Is Global Oil Demand Key to Crude Oil Bulls?

The EIA estimates that global oil demand could average 100.1 MMbpd in 2018. Global oil demand could increase to 101.75 MMbpd in 2019.

Nov. 20 2020, Updated 4:52 p.m. ET

US crude oil futures

March WTI crude oil (UWT) (UCO) futures contracts fell 1.2% and were trading at $64.76 per barrel at 1:15 AM EST on January 30, 2018. Prices fell due to the expectation of a rise in US crude oil production and inventories. The EIA will release the data on January 31, 2018.

Meanwhile, March E-Mini S&P 500 (SPY) futures contracts fell 0.49% to 2,839.5 at 1:15 AM EST on January 30, 2018.

Global oil demand in 2016 and 2017

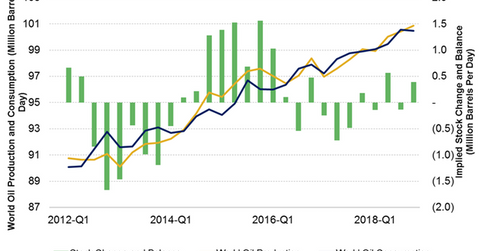

According to the EIA, global oil demand averaged 96.94 MMbpd (million barrels per day) in 2016. Global oil demand increased to 98.38 MMbpd in 2017. There was higher consumption from the US and China. The US and China are the largest oil consumers. They account for 33% of global oil consumption.

Production cuts and a rise in oil consumption supported oil (UWT) (DWT) prices. US oil prices increased 12.4% in 2017. Higher oil prices benefit oil producers (VDE) (RYE) like Whiting Petroleum (WLL), Newfield Exploration (NFX), Sanchez Energy (SN), and Gastar Exploration (GST).

Estimates

The EIA estimates that global oil demand could average 100.1 MMbpd in 2018. Global oil demand could increase to 101.75 MMbpd in 2019. The rise in consumption from the US, Europe, the Middle East, China, and India would drive consumption in 2018.

Impact

Higher compliance with production cuts along with the rise in consumption in 2018 could benefit oil (DBO) prices. Strong oil demand would be the second-biggest driver for oil prices after production cuts in 2018. So far, US crude oil prices have risen ~9% in January 2018—oil’s best January performance in 12 years.

Next, we’ll discuss the third-biggest bullish driver for oil prices in 2018.