Six Flags Entertainment Corp

Latest Six Flags Entertainment Corp News and Updates

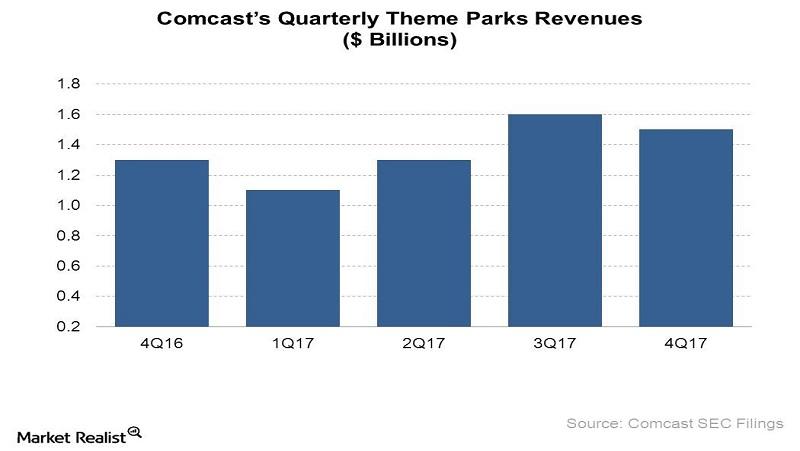

Here’s How Comcast’s Theme Park Business Performed in 4Q17

Comcast’s (CMCSA) Theme Parks business was a star performer in 4Q17, with revenue growth accelerating over the previous quarter.

Six Flags Entertainment: An overview of the largest theme park

Six Flags Entertainment Corp. (SIX) is the world’s largest regional theme park company with $1.1 billion in revenue and 18 parks across North America.

