Why Did Barrick Gold’s Reserves Fall in 2018?

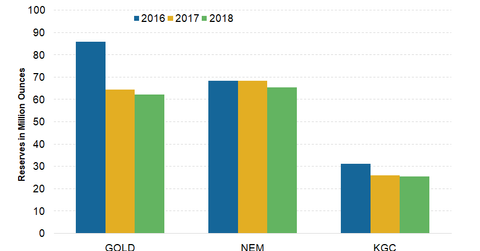

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

March 1 2019, Updated 9:00 a.m. ET

Reserve replacement

Gold miners (GDX) (SGDM) have faced ongoing concerns. They face the problem of compensating for every ounce they take out of the ground. Investors should look at miners’ reserves and resource estimates and the assumptions used to calculate them.

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY (year-over-year). The following developments led to this decline:

- 5.4 million ounces of reserves were depleted through mining and processing

- 3.2 million ounces of reserves added

The reserves at Barrick Gold’s underground operations were replaced with additions at Turquoise Ridge, Goldstrike, Hemlo, and Porgera. The company kept its gold price assumption of $1,200 per ounce unchanged to calculate the reserves.

Higher reserve grade

The average grade for the company’s reserves was essentially unchanged from 2017 at 1.56 grams per ton. The company boasts the highest grades in the industry. Newmont Mining (NEM), Goldcorp (GG), and Kinross Gold (KGC) have lower grades than Barrick Gold.

Higher grades are one of the most likely reasons for Barrick Gold’s lower all-in sustaining costs.

Other miners’ reserves

Other gold miners’ (NUGT) (RING) reserves have been declining. Newmont Mining (NEM) reported reserves of 65.4 million ounces for 2018—4.5% lower compared to 2017.

Kinross Gold’s (KGC) reserves fell 1.5% YoY in 2018 to 25.5 million ounces.

Agnico Eagle Mines’ (AEM) reserves increased 7% YoY to 22 million ounces in 2018. The company’s reserve grade also improved 8%.