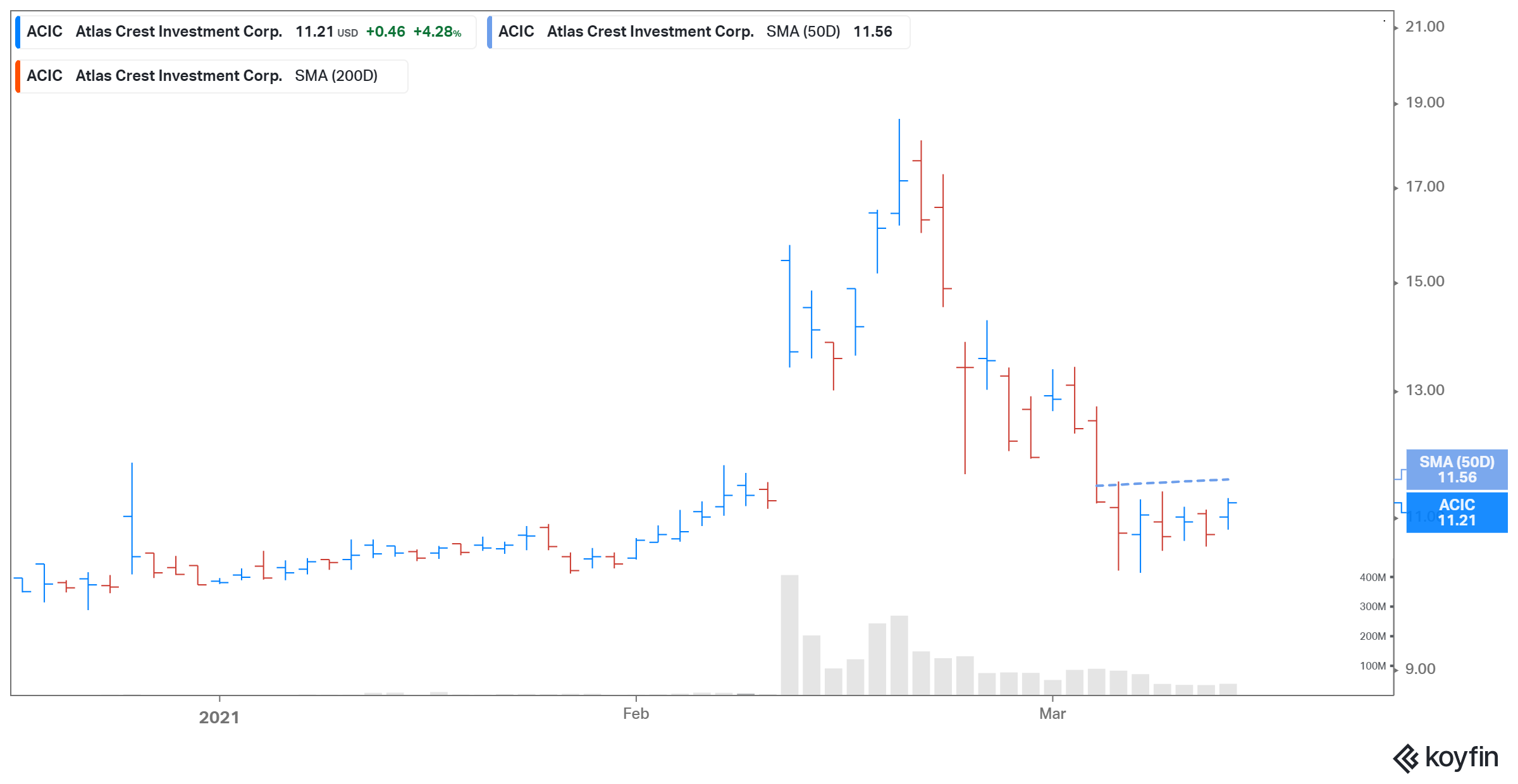

Atlas Crest Investment Corp. (ACIC), a SPAC, saw its stock rise 4.3 percent on March 11. However, the stock is down 40 percent from its 52-week high. What’s the forecast for ACIC stock before the SPAC merges with Archer? Will ACIC rise or continue to fall?

The ACIC SPAC is scheduled to take Archer public. Archer is a leading urban air mobility company that develops an all-electric vertical take-off and landing (eVTOL) aircraft. The blank-check company is led by CEO Michael Spellacy, a former Accenture executive, and Chairman Ken Moelis, the founder of global investment bank Moelis & Company. The ACIC and Archer merger is expected in the second quarter of 2021.

Why ACIC SPAC stock is falling

ACIC stock has risen by 12.1 percent since its IPO. Currently, it's down 39.7 percent from its all-time high of $18.60, which it hit on Feb. 18. The stock has been trending downwards since the SPAC space is witnessing a major sell-off. The sell-off might have been triggered because of the collapse of the SPACs led by Chamath Palihapitiya and Churchill Capital IV (CCIV). Also, rising bond yields are hurting stock prices.

ACIC and Archer merger details

The ACIC and Archer merger is expected to close in the second quarter of 2021. The transaction, subject to approval by ACIC shareholders and other customary closing conditions, is set to have a pro forma enterprise value of $2.7 billion. The combined company will be listed on the NYSE under the ticker symbol “ACHR.”

The deal will provide Archer with nearly $1.1 billion in total proceeds to fund the company’s growth initiatives. The transaction will be funded by a combination of $500 million in cash held by ACIC in trust and an additional $600 million in PIPE (private investment in public equity). Investors in the PIPE include United Airlines, Stellantis, and Baron Capital Group, among others. Existing Archer shareholders are set to own about 67 percent of the combined company when the deal closes.

Archer versus Joby Aviation

Archer expects to generate sales of $42 million in 2024 and forecasts its sales growing by 2,375 percent in 2025 and 114 percent in 2026. The company expects sales and EBITDA of $2.2 billion and $647 million in 2026, respectively. Archer expects to be cash flow positive in the fourth quarter of 2025. The company's 2026 EBITDA margin of around 29 percent also looks good.

Archer faces the biggest competition from Joby Aviation. Joby Aviation plans to go public later this year through a reverse merger with Reinvent Technology Partners (RTP) SPAC. The company expects to generate sales of $721 million in 2025 and $2.05 billion in 2026. Joby Aviation expects to be adjusted EBITDA positive by 2025.

ACIC Stock Price

Archer’s valuation

ACIC valued Archer at a pro forma implied equity value of $3.75 billion. Meanwhile, at ACIC’s current stock price, Archer is valued at around $4.2 billion. Joby Aviation is valued at $7.4 billion based on RTP’s current stock price. From a valuation perspective, Archer is valued at a 2026 EV-to-sales multiple of around 1.2x, while Joby Aviation is valued at 2.3x.

ACIC SPAC stock is a buy before Archer merger

ACIC SPAC stock looks like a good buy based on Archer’s strong growth outlook and valuations. Archer is also expected to benefit from the surge in demand for urban air mobility after it’s operational. The company thinks that urban air mobility is a $1.5 trillion market. However, the stock is a speculative play until the ACIC and Archer transaction closes.