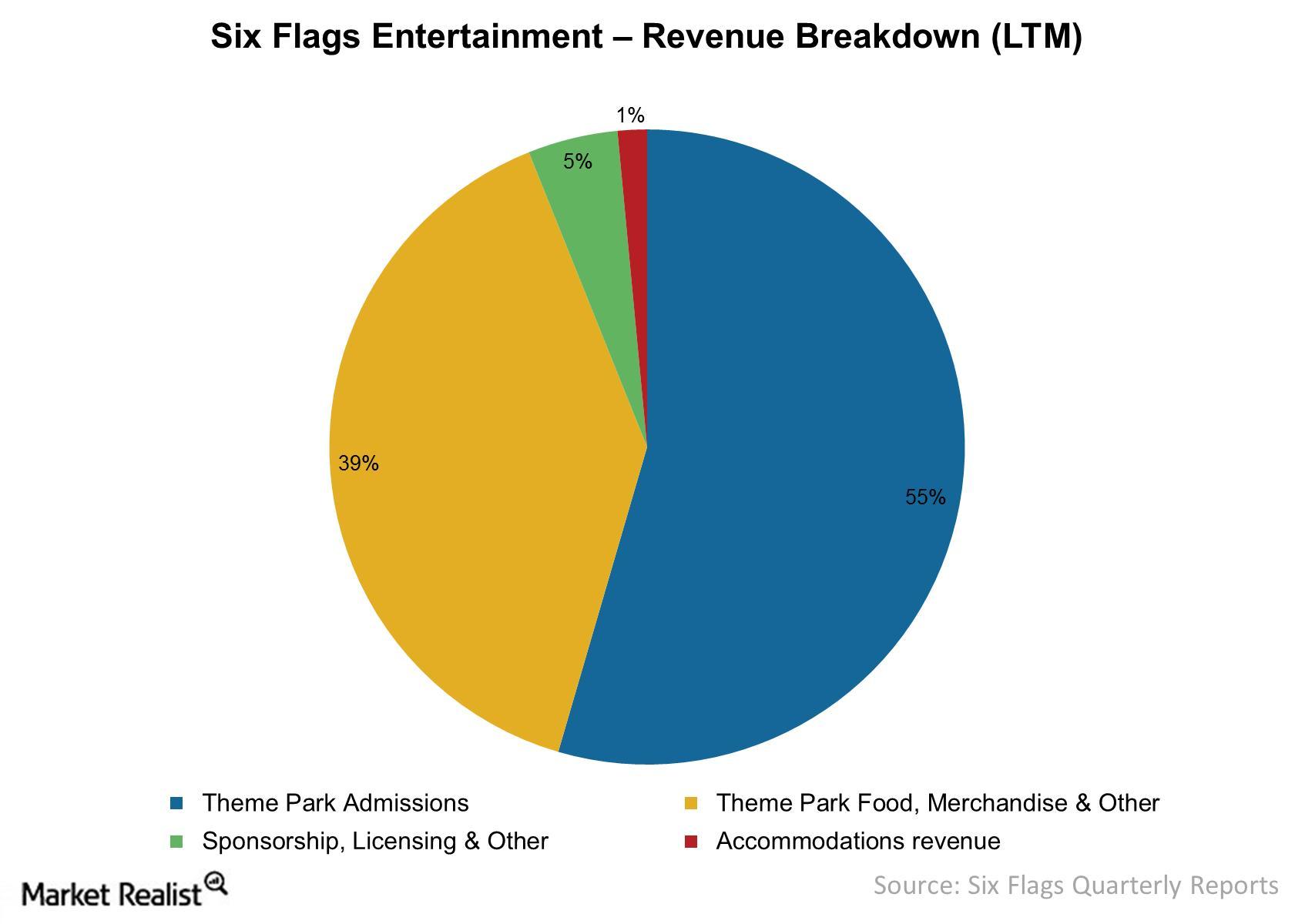

Must-know: How Six Flags generates its revenues

Six Flags derived 55% of its revenues from theme park admissions for the last 12 months ended September 30, 2014.

