Buckeye Partners LP

Latest Buckeye Partners LP News and Updates

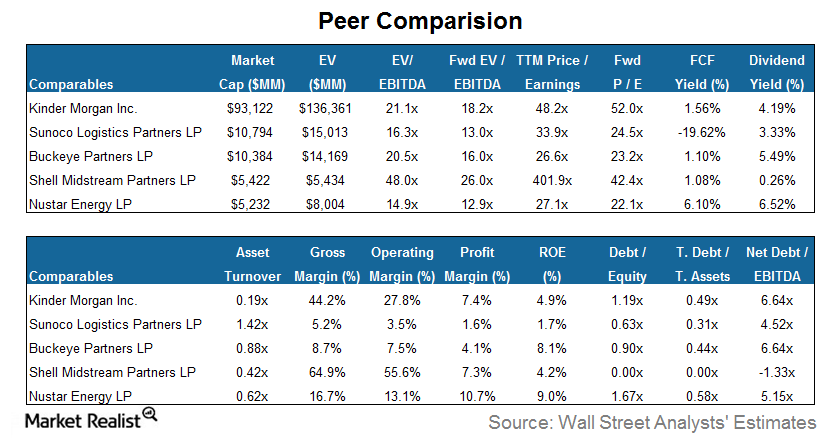

Why Sunoco Logistics Has the Lowest Profit Margins

Sunoco Logistics has the lowest profit margin and ROE among its peers. Its profit margin and ROE of 1.6% and 1.7%, respectively, are well below the group average.

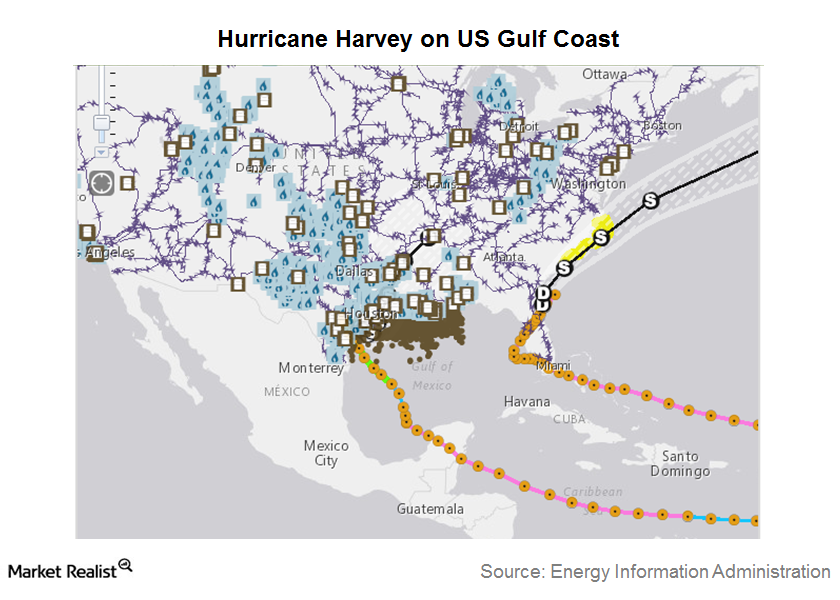

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

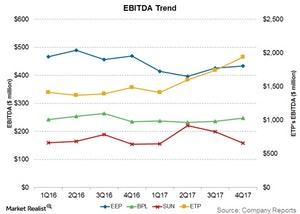

Why Energy Transfer Partners’ Earnings Are on the Rise

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.

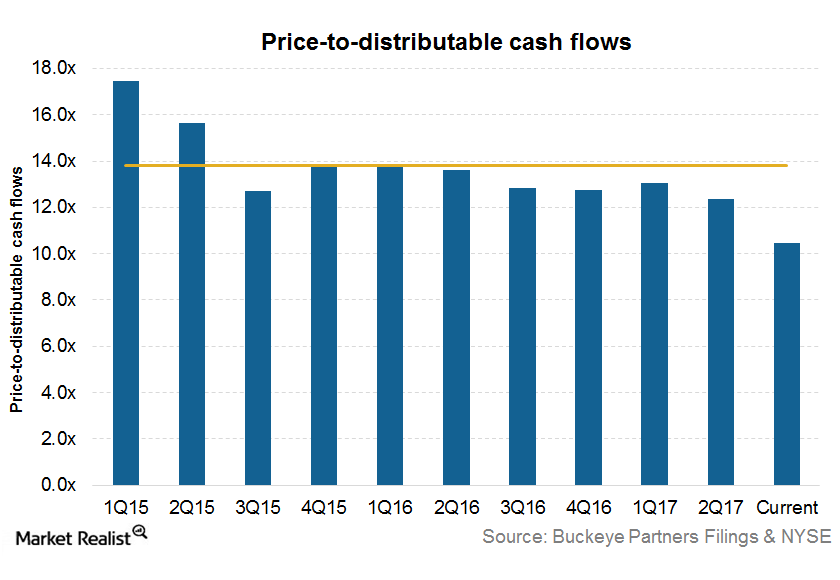

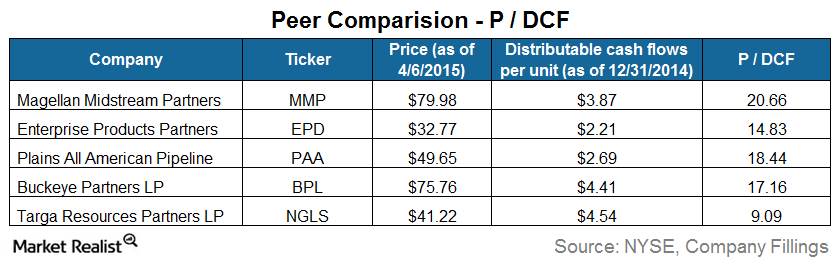

What Buckeye Partners’ Current Valuation Indicates

On October 31, 2017, Buckeye Partners (BPL) was trading at a price-to-distributable-cash-flow multiple of 10.4x, which is significantly below the historical ten-quarter average of 13.8x.

