EV CA Muni Bond II Common

Latest EV CA Muni Bond II Common News and Updates

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.

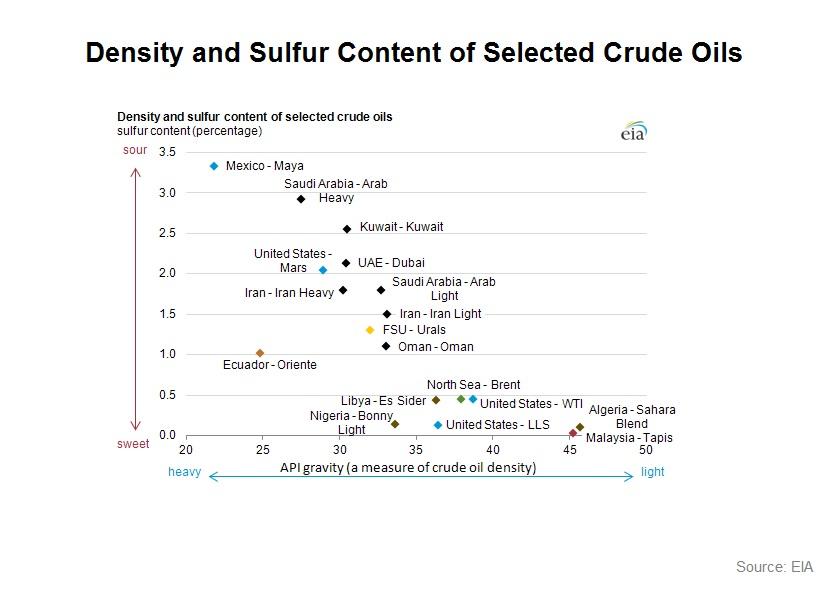

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.