Cushing Inventories Rose for the First Time in Nearly 2 Months

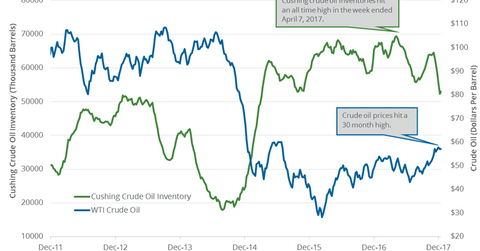

Cushing inventories rose by 754,000 barrels or 1.4% to 52.9 MMbbls (million barrels) on December 8–15, 2017, according to the EIA.

Dec. 27 2017, Updated 9:00 a.m. ET

Cushing inventories

Cushing, Oklahoma, is the biggest crude oil storage facility in the US. Analysts estimated that crude oil inventories at Cushing would rise on December 15–22, 2017. Any increase in Cushing inventories has a negative impact on oil (DBO) (DWT) prices.

WTI crude oil (UWT) prices were near a 30-