Natural Gas: Have Oversupply Concerns Eased?

On December 19, natural gas (UNG)(BOIL)(FCG) January 2018 futures closed $0.31 below its January 2019 futures.

Dec. 21 2017, Updated 9:02 a.m. ET

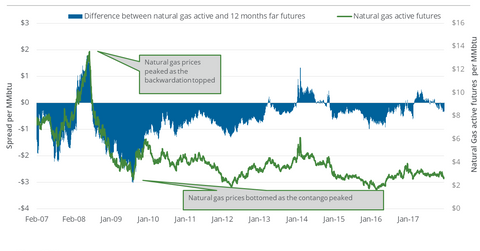

Futures spread

On December 19, natural gas (UNG)(BOIL)(FCG) January 2018 futures closed $0.31 below its January 2019 futures. The futures spread was at a discount on the same day.

On December 12, the discount was $0.33. Between December 12 and December 19, natural gas January futures rose 0.5%.

Importance of futures spread discounts and premiums

A rise in the discount could have a negative impact on natural gas prices. On March 3, 2016, natural gas futures closed at ~$1.64 per MMBtu.[1. million British thermal units] The futures spread rose to a discount of $0.84 for the lowest closing price in the last 17 years. However, a fall in the discount could boost natural gas prices.

Similarly, a rise in the futures spread premium could have a positive impact on natural gas prices. On May 12, 2017, natural gas futures closed at their highest closing price in 2017 as the futures spread premium hit $0.50. Conversely, a fall in the premium could harm natural gas’s gains.

In the seven calendar days before December 19, the discount fell slightly and natural gas futures gained just 0.5%. This could mean natural gas supply concerns have eased slightly.

Energy sector

US natural gas producers’ (XOP)(DRIP)(IEO) hedging techniques could be influenced by the natural gas futures forward curve. The midstream sector’s (AMLP) natural gas transportation, storage, and processing operations also relate to this curve.

On December 12, January 2018 futures contracts stood $0.005 below the February 2018 futures. This pricing could be a slight disadvantage for ETFs like the ProShares Ultra Bloomberg Natural Gas ETF (BOIL) and the United States Natural Gas Fund LP ETF (UNG). These ETFs have exposure to natural gas futures.