Gasoline and Distillate Inventories Could Impact Crude Oil Prices

February US crude oil (DWT) (SCO) futures contracts rose 0.8% and were trading at $63.46 per barrel at 1:13 AM EST on January 10, 2018.

Jan. 10 2018, Updated 10:00 a.m. ET

US crude oil futures

February US crude oil (DWT) (SCO) futures contracts rose 0.8% and were trading at $63.46 per barrel at 1:13 AM EST on January 10, 2018. Prices rose due to the API’s (American Petroleum Institute) bullish crude oil inventory report after trading hours on January 9. US crude oil prices are at the highest level since December 2014. Higher oil (UCO) prices favor the Energy Select Sector SPDR ETF (XLE), which fell 0.3% to 75.2 on January 9, 2018.

Meanwhile, E-Mini S&P 500 (SPY) futures contracts for March delivery fell 0.06% to 2,750.25 at 1:13 AM EST on January 10, 2018.

API’s gasoline inventories

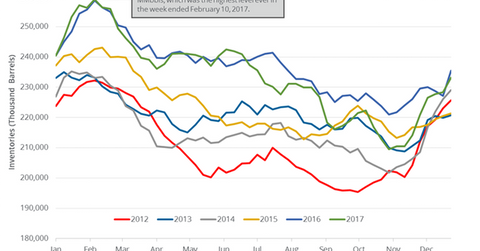

The API released its weekly crude oil inventory report on January 9, 2018. US gasoline inventories rose by 4.34 MMbbls (million barrels) between December 29, 2017, and January 5, 2018, according to the API.

Analysts expected that US gasoline inventories would have risen by 2.6 MMbbls during the same period. A large increase in gasoline inventories could have a negative impact on gasoline (UGA) and oil (UCO) prices.

Lower oil (DBO) prices have a negative impact on energy companies (RYE) (PXI) like Tesco (TESO), Recon Technology (RCON), and Gastar Exploration (GST).

API’s distillate inventories

According to the API, US distillate inventories rose by 4.69 MMbbls between December 29, 2017, and January 5, 2018. Analysts estimated that US distillate inventories could have risen by 1.5 MMbbls during the same period. A large build in distillate inventories could have a negative impact on diesel and oil (USO) prices.

Next, we’ll discuss how US gasoline demand impacts oil prices.