Analyzing the Consumer Cyclical Sector’s Dividend Yield: Part One

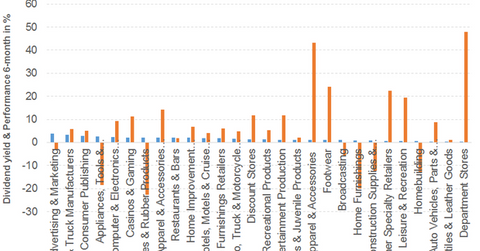

The consumer cyclical sector has an average dividend yield of 1.4%.

June 8 2018, Updated 4:30 p.m. ET

Consumer cyclical industries

The consumer cyclical sector has an average dividend yield of 1.4%. Of the sectors within the industry, advertising and marketing and auto and truck manufacturers have the highest and second highest dividend yields within the sector, respectively. Only advertising and marketing, auto and truck manufacturers, consumer publishing and appliances, and tools and housewares have beaten the broad-based indexes’ dividend yields.

Industries within this sector and the top dividend payer under the respective industry are as follows:

- advertising and marketing with a dividend yield of 3.7% and WPP (WPP)

- auto and truck manufacturers with a dividend yield of 3.3% and Toyota Motor (TM)

- consumer publishing with a dividend yield of 2.8% and Pearson (PSO)

- appliances, tools, and housewares with a dividend yield of 2.7% and Newell Brands (NWL)

- computer and electronics retailers with a dividend yield of 2.3% and Best Buy (BBY)

- apparel and accessories retailers with a dividend yield of 2.2% and L Brands (LB)

- tires and rubber products with a dividend yield of 2.2% and Goodyear Tire & Rubber (GT)

- casinos and gaming with a dividend yield of 2.1% and Las Vegas Sands (LVS)

- home improvement products and services retailers with a dividend yield of 2.1% and the Home Depot (HD)

- restaurants and bars with a dividend yield of 2.1% and McDonald’s (MCD)

- home furnishings retailers with a dividend yield of 1.9% and Williams-Sonoma (WSM)

- hotels, motels, and cruise lines with a dividend yield of 1.8% and Carnival (CCL)

- auto, truck, and motorcycle parts with a dividend yield of 1.6% and Cummins (CMI)

- discount stores with a dividend yield of 1.5% and Costco Wholesale (COST)

- recreational products with a dividend yield of 1.4% and Polaris Industries (PII)

- entertainment production with a dividend yield of 1.3% and Time Warner (TWX)

- apparel and accessories with a dividend yield of 1.1% and Hanesbrands (HBI)

- toys and juvenile products with a dividend yield of 1.1% and Mattel (MAT)

- footwear with a dividend yield of 1% and Nike (NKE)

- home furnishings with a dividend yield of 1% and Leggett & Platt (LEG)

- broadcasting with a dividend yield of 0.9% and Comcast (CMCSA)

- construction supplies and fixtures with a dividend yield of 0.8% and Masco (MAS)

- other specialty retailers with a dividend yield of 0.7% and National Vision (EYE)

- leisure and recreation with a dividend yield of 0.7% and Six Flags Entertainment (SIX)

- homebuilding with a dividend yield of 0.6% and D.R. Horton (DHI)

- auto vehicles, parts and service retailers with a dividend yield of 0.4% and KAR Auction Services (KAR)

- textiles and leather goods with a dividend yield of 0.4% and Culp (CULP)

- department stores with a dividend yield of 0.1% and Macy’s (M)