Traders Track US Crude Oil Production and Exports

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

Nov. 20 2020, Updated 2:19 p.m. ET

Monthly US crude oil production

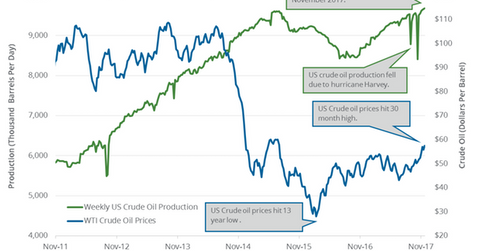

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month. It also rose by 765,000 bpd or 8.7% from the same period in 2016. Monthly US crude oil production was at the highest level since April 2015. Weekly US crude oil production hit a record 9,682,000 bpd on November 17–24, 2017. Tradition Energy expects that US crude oil output could hit 10,000,000 bpd in the next three to six months.

US crude oil production impact on oil

The above chart shows the relationship between US crude oil production and oil prices. High production weighed on oil (USO) (DWT) prices last week. As a result, US oil prices have fallen 2.3% since the 30-month high in November 2017. Lower oil prices have a negative impact on oil companies’ (IYE) (IXC) earnings like Denbury Resources (DNR), Contango Oil & Gas (MCF), SM Energy (SM), and Marathon Oil (MRO).

US crude oil exports

Weekly US crude oil exports fell by 179,000 bpd or 11% to 1,412,000 bpd on November 17–24, 2017. Exports have risen 200% year-over-year. They hit 2,133,000 bpd for the week ending October 27, 2017. Exports increased due to the rise in domestic production, a wider spread between Brent and US oil prices, and lifting the oil export ban. Monthly US crude oil exports averaged 1,473,000 bpd in September 2017, which was almost twice the exports in August 2017. High US oil exports are bearish for Brent oil (BNO) (UWT) prices.

Impact

Traders are tracking US production and exports because it will be the biggest bearish driver for oil prices in 2018. The EIA will release US crude oil production and exports data on December 6, 2017. Any rise in US oil production and exports could offset some of the impacts of current production cuts. As a result, it could pressure oil (BNO) (DBO) prices.

Next, we’ll discuss US gasoline inventories and demand.