China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

Jan. 19 2018, Published 11:20 a.m. ET

China’s December data

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index. The data help investors assess the crude oil tanker industry’s outlook.

China’s impact

China, the second-largest economy in the world, is a key nation that has a significant impact on the crude tanker industry. It imports ~60% of the oil that it needs. Most of the oil is imported by sea using crude tankers. We’ve observed a certain trend this year. China’s oil production is falling, while its oil demand is increasing. The trend is expected to continue next year as well. It should increase China’s oil imports, which benefits crude tankers.

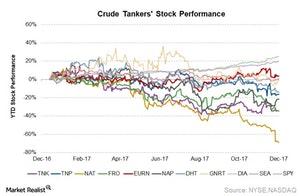

China is the largest manufacturing hub in the world. A country’s oil demand is related to its manufacturing activities. Higher manufacturing activity translates into higher oil demand, while higher oil demand means higher tanker demand. A country’s oil demand is closely related to its gasoline demand. China is a leading car manufacturer. In many ways, China is the most important country for the tanker industry. Major companies in the industry include Nordic American Tankers (NAT), Euronav (EURN), Gener8 Maritime Midstream Partners (GNRT), Tsakos Energy Navigation (TNP), and Teekay Tankers (TNK).

Series overview

In this series, we’ll see how China’s crude oil imports fared in December. We’ll also gauge China’s oil demand through its manufacturing industry’s performance and auto sales in December.