Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

Jan. 11 2018, Updated 12:55 p.m. ET

Looking ahead

Previously in this series, we discussed that crude (DBO) tanker stocks were mixed in the week ending January 5, 2018. VLCC (very large crude carrier), Suezmax, and Aframax rates fell. In this part of the series, we’ll see how crude oil and bunker fuel prices fared in the first week of 2018.

Oil prices

Crude oil prices rose to a three-year high on January 3, 2018. Anti-government protests in Iran and a blast of cold weather raised concerns about potential supply disruptions. Brent crude oil prices traded at $67.93 per barrel, while West Texas Intermediate crude oil rose to a high of $61.8 per barrel.

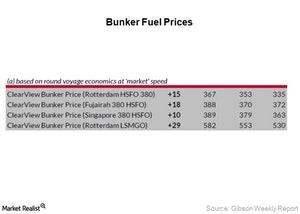

Bunker fuel prices

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017. According to the Gibson report for week 1, bunker fuel prices at Rotterdam were $367 per ton on January 4, 2018—compared to $353 per ton the previous week. Bunker fuel prices at the Port of Fujairah rose to $388 per ton from $370 per ton two weeks ago, according to the same report.

Which companies were impacted?

Industries that transport commodities on ships incur bunker fuel costs. These industries are LNG (liquefied natural gas) carriers, product tankers, dry bulk carriers, and crude oil tankers. Bunker fuel prices are closely related to oil prices.

Some of the major crude oil tanker companies are Nordic American Tankers (NAT), Frontline (FRO), Gener8 Maritime Partners (GNRT), and Euronav (EURN). GasLog (GLOG) and Hoegh LNG Partners (HMLP) are LNG carrier companies. Navios Maritime Partners (NMM) is a major dry bulk shipper.