Matt Tucker, CFA

Matt is Head of the iShares Fixed Income Strategy team. He and his team focus on product strategy for iShares ETFs in North and Latin America. He has over fifteen years of experience in the fixed income markets and is a CFA charterholder. He writes about fixed income and ETF education.

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of BlackRock.

More From Matt Tucker, CFA

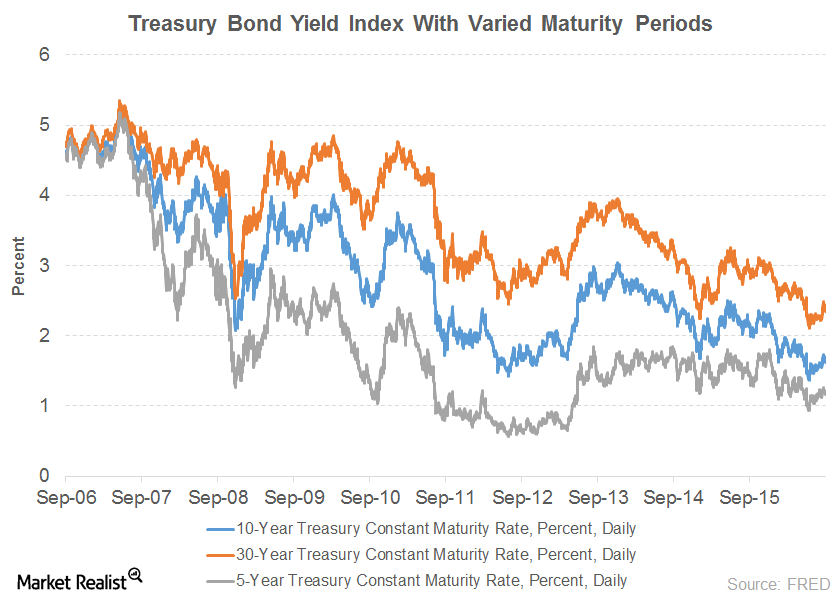

The Tails Of The Yield Curve May Provide Value

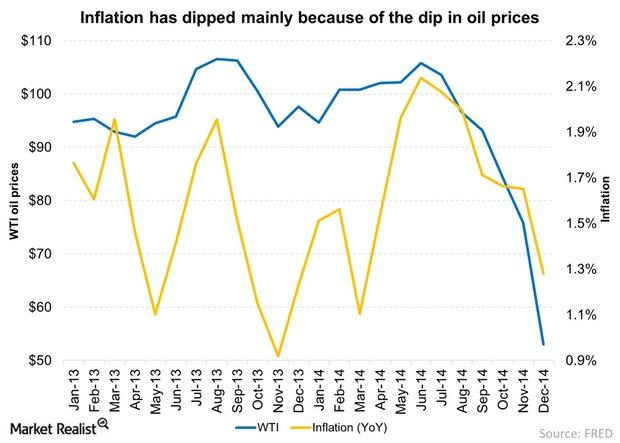

The tails of the yield curve may provide more value due to low inflation.

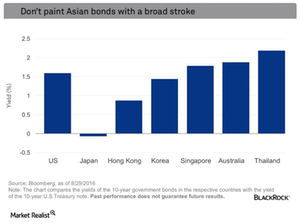

Hunting for Yield: Looking beyond Japan

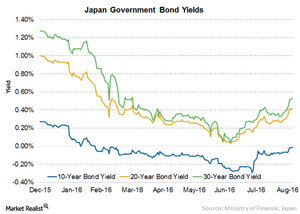

Japan is the largest accessible bond market in Asia (source: Barclays Multiverse Index as of 7/29/16), but the problem is the yields for many local bonds are negative.

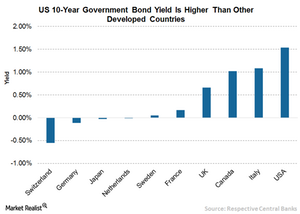

The Intense Search for Yield Ends in the United States

You historically can’t get a high level of yield from relatively safe fixed income investments.

