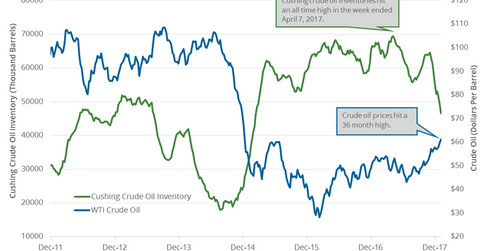

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

Sept. 30 2019, Updated 7:17 p.m. ET

Cushing inventories

Cushing, Oklahoma, is the largest crude oil storage hub in the US. Analysts expect that the crude oil inventories at Cushing could have declined on January 5–12, 2018.

Any fall in Cushing inventories is bullish for oil (DWT) (UWT) prices. US crude oil (SCO) prices are at a 37-month high. It also favors funds like the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and the iShares U.S. Energy ETF (IYE). These ETFs have exposure to US energy stocks.

EIA’s Cushing inventories

The EIA released its weekly crude oil inventories report on January 10, 2018. Cushing inventories fell by 2,395,000 barrels to 46.5 MMbbls (million barrels) between December 29, 2017, and January 5, 2018, according to the EIA. Inventories fell 4.8% week-over-week and by 20,352,000 barrels or 30% year-over-year.

Any decline in the inventories benefits oil (UCO) prices. Higher oil (SCO) prices benefit energy producers’ (VDE) (XES) earnings like SN Energy (SN), Northern Oil & Gas (NOG), Bill Barrett (BBG), and Whiting Petroleum (WLL).

EIA’s US crude oil inventories

US crude oil inventories fell by 4.9 MMbbls or 1.1% to 419.5 MMbbls between December 29, 2017, and January 5, 2018, according to the EIA. The inventories also fell by 63.5 MMbbls or 13.2% from a year ago. The inventories fell ~21.7% from their peak.

Impact

Cushing crude oil inventories fell ~33% or by 22.9 MMbbls from their peak on April 7, 2017. Since then, WTI crude oil (USO) prices have risen ~18%.

Cushing crude oil inventories were near the lowest level since February 13, 2015. Any decline in US and Cushing inventories could support oil (DBO) prices.

Next, we’ll discuss US crude oil rigs.