Sean Millard

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sean Millard

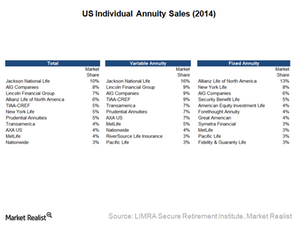

Leading Players in the US Annuity Industry

The market leader in the fixed annuity industry is Allianz Life Insurance Company of North America with 13% market share, followed by New York Life with 8%.

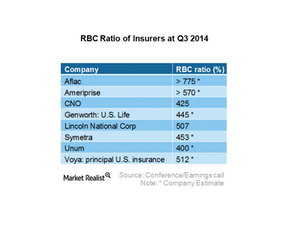

How insurers manage their capital requirements

A company managing higher risk products must maintain a higher level of minimum capital compared to a company with a relatively lower level of risk.

What impacts an insurer’s profits?

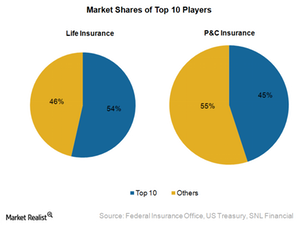

In 2013, the top ten life and health insurance companies had just above 50% market share in terms of direct premiums written.

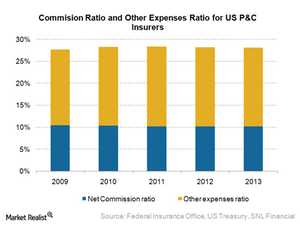

How cost structures and distribution channels impact profit

As customers use Internet-based aggregators to purchase insurance policies, insurers use online sales to interact directly with customers and reduce costs.

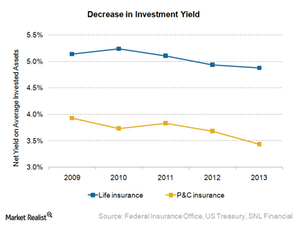

How investment income drives profit

The impact of interest rate movements is lower in the P&C segment, as their products can be repriced annually to keep in line with interest rate movements.

How key drivers impact insurance sales

For P&C insurers such as AIG and ACE, various mandatory requirements may drive sales of vehicle, workers’ compensation, and homeowners insurance.

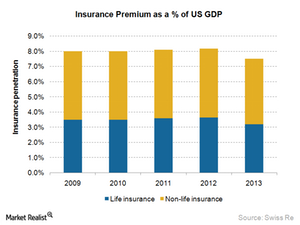

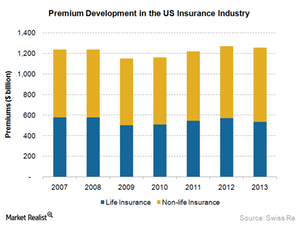

The US insurance industry: Largest in the world

Insurance premiums have grown at a modest pace after a dip in 2009 due to the financial crisis, which the industry was able to navigate.

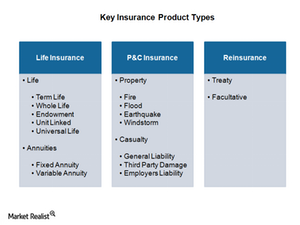

Life insurance, P&C insurance, and reinsurance

P&C products have commoditized characteristics, resulting in sharp competition in the market and business cycles. AIG and ACE are key players in this space.

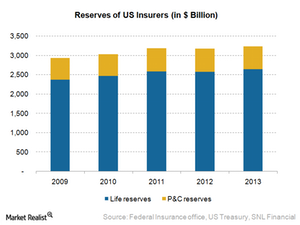

Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

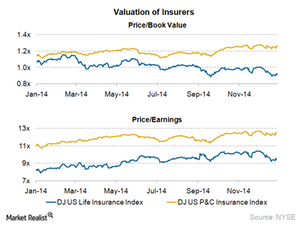

How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

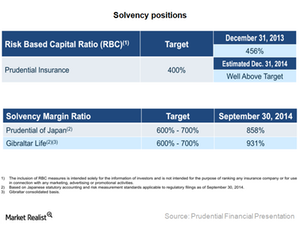

Prudential Financial Enjoys Strong Solvency Ratios

Prudential has comfortable solvency positions in its subsidiaries. In the US, Prudential Insurance’s solvency ratio was well above the target ratio of 400%.