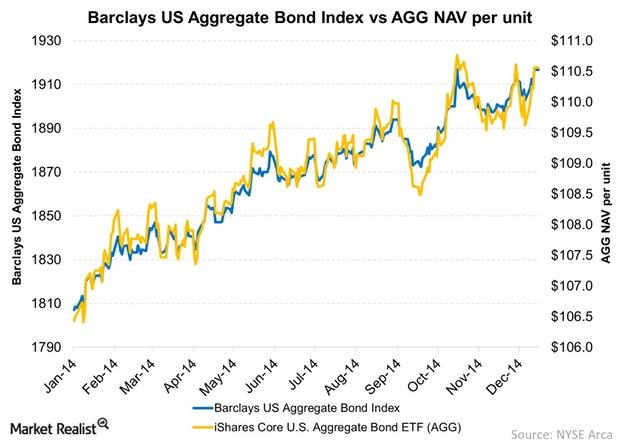

When The Net Asset Value Of A Bond ETF Differs From Market Price

The Intraday Indicative Value gives us a more real-time value than the bond ETF’s NAV. It’s considered an implied value of an ETF.

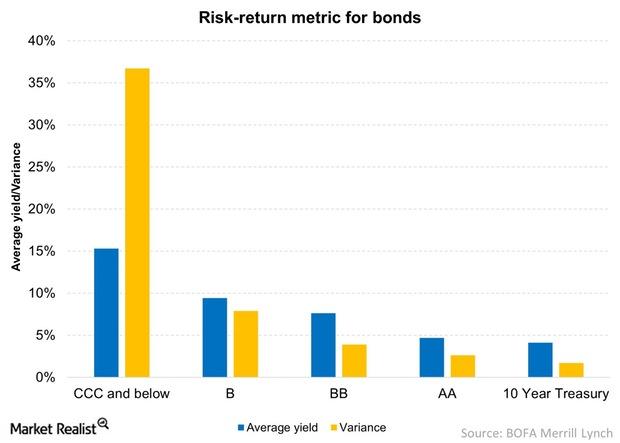

How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

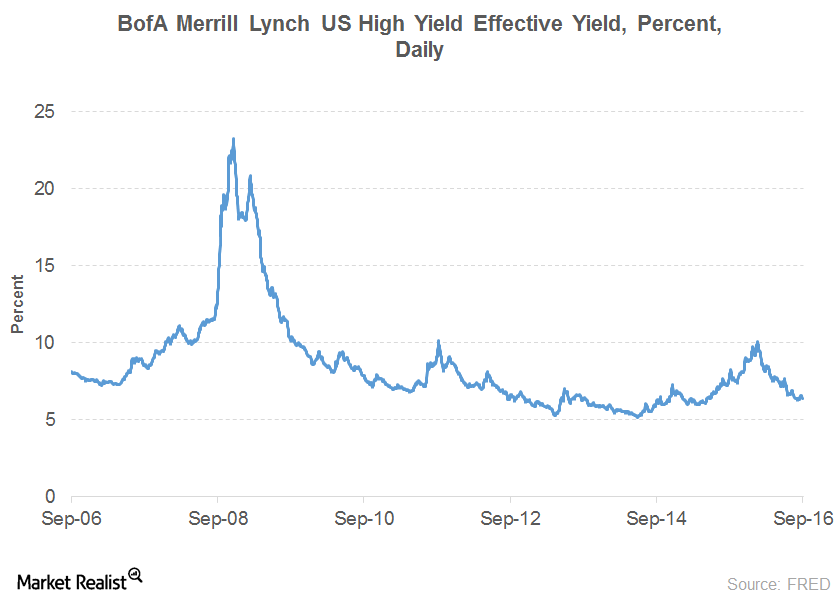

High-Yield Bonds Are Turning Out to Be the Real Winners

High-yield bonds gained popularity due to higher yields compared to Treasury bonds, whose yields were being pushed down by the Fed’s interest rate policy.

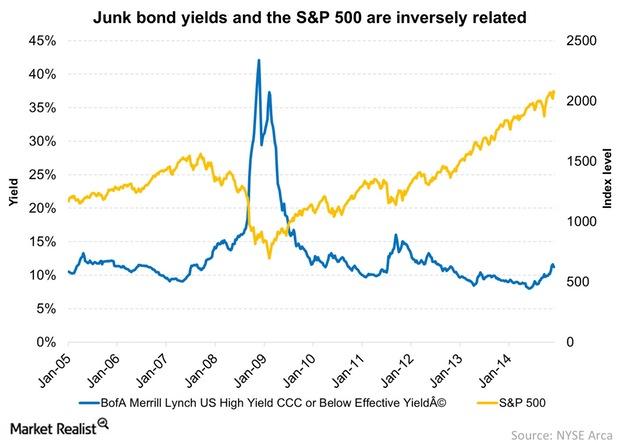

Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.

Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

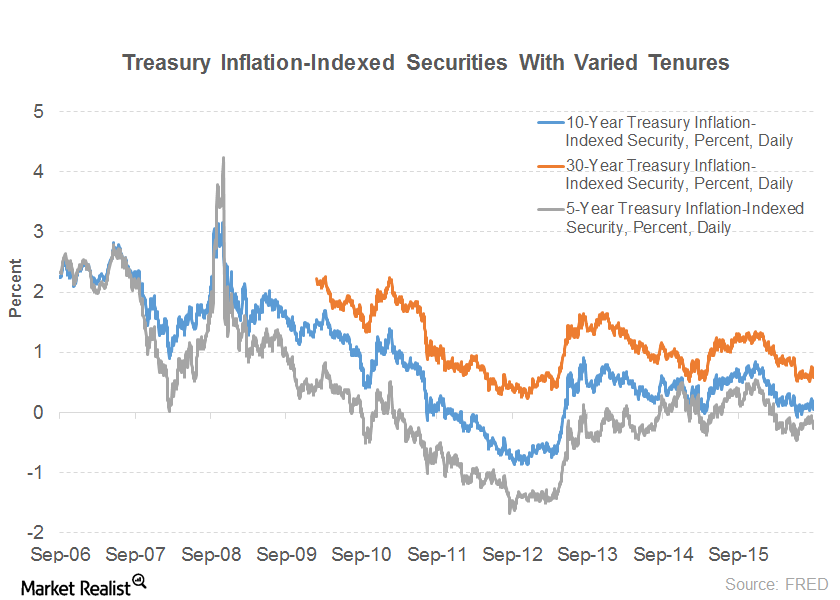

Will Treasury Inflation-Protected Securities Be a Game-Changer?

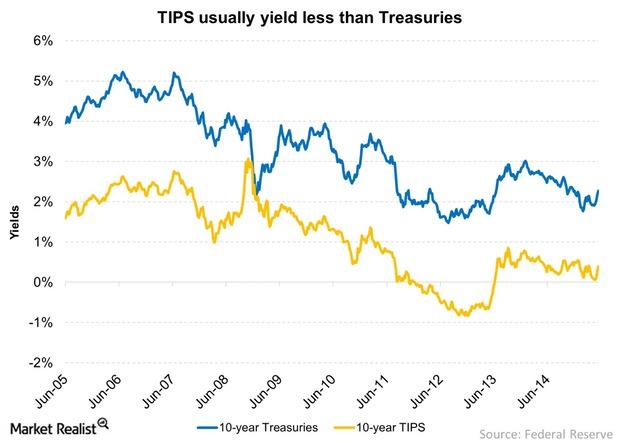

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market.

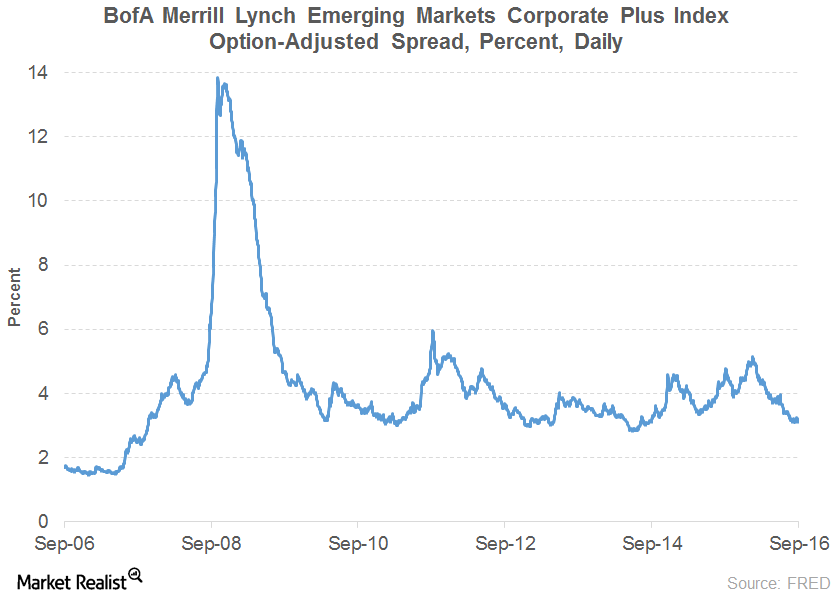

The Rally in Emerging Market Debt

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.

