At Under $10, Is IPOF Stock a Buy Now?

IPOF stock is down 45 percent from its 52-week high. Is the stock a good buy now amid the latest merger news?

Aug. 16 2021, Published 7:38 a.m. ET

Social Capital Hedosophia VI (IPOF) stock is down 45 percent from its 52-week high. The SPAC's stock has pulled back with the selloff in growth-oriented technology stocks. Is IPOF stock a good buy now amid the latest merger news?

The IPOF SPAC has yet to announce an acquisition. After its attempt to acquire a fitness chain fell through, it's looking for a new merger target.

Who owns the IPOF SPAC?

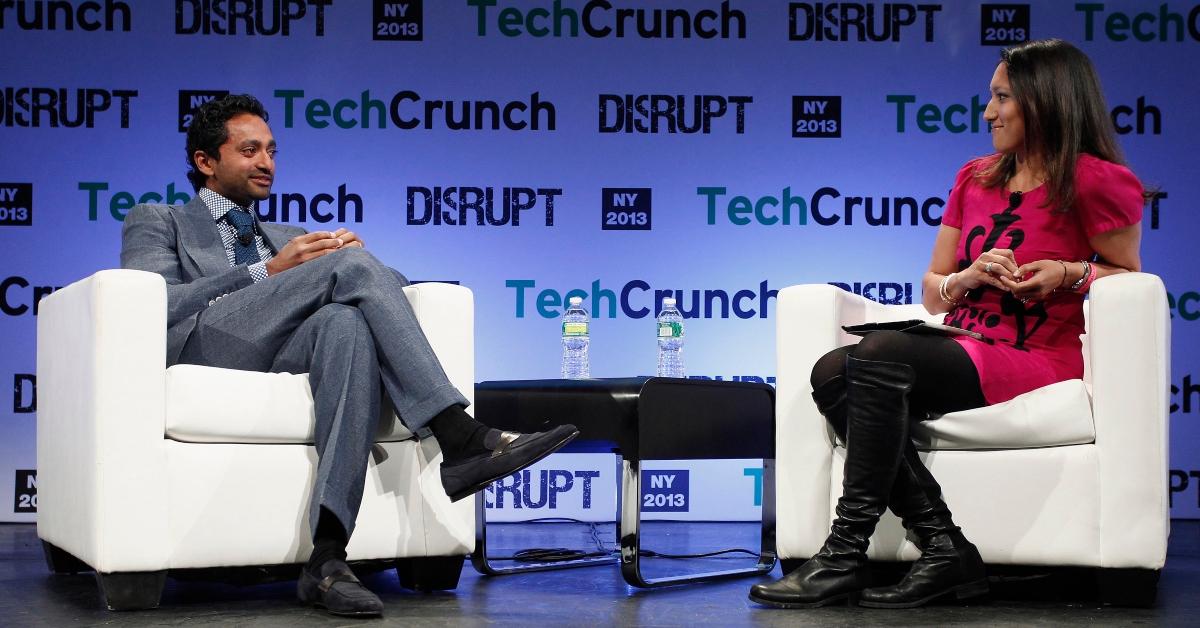

The Chamath Palihapitiya-led IPOF SPAC, the sixth blank-check company created by Social Capital and Hedosophia, aims to merge with a technology company. In its Oct. 2020 IPO, IPOF raised $1 billion by offering 100 million shares for $10 each.

IPOF and Equinox merger talks fail

IPOF is reportedly no longer in talks to merge with luxury gym operator and Peloton Interactive rival Equinox, according to people familiar with the matter. The negotiations fell apart due to disagreement over the combined entity’s valuation. IPOF and Equinox declined to comment on the matter.

In May, Bloomberg reported that the two companies were in talks regarding a merger that could value the combined company at $7.5 billion. Equinox, which was forced to shutter several locations amid the COVID-19 pandemic and posted a loss of $350 million on sales of $650 million in 2020, drew interest from SPACs.

In 2020, Equinox agreed to a financing deal with private equity company Silver Lake to develop its Equinox+ digital platform. It merged its Equinox+ and Equinox applications in Aug. 2021, offering users access to at-home content from SoulCycle, Rumble, and Solidcore.

How Chamath Palihapitiya’s past SPACs have performed

Over the last year, Palihapitiya has used SPACs to take several companies public. Of them, space tourism company Virgin Galactic, real-estate platform Opendoor Technologies, and fintech startup SoFi have performed well, rising 154, 76, and 50 percent from their IPO prices, respectively. However, Clover Health stock has fallen 18 percent since its IPO, much because short-seller Hindenburg Research accused Clover of deceiving investors by failing to disclose U.S. DOJ probes. IPOD and IPOF, yet to announce merger targets, are trading near their IPO prices of $10.

Is IPOF stock a good buy now?

Overall, IPOF’s management team looks to be solid, with an impressive track record in the SPAC space. Until IPOF discloses a merger target, its stock is a speculative play—but if it finds a hot merger target, the stock may skyrocket. On Aug. 13, IPOF stock closed at $9.86, which means that it's almost certain to generate returns, as shareholders can cash out at $10 if they don’t like its merger target.