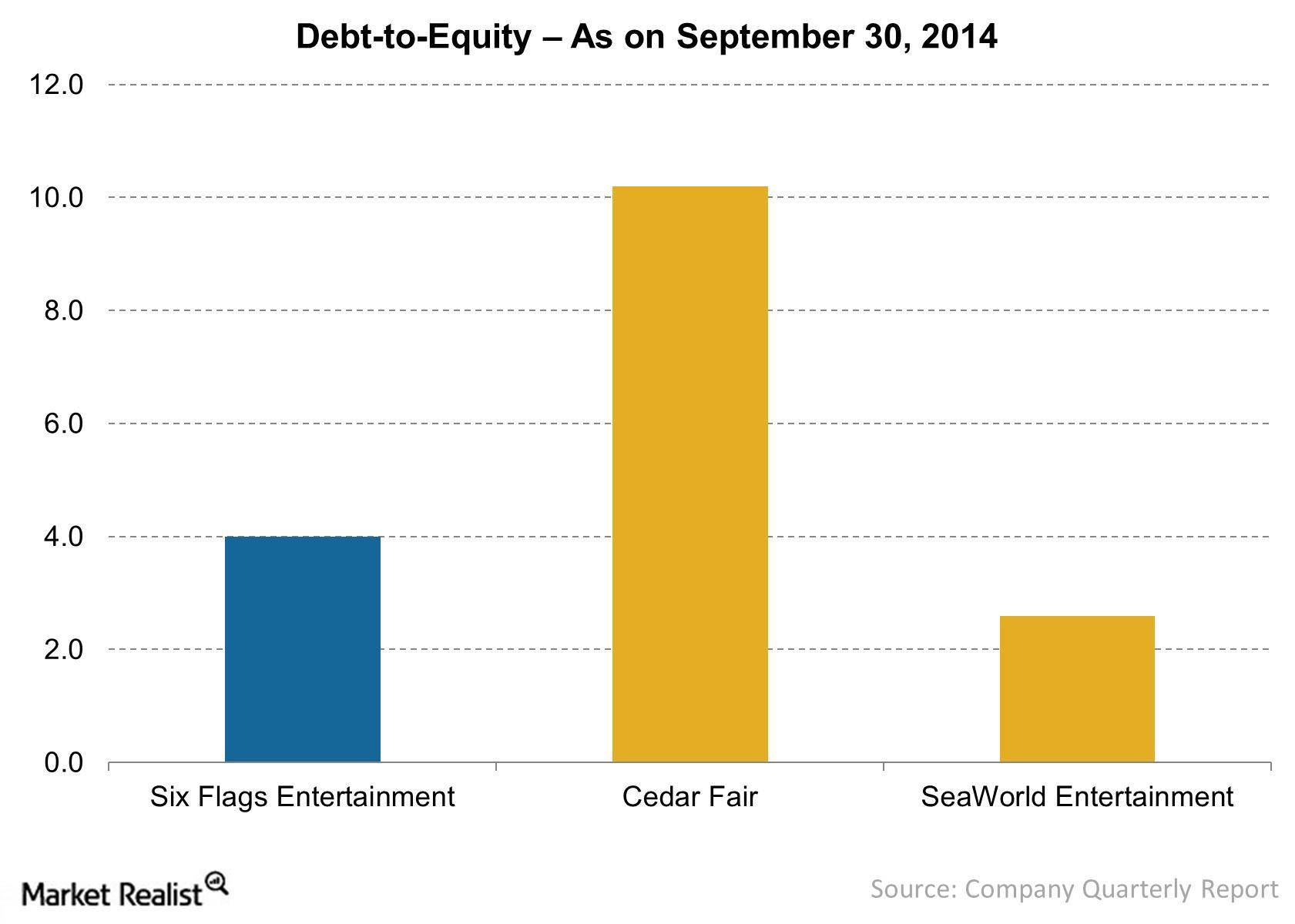

Must-know: A look into Six Flags’ debt-to-equity ratio

Industry debt-to-equity ratio is about 5.5. Six Flags’ debt-to-equity ratio of 4.0 shows the company aggressively finances operations with debt capital.

