SOFI Misses Q2 Earnings Estimates, Current Dip Is a Buying Opportunity

SOFI posted its second-quarter earnings on Aug. 12. The stock fell sharply on the earnings miss. What is SOFI’s stock forecast after its Q2 earnings report?

Aug. 13 2021, Published 9:38 a.m. ET

SoFi Technologies (SOFI) stock fell nearly 10 percent in the premarket trading session on Aug. 13. The stock is down significantly after the company reported a lower-than-expected second-quarter earnings report. What is SOFI’s stock forecast after its second-quarter earnings report?

On June 1, fintech startup SoFi went public through a reverse merger deal with blank-check company Social Capital Hedosophia Holdings V (IPOE). SoFi received nearly $2.4 billion in gross cash proceeds through the business combination, which valued it at about $8.65 billion. BlackRock, Altimeter Capital Management, Baron Capital, and billionaire investor Chamath Palihapitiya participated as PIPE investors.

SOFI stock is going down.

SOFI stock is down significantly after the company posted a net loss for the second quarter, despite sales more than doubling at the online personal finance platform. Also, the fintech company’s third-quarter revenue guidance was under analysts’ consensus estimates.

SOFI’s Q2 earnings missed the estimates.

In the second quarter, SOFI’s adjusted net revenue rose more than 74 percent YoY to $237.2 million, which beat its internal projection of $215 million–$220 million. It also reported an adjusted EBITDA of $11.2 million despite an $8 million loss being expected. However, SoFi reported a net loss of $0.48 per share compared to a net loss of $0.03 in the second quarter of 2020.

Wall Street analysts anticipated a net loss of $0.06 per share on revenue of $219 million. SoFi forecasts an adjusted net revenue of $250 million and an adjusted EBITDA of -$2 million at the midpoint in the third quarter.

SOFI’s stock forecast

According to CNN Business, analysts' median target price for SoFi stock is $26.50, which is 52 percent above its current price. All three of the Wall Street analysts tracking SoFi recommend a buy.

Will SOFI go back up?

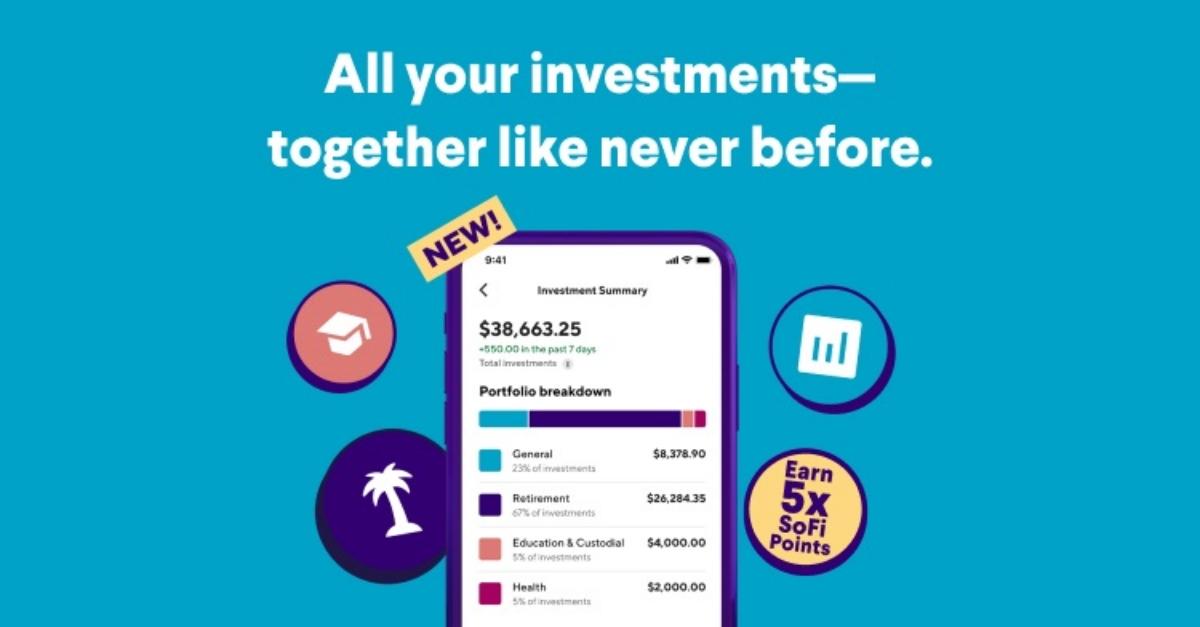

The outlook for SOFI stock looks promising. The company has a competitive edge because of its diverse product portfolio. SoFi’s total member base increased to 2.6 million, up from 1.2 million in the second quarter of 2020, while total products hit 3.7 million, up from 1.6 million a year earlier.

In March, SoFi agreed to acquire Golden Pacific Bancorp as a part of its efforts to obtain the banking charter. This would help SoFi lower its cost of capital and increase the net interest margin. Also, SoFi is responsible for over 90 percent of new neobanks formed in the U.S. SoFi’s Galileo provides fintech companies with application programming interfaces for core digital banking functions. It had 79 million accounts as of June 2021—up from 36 million a year ago.

SOFI stock on Reddit

SOFI stock is seeing high interest from retail traders on social media platforms. The stock is among the top 10 discussion topics on Reddit forum WallStreetBets. Many mentions, which included rocket ship emojis, predicted that the stock price would skyrocket. A post mentioned that SOFI stock could reach $200 by the end of 2022. The bullish sentiment on social media indicates that retail traders see the dip as a buying opportunity.