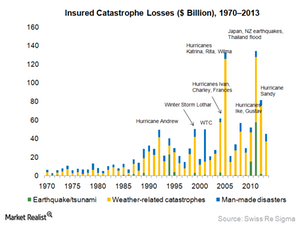

A Closer Look at the Costliest Catastrophes

Hurricanes Sandy, Ike, and Andrew remain near the top of the list of the costliest catastrophes in terms of insured losses.

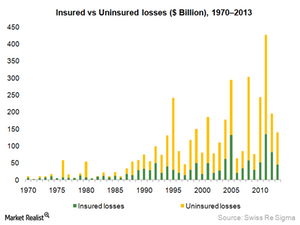

Making Sense of Economic and Insured Losses

Insured losses are the ones that impact the profitability of insurance companies.

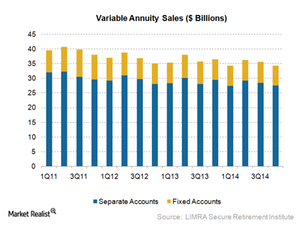

Variable Annuity Sales Lower in 2014

Compared to 2013, variable annuity sales were down by ~3.6% in 2014, at around $140 billion, despite a strong performance in the equity markets.

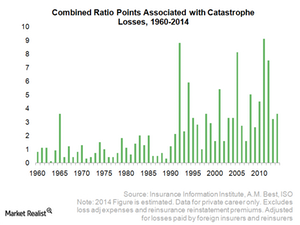

How Catastrophes Impact a P&C Insurer’s Combined Ratio

The percentage points for catastrophe losses in the combined ratio have increased in recent years.

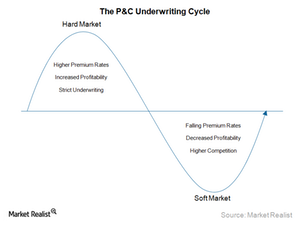

How Underwriting Cycles Impact the Top Line and the Bottom Line

The underwriting cycle moves between hard and soft market conditions, which have different sets of characteristics that determine the profitability of the insurance industry.

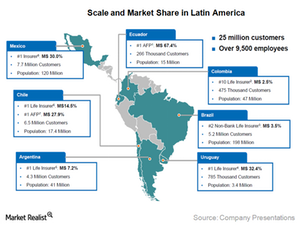

MetLife is the largest player in Latin America

MetLife plans to grow its retail and group business in Latin America, capitalizing on the growing middle class, affluent class, and corporate needs.

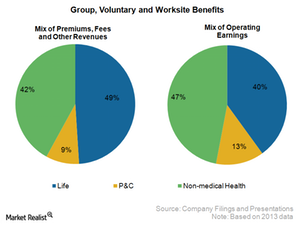

MetLife is a key player in the US group insurance business

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market.

MetLife is a leading player in the US insurance industry

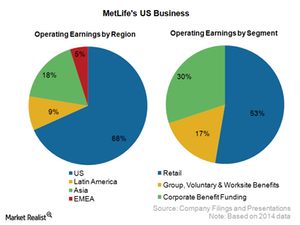

MetLife intends to grow its retail business and expects low single-digit growth in the long term.

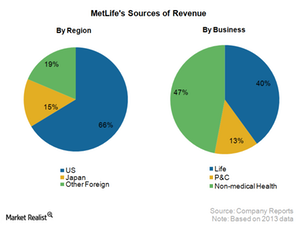

MetLife – A globally diversified insurance company

MetLife is a market leader in the US and the largest life insurer in Mexico and Chile. It is among the leading players in Japan, Korea, and Poland.