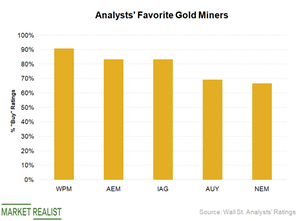

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

March 26 2019, Published 4:04 p.m. ET

Gold miners’ leveraged performance

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

The Direxion Daily Gold Miners Bull 3X ETF (NUGT) and the Direxion Daily Junior Gold Miners Bull 3X ETF (JNUG) saw even more dramatic price action. JNUG and NUGT saw losses of 48% and 45%, respectively, in 2018.

In 2019 year-to-date, GDX has gained 10.3%, compounding the 3.0% gain in gold prices.

Company-specific factors

In addition to gold’s price movements, gold miners are also affected by company-specific factors. In 2019 so far, several company-specific issues have affected miners’ performance.

Barrick Gold (GOLD) completed its merger with Randgold Resources on January 1. It has also been affected by issues at its mines. Kinross Gold (KGC) and Eldorado Gold (EGO) came under stress due to mining code changes and government interference where they operate. Newmont Mining (NEM) also announced a merger with Goldcorp (GG) in January.