Why Peloton Is a Better Home Fitness Stock to Buy Than Beachbody

FRX, which will merger with Beachbody, and Peloton have both crashed. However, PTON looks like the better home fitness stock to buy now.

May 7 2021, Published 8:37 a.m. ET

Beachbody will go public through a three-way merger with the Forest Road Acquisition Corp. (FRX) SPAC. FRX is trading almost at the IPO price of $10. FRX has fallen 45 percent from its 52-week highs. Peloton (PTON) is also down over 50 percent from the highs. Which of these is a better home fitness stock to buy now after the crash?

There has been a sell-off in home fitness stocks in 2021, which is reminiscent of broader investor apathy towards “stay-at-home stocks.” While macro factors like the shift from growth to value stocks are weighing heavy on FRX and PTON, micro factors are also at play.

Why FRX stock been falling before the Beachbody merger

Investors have been getting increasingly apprehensive of SPACs and many of them have fallen below $10. Even FRX briefly fell below $10 but now trades just above the IPO price of $10.

As for PTON stock, several micro factors have been at play. First, the company has been facing supply chain issues in meeting customer demand. The news of a fatal accident involving a Tread+ and the subsequent voluntary recall didn't help matters and PTON stock fell sharply.

Beachbody might gain from the Peloton recall.

Beachbody and Peloton are both in the home fitness market. The accidents involving Peloton’s treadmill will certainly have an impact on the Peloton brand. The brand helped the company charge a premium for its products and services.

FRX is a three-way merger with Beachbody and MYX Fitness. Beachbody, like Peloton, offers subscription-based services where you can stream online workout videos and live videos from anywhere. However, it doesn't offer equipment.

MYX Fitness sells bikes on its platform. The company could benefit if some consumers decide to shift away from Peloton to an alternate home fitness equipment.

Pelton versus FRX valuation

The FRX and Beachbody merger valued the combined entity at a pro forma EV (enterprise value) of $2.9 billion, which means a 2022 EV-to-sales multiple of 2.2x. Beachbody expects its revenues to increase at a CAGR of 30 percent between 2020 and 2025. The forecasts don’t include the international expansion from MYX Fitness and Openfit.

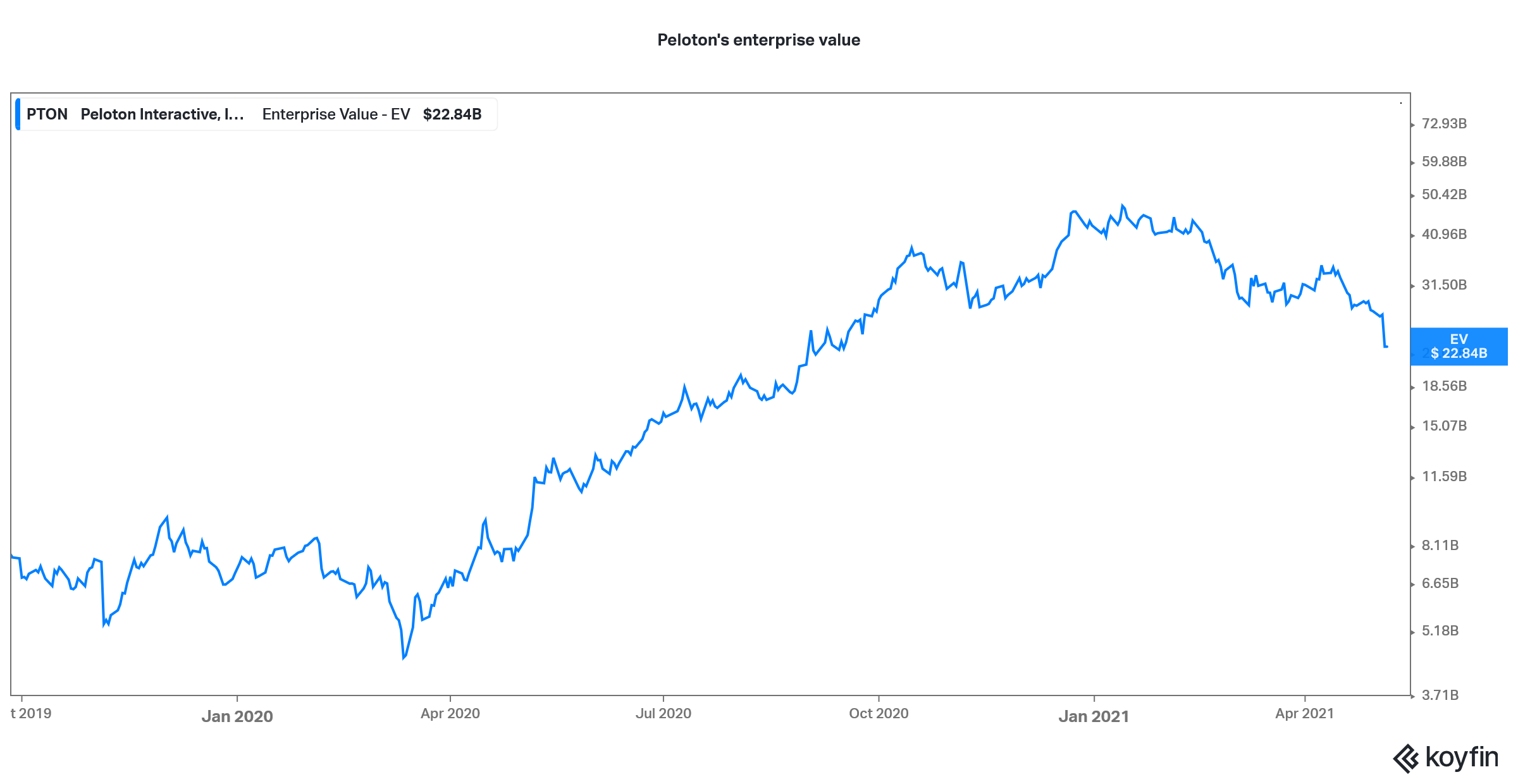

PTON's enterprise value

Looking at Peloton, it has an EV of nearly $23 billion after the crash. The company is expected to post revenues of $6.5 billion in 2022, which would mean a 2022 EV-to-sales multiple of 3.5x. Peloton’s revenues are expected to rise 35 percent YoY in 2022, while Beachbody is forecasting that its revenues will increase 33 percent in the year.

Is FRX undervalued compared to PTON?

FRX SPAC stock looks undervalued compared to PTON since it's trading at a much lower valuation multiple. However, I would argue that given its strong brand (even after the tread recall) and premium pricing, PTON can command a valuation premium. So, it wouldn't be prudent to say that FRX SPAC stock is relatively undervalued compared to PTON.

PTON is a better home fitness stock to buy

While I think that Beachbody and Peloton are both exciting investments, given the positive outlook for the home fitness market, on a relative basis, Peloton is a better stock to buy now. The sell-off in the stock looks overdone and it will recoup some of the losses soon.

While the treadmill recall will impact earnings in the short term and have a medium-term impact in the form of brand dilution, I would expect Peloton stock to bounce back from these levels considering the positive long-term growth story.