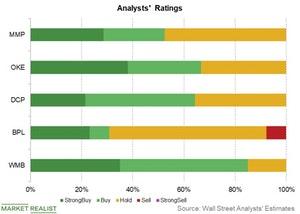

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

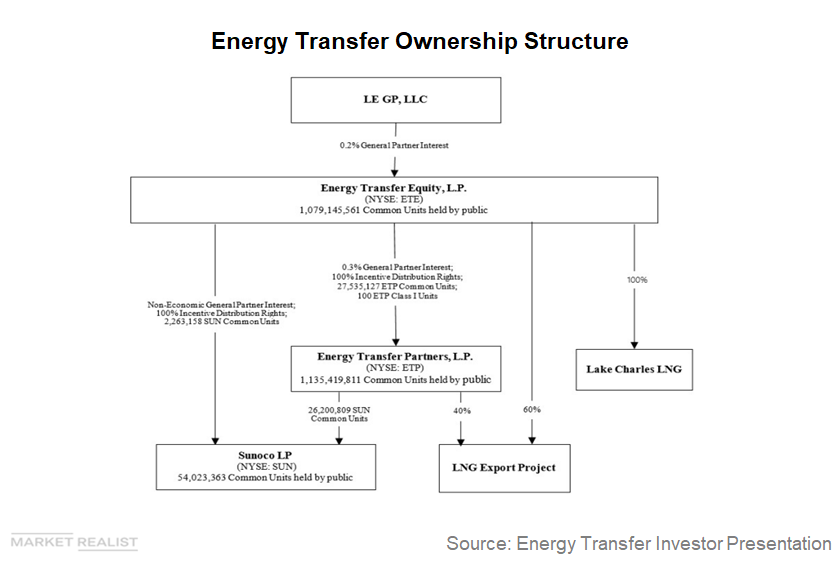

Is Energy Transfer Partners Exploring a C Corporation Structure?

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

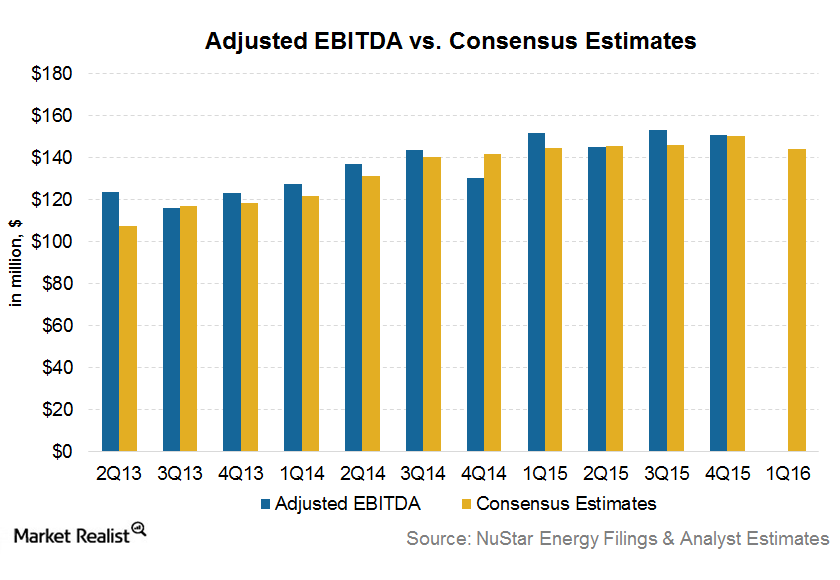

Analyzing NuStar Energy’s 1Q16 EBITDA Estimates

NuStar Energy is expected to release its 1Q16 earnings on April 27. Wall Street analysts’ 1Q16 consensus EBITDA estimate for NuStar Energy is $144.3 million.

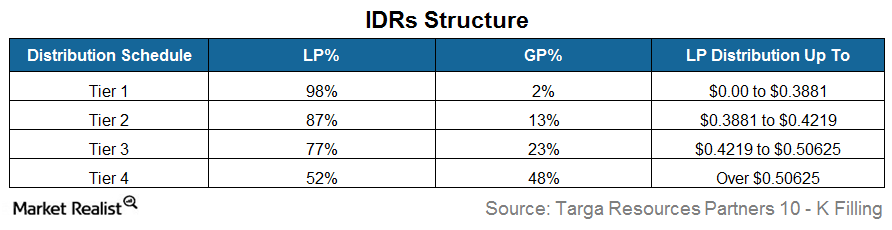

IDRs: How Do They Impact MLPs?

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.