US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

Oct. 9 2019, Updated 8:52 p.m. ET

Weekly US crude oil production

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018, according to the EIA. Production could have fallen due to cold weather during this period.

On January 10, 2018, the EIA published US crude oil production data. The unexpected fall in US crude oil production supported oil (SCO) (DBO) prices on January 10, 2018. US crude oil prices are at the highest level since December 2014. It benefits funds like the Energy Select Sector SPDR Fund (XLE), which fell 0.12% to 75.14 on January 10, 2018.

US crude oil production recovery

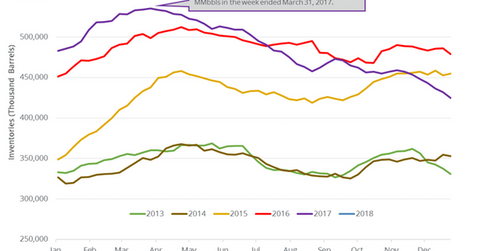

US crude oil production hit 8,428,000 bpd for the week ending July 1, 2016—the lowest production level in more than two years. Production has risen by 1,064,000 bpd or 12.6% since July 1, 2016. Higher oil (USL) prices in 2017 and improving drilling costs supported the increase in US oil production.

Higher oil (DBO) prices also benefit energy producers (XOP) (FXN) like Parsley Energy (PE), Occidental Petroleum (OXY), and Denbury Resources (DNR).

Estimates for 2018

US crude oil production averaged 9,410,000 bpd in 2015 and 8,860,000 bpd in 2016. Production averaged 9,300,000 bpd in 2017. The EIA released its monthly STEO (Short-Term Energy Outlook) report on January 9, 2018. It estimates that US oil production could average ~10,270,000 bpd in 2018, which is 2.6% higher than the December 2017 estimates. It would be the highest annual production average ever.

Output cuts and US oil production

Russia and OPEC prolonged the output cuts until December 2018. US oil production is expected to increase by 1,410,000 bpd or 16% from January 2017 to December 2018. If US production rises at this pace, it could offset 75% of the ongoing production cuts.

Impact

The increase in US oil production could be the biggest threat to oil prices in 2018. The rise in supplies from Canada and Brazil could also pressure oil (SCO) prices.

Next, we’ll discuss another bearish catalyst for crude oil in 2018.