AMLP, AMZA, EMLP, MLPX: How Are They Different?

The Alerian MLP ETF (AMLP) invests only in infrastructure MLPs. Similarly, the Global X MLP ETF (MLPA) invests at least 80% of its assets in MLPs.

Jan. 8 2018, Updated 7:37 a.m. ET

Investment focus

The Alerian MLP ETF (AMLP) invests only in infrastructure MLPs. Similarly, the Global X MLP ETF (MLPA) invests at least 80% of its assets in MLPs. The Infracap MLP ETF (AMZA) also primarily invests in MLPs. On the other hand, as we discussed in the previous part, the First Trust North American Energy Infrastructure Fund (EMLP) invests in MLPs as well as pipeline companies, utilities, and other energy infrastructure companies.

The Global X MLP & Energy Infrastructure ETF (MLPX) also invests in midstream companies along with MLPs.

Current composition

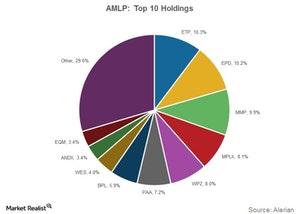

The above graph shows the Alerian MLP ETF’s top holdings. Notably, the top ten holdings of the Global X MLP ETF (MLPA) are the same as those of AMLP but in a different proportion.

Energy Transfer Partners (ETP), Williams Partners (WPZ), and Buckeye Partners (BPL) are the top three holdings of the Infracap MLP ETF (AMZA). These account for 20.5%, 13.6%, and 9.7%, respectively, of AMZA’s current portfolio.

EMLP and MLPX

The top ten holdings account for nearly 40% of the First Trust North American Energy Infrastructure Fund’s (EMLP) portfolio. Of these holdings, only 15% is directly invested in MLPs currently. Around 15% is invested in midstream c-corps, whereas ~10% is invested in Enbridge Energy Management (EEQ) and Enbridge Income Fund Holdings (ENF.TO).

None of the top five holdings of the Global X MLP & Energy Infrastructure ETF (MLPX) is an MLP currently. Enbridge (ENB), Kinder Morgan (KMI), and Williams Companies (WMB) are the top three holdings of MLPX, accounting for 27% of its current portfolio.

Investors looking for MLP exposure should consider this before adding any of the ETFs to their portfolio.