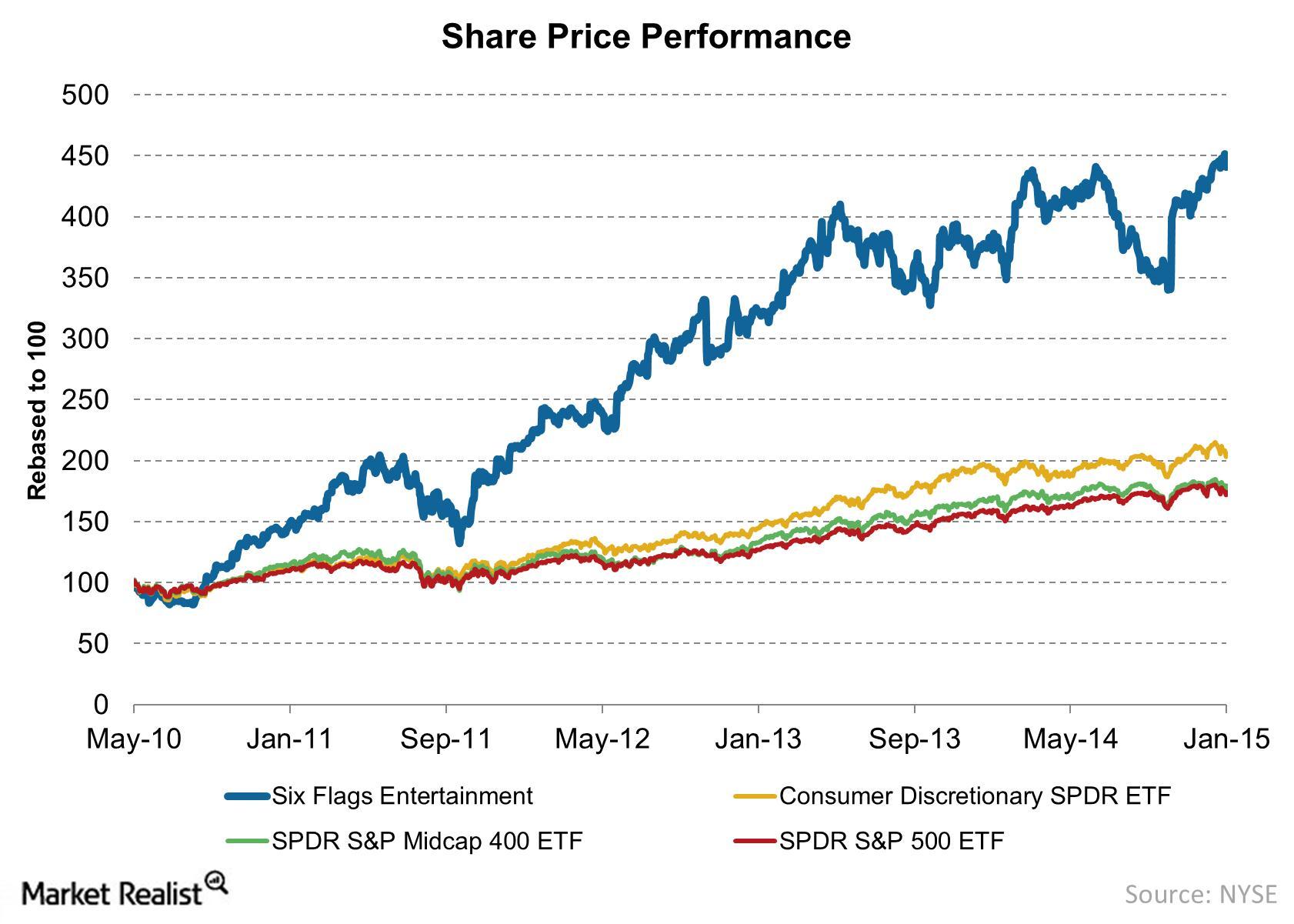

Share price performance for Six Flags since bankruptcy recovery

Six Flags’ share price on May 10, 2010, reflects $7.36 per share, the price of new common stock upon the company’s emergence from bankruptcy.

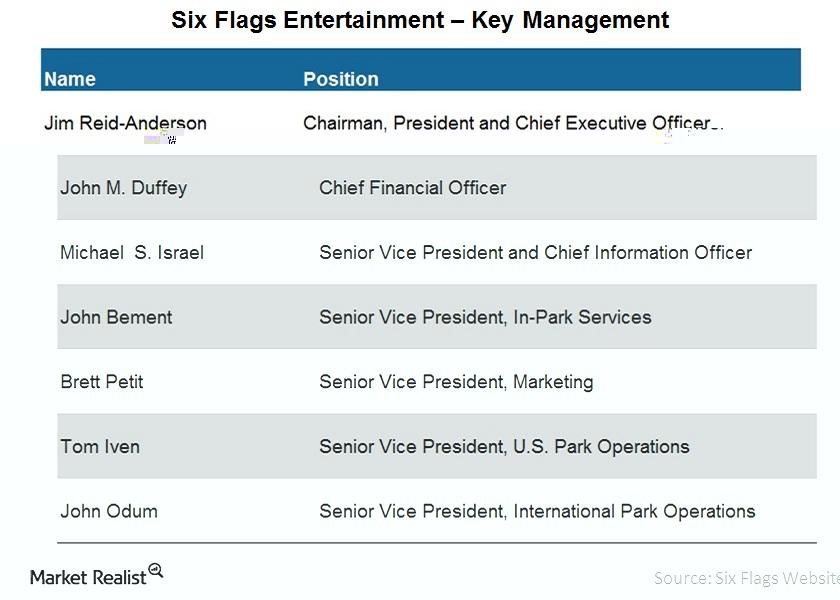

A brief overview of Six Flags’ management

Six Flags’ management plays a vital role in shaping the company and leading it in the desired direction. This article reviews three management positions.

Why China Is Becoming an Important Market for Disney

Popularity of English-language content in China Media companies in the United States (SPY) are increasingly looking at the Chinese (FXI) market as Hollywood movies become popular there. However, there have also been concerns about box office success in the country. On June 27, The Wall Street Journal reported, citing an unknown source, that the six […]

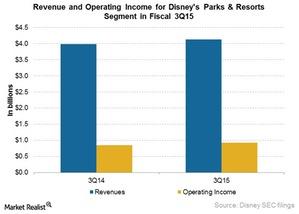

Disney’s Parks and Resorts: Shanghai Disneyland’s Capex Rising

Disney is incurring significant pre-opening expenses for Shanghai Disneyland (FXI), which will be unveiled in spring next year.

