How Energy Commodities Performed from June 18–20

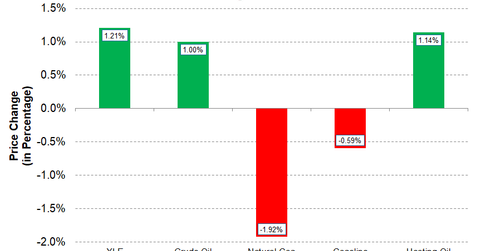

Energy stocks are rising this week. The Energy Select Sector SPDR ETF (XLE) has risen 1.2% from June 18–20.

Dec. 4 2020, Updated 10:53 a.m. ET

Crude oil moving up

From June 18–20, crude oil (USO) prices were on the rise, increasing to $65.71 per barrel from last week’s close of $65.06, a 1% rise. On May 22, Crude oil prices hit a 52-week high of $72.90 per barrel but then retreated. Even heating oil (UHN) increased 1.1% from June 18–20. Gasoline (UGA), however, decreased 0.6% in that period.

Natural gas trading down

Natural gas (UNG) prices were trading down from June 18–20. They decreased from last week’s close of $3.02 per mmBtu (million British thermal unit) on June 15 to $2.96 per mmBtu on June 20, a fall of 2%.

Energy equities

With mixed performances from energy commodities, energy stocks are rising this week. From June 18–20, the Energy Select Sector SPDR ETF (XLE), which represents the energy sector of the S&P 500 Index, increased 1.2%.

Stocks leading the rise in XLE are Cimarex Energy (XEC), Apache (APA), and Newfield Exploration (NFX), which have risen 11.8%, 9.8%, and 7.4%, respectively, from June 18–20.

Having analyzed the performance of energy commodities and the broader energy sector from June 18–20, let’s look next at the gainers in the upstream sector for that same period.