Diminishing Opportunities in Asia: What You Need to Know

The balance of countries in Asia present more interesting opportunities. To better focus our discussion, I’ll concentrate on investment grade markets.

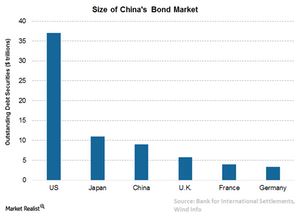

Regulatory Hurdles Affecting Chinese and Indian Bond Markets

As the intensifying search for yield goes international, Matt examines and shares his thoughts on the different Asian bond markets.

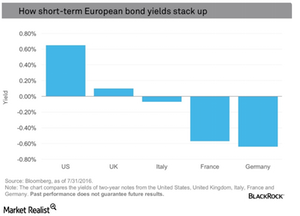

Negative Rates Rules in Continental Europe

The lackluster economic growth and low inflation in Europe have forced the European Central Bank to unleash measures such as quantitative easing.

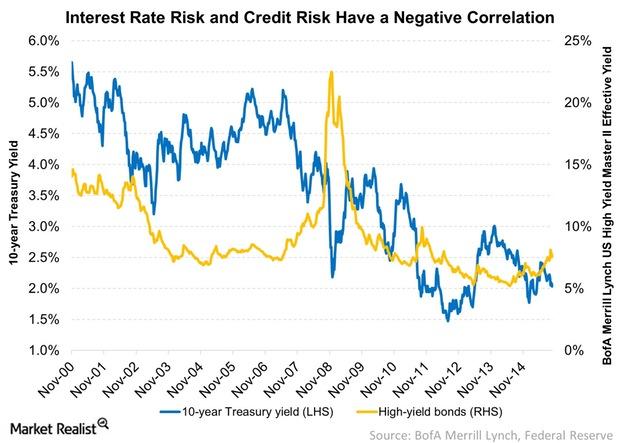

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

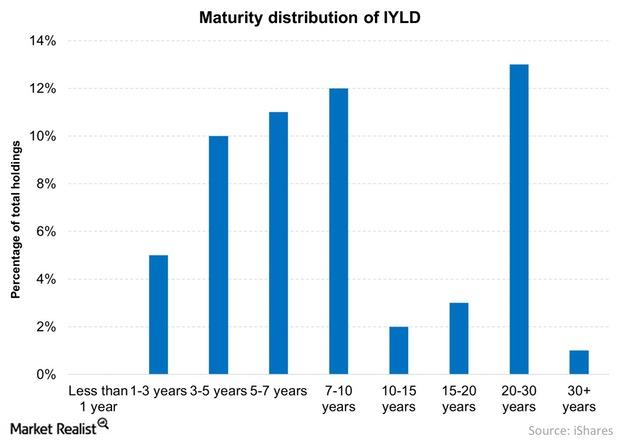

IYLD: A Diversified Fixed Income Portfolio

Within fixed income securities, there are two main types of risks: interest rate risk and credit risk.

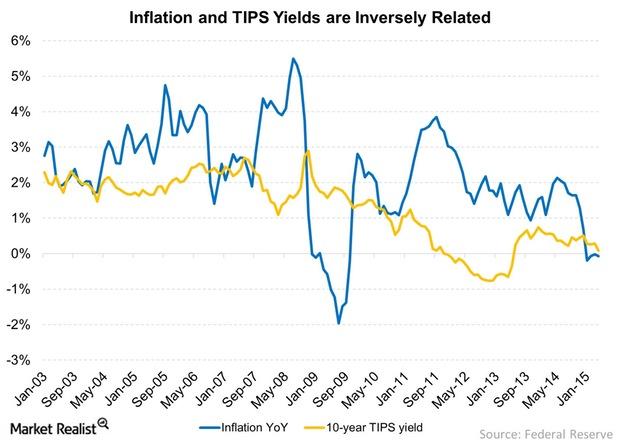

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.

Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

Where Are High Yield Bonds On The Risk Continuum?

High yield bonds (HYG), which are usually issued by mid- and small-cap companies, are considered riskier than investment grade corporate bonds.

Calculating A Bond ETF’s Underlying Value

The calculation of a bond ETF’s underlying value is going to be less precise than a stock ETF’s underlying value.