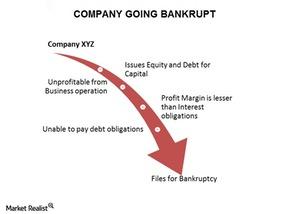

What Is Bankruptcy Investing?

Informed investors can profit from businesses that have filed for bankruptcy. A chapter 11 bankruptcy gives a company a second chance to revive its business.

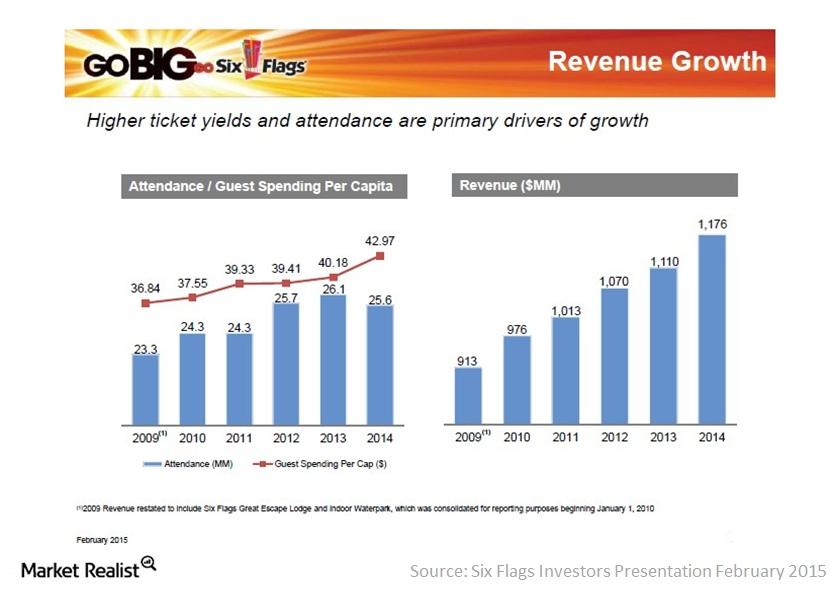

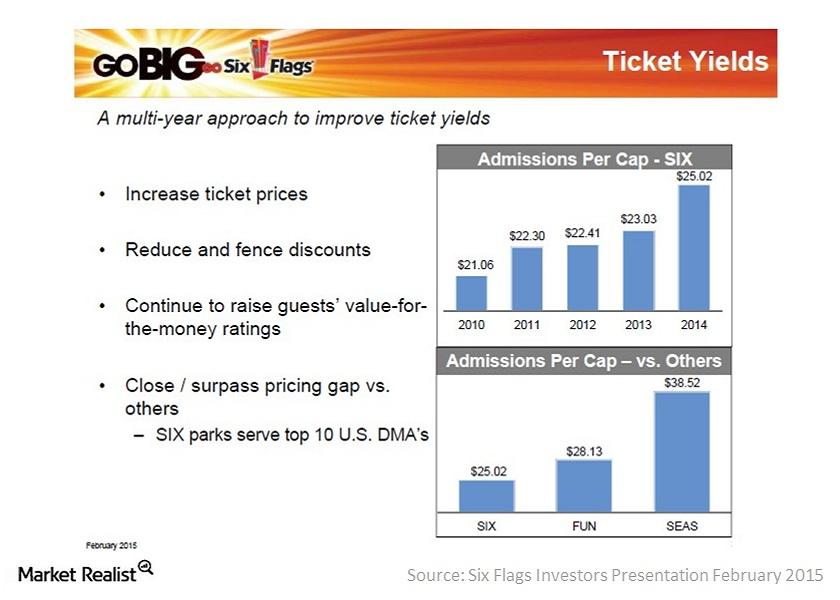

Why Six Flags’ guest spending per capita improved

Six Flags’ per capita guest spending increased $2.79, or 7%, to $42.97 in 2014, primarily due to improved admissions pricing and new offerings in the parks.

Ticket pricing pushes Six Flags’ admissions revenue up

Six Flags’ (SIX) admissions revenue per capita increased by 9% in 2014, primarily driven by pricing improvements on multi- and single-use ticket offerings.