Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

March 28 2018, Updated 4:10 p.m. ET

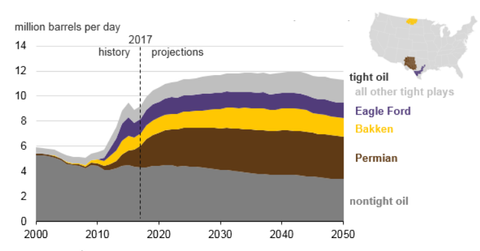

US tight oil production

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040. Tight oil is oil extracted from impermeable shale deposits such as the Permian, Eagle Ford, and Bakken using hydraulic fracturing or “fracking.”

The EIA expects US tight oil production to surpass 8.2 million barrels per day in 2040, accounting for almost 70% of total US production. In 2017, tight oil production made up 54% of the total US production.

From 2050 onward, the EIA expects tight oil production to remain relatively constant, as development would focus on productive areas. Then, total US oil production (tight oil and non-tight oil) is expected to increase from 9.3 million barrels per day in 2017 to ~12 million barrels per day in the early 2040s and then decrease slightly through 2050.

Permian Basin driving tight oil growth

According to the EIA, the Permian Basin has been driving US tight oil production. The three major tight oil plays in the basin—the Spraberry, Bone Spring, and Wolfcamp—had accounted for 36% of US tight oil production in 2017.

Companies that hold positions in the plays mentioned above include Pioneer Natural Resources (PXD), Callon Petroleum (CPE), EP Energy (EPE), Marathon Oil (MRO), Apache (APA), Cimarex Energy (XEC), and Parsley Energy (PE).

The EIA expects production from these three plays to continue to increase and to account for 43% of total tight oil production through 2050. In comparison, the Bakken and Eagle Ford formations should account for 20% and 17% of the total tight oil production, respectively.

In the report released by the EIA on February 22, it noted, “However, future growth potential of domestic tight oil production depends on the quality of resources, technology and operational improvements that increase productivity and reduce costs, and market prices—factors with futures that are both interconnected and uncertain.”

Next in this series, we’ll discuss the EIA’s projections about investments in tight oil.