Buy Opendoor Stock Before It Catches WallStreetBets' Attention

Reddit group WallStreetBets seems to be in love with Chamath Palihapitiya stocks. Will the group target Opendoor next?

June 9 2021, Published 12:07 p.m. ET

Opendoor Technologies (OPEN) stock was higher in the early price action on June 9 and continued its momentum from the previous day. The company went public through a merger with Chamath Palihapitiya’s Social Capital Hedosophia Holdings II (IPOB). The stock has fallen sharply from its post-merger highs. Should you buy the stock now? Will Opendoor stock catch WallStreetBets' attention?

Opendoor is a home-flipping platform. The stock was under pressure for multiple reasons, including a general sell-off in growth names, concerns about the health of the U.S. housing market, and apprehension towards stocks associated with Palihapitiya. SPACs sponsored by him have underperformed in 2021 after Hindenburg Research accused Clover Health of fraud. Clover Health went public through a merger with a SPAC sponsored by Palihapitiya.

Palihapitiya SPACs have fallen in 2021

As I noted previously, despite several issues, Opendoor stock looked like a good buy. However, the stock continued to trade weakly. The rise in bond yields also put pressure on OPEN stock. Rising rates could dampen the U.S. housing market sentiments.

Cathie Wood also bought Opendoor stock

Cathie Wood of ARK Invest, who has built her reputation identifying gems like Tesla and Square early, also invested in Opendoor stock. Wood likes companies that have disruptive technologies and Opendoor fits the bill. The company is looking to revolutionize the housing market.

Most of the houses in the U.S. are bought and sold through independent brokers. Opendoor is looking to redefine the market. With the increasing pace of digitization, online home buying and selling would also receive an impetus. The U.S. real estate market is worth $1.6 trillion annually and less than 1 percent of real estate buying and selling happens online.

According to a survey conducted by Opendoor, three-fourths of respondents want digital options when buying a home. While that percentage might seem high, home buying is one frontier that's at the cusp of a major digital explosion.

Reddit is in love with Palihapitiya stocks.

Reddit seems to be in love with Palihapitiya stocks. Clover Health (CLOV) is currently the most popular name on WallStreetBets. Social Finance (SOFI), which was listed recently, is also among the top 15 discussion topics in the group. Most WallStreetBets members are positive about the stock.

Can WallStreetBets target OPEN stock next?

Reddit traders have been acting as a cohort and have been buying stocks in a synchronized way. The buying support from retail traders has led to an increase in many stocks like AMC Entertainment and ContextLogic (WISH). While we might agree or disagree with the group, it's still a force to reckon with.

There are several reasons why Opendoor stock might be on WallStreetBets’ radar. First, it has a fundamental saleable story of taking home buying online. This is among the themes that could interest Reddit traders. Also, many of the stocks that WallStreetBets identified were undervalued initially even though the pumping took many of them above their fundamental value.

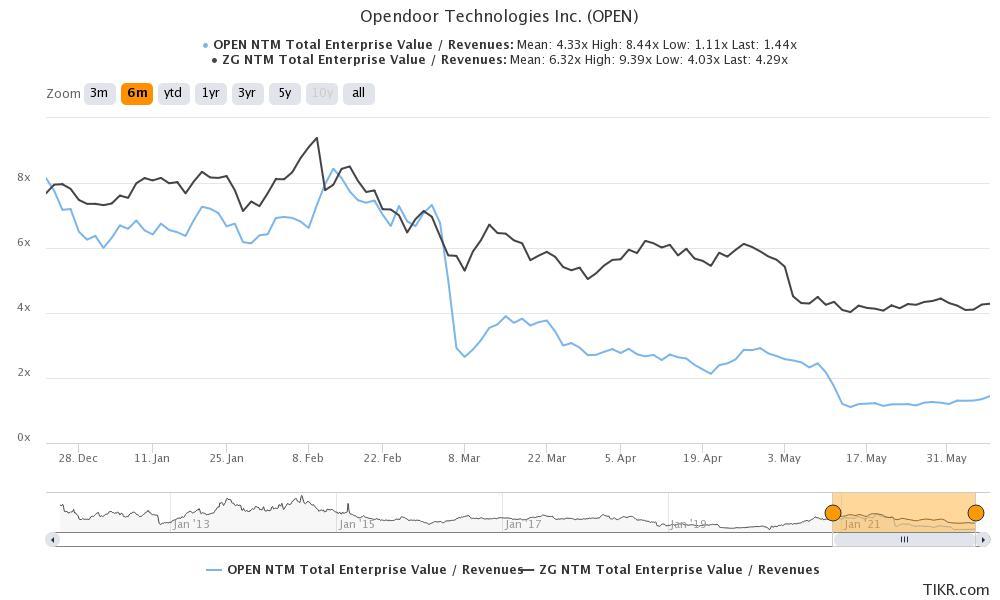

Opendoor trades at an NTM EV-to-sales multiple of 1.4x, which is almost a third of Zillow. Wall Street analysts have a bullish forecast too on OPEN stock and its consensus target price implies an upside of over 100 percent.

In the past, the stocks picked by WallStreetBets were at odds with Wall Street analyst recommendations. Recently, the stocks targeted by the group are trading at a steep discount to their target prices. WISH and CLOV are two examples where Wall Street analysts and WallStreetBets might have convergent views.

Opendoor stock short interest

According to the most recent filing, Opendoor’s days-to-cover ratio was 2.4 as of May 14, which looks high. WallStreetBets has targeted stocks with high short interest. Opendoor stock looks like a fundamentally strong stock to buy now. While WallStreetBets traders may or may not target the stock, it looks like a good stock for the long term.