Negative Rates Rules in Continental Europe

The lackluster economic growth and low inflation in Europe have forced the European Central Bank to unleash measures such as quantitative easing.

Sept. 12 2016, Updated 8:05 a.m. ET

Everything is coming up negative

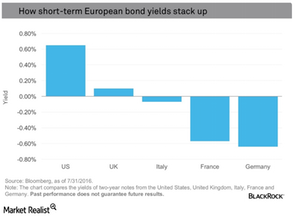

Looking across to continental Europe, however, we see a very different picture. The European Central Bank (or ECB) has been very aggressive in not only setting short-term interest rates at 0%, but also aggressively buying bonds to push longer-term rates down. Even before Brexit, Europe was faced with declining growth and near zero levels of inflation. In an effort to boost the economy, the ECB has embarked on a large scale quantitative easing program. It ended up buying not only government bonds, but more recently, corporate bonds as well. As a result, yields on most European debt has plunged. As of July 31, the yield on a 10-year German bond was -0.12%, while the yields on 10-year bonds from other continental European countries were low to negative, according to Bloomberg data. And it gets worse. If you look at short-term bonds, as illustrated in the chart below, yields on two-year notes in Germany, France, Italy, Spain, Sweden, the Netherlands and Switzerland were all negative.

Market Realist – Yields plunged to record lows

The lackluster economic growth (IEV) and low inflation in Europe (EZU) (HEZU) have forced the ECB (European Central Bank) to unleash measures such as quantitative easing, incentivizing banks to increase lending by allowing them to borrow from the ECB at negative interest rates, and interest rate cuts to stimulate the Eurozone economy.

In March 2016, the ECB cut its deposit rate by 10 basis points to -0.4% and cut the benchmark refinancing rate from 0.05% to 0.0%. The lending rate on banks’ overnight borrowing from the ECB was also cut from 0.3% to 0.25%. A negative deposit rate means banks will have to pay the ECB to hold their money overnight. This was done to encourage banks to lend the money rather than keep it with the ECB.

Expansion of quantitative easing

As part of the liquidity-boosting measures, the ECB expanded its bond-buying (HHYX) program to 80 billion euros per month from the earlier 60 billion euros. The stimulus program also includes buying corporate bonds worth $7.9 billion per month.

Negative yield

Against this background, yields on most European debt (IGOV) plunged to record lows. All major countries in continental Europe have a negative yield on short-term bonds. The Swiss government’s two-year bond yields -0.97%, while the yield on a German bond of the same maturity is -0.67%. Similarly, ten-year government bonds fell below 0.0% in Switzerland (-0.5%), Germany (-0.12%), and the Netherlands (-0.02%). They’re close to 0.0% in Denmark.