EPE Energy Corp

Latest EPE Energy Corp News and Updates

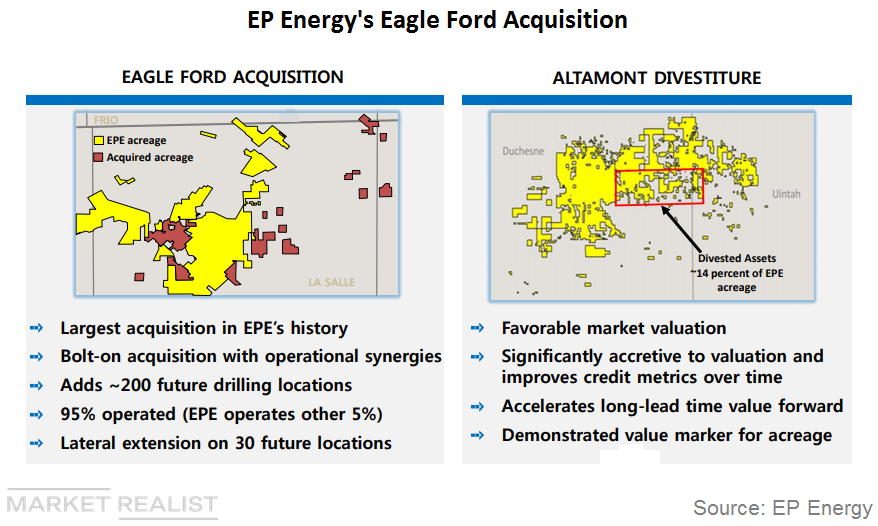

Is EP Energy Increasing Its Focus on Eagle Ford?

In February, EP Energy (EPE) announced that it had closed the acquisition of Carrizo Oil & Gas’s (CRZO) Eagle Ford assets.

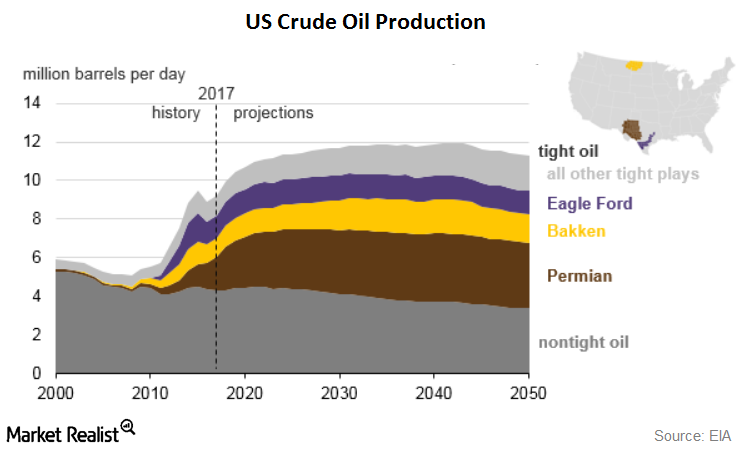

Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

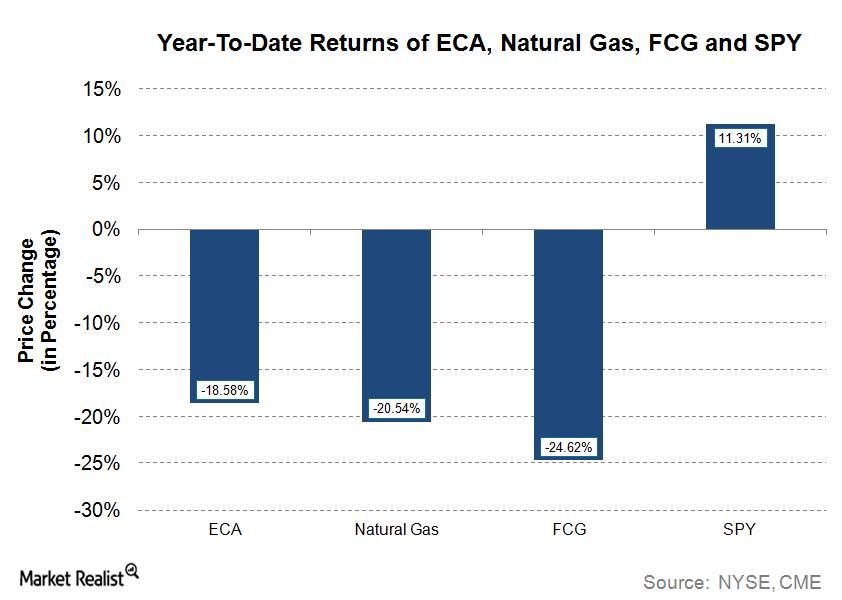

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

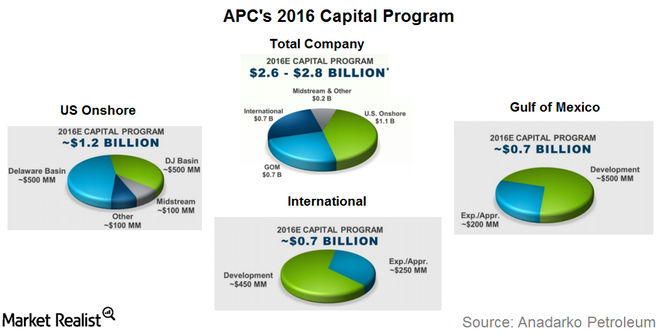

What Are Anadarko’s Capex Plans in 2016?

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

A Quick Look at Joy Global’s History and Operations

Joy Global operates in two business segments, namely its Underground Mining Machinery and Surface Mining Equipment segments.

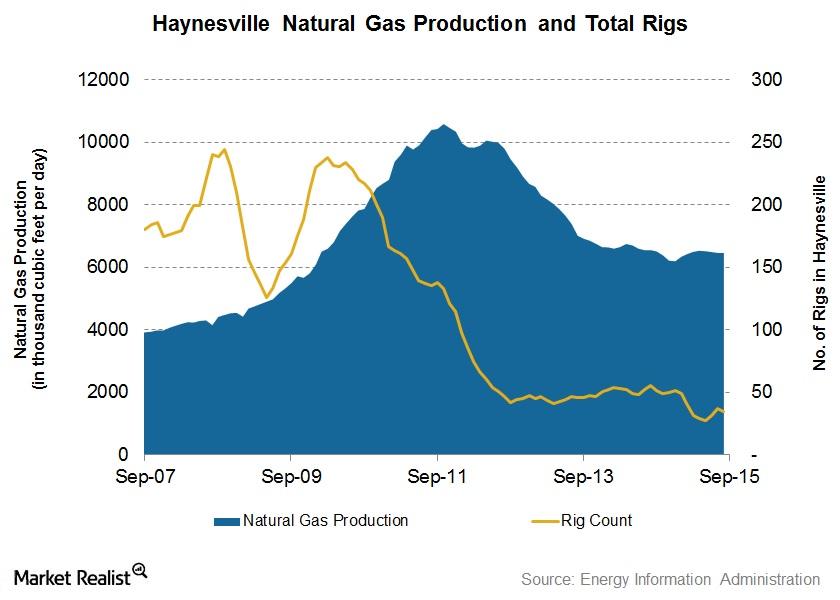

Haynesville Shale Natural Gas Production Fell in September

The Haynesville Shale’s natural gas production in September was 0.1% lower than August. On a YoY basis, it was 1.4% less. The drop marked the fourth straight month-over-month fall in production.