Chinese Exports Rose in June 2017 on Improving Global Demand

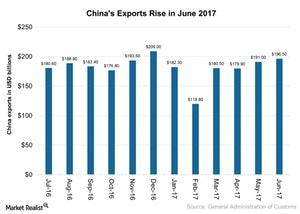

Chinese (FXI) exports stood at $196.6 billion in June 2017, a rise of 11.3% year-over-year basis and a rise of 8.7% month-over-month.

July 21 2017, Updated 9:14 a.m. ET

Chinese exports

Chinese (FXI) exports stood at $196.6 billion in June 2017, a rise of 11.3% year-over-year basis and a rise of 8.7% month-over-month. The stronger-than-expected rebound of global (ACWI) economic growth and the increased progress on the Belt and Road initiative are expected to boost China’s (MCHI) exports in 2017.

Let’s look at exports in China over the last year.

Exports in June 2017

China’s exports in June 2017 exceeded the market’s expectation of 8.7% growth. June was the fourth consecutive month during which China saw increased exports. Exports also reached their highest value in 2017 in the month supported by firmer global demand.

China’s reliance on exports

Over the years, China’s (ASHR) economy has been supported by its remarkable export growth. China’s (YINN) structural shift from an export-based economy to a more consumption-based economy is expected to affect its exports in 2017. However, its exports have continued to contribute significantly to its economic activity in 2017.

Global economic activity is picking up after long-awaited cyclical recovery in manufacturing and trade in 2017. This improved global trade is expected to help increase Chinese exports supported by a partial recovery in commodity prices in 2017.

US-Chinese trade relations

Trade-related tensions among the United States and China have also eased. China’s 100-day trade talks with the United States ended on July 16, 2017. The negotiations, which began in April 2017, resulted in the opening of the Chinese market to US beef after 14 years. The negotiations also resulted in ongoing discussions about China’s buying US liquefied natural gas and providing the United States with access to its service sector, according to data from Reuters.

The United States (SPY), Hong Kong (EWH), Japan (EWJ), Germany (EWG), and South Korea (EWY) are China’s top export destinations.

Let’s look at China’s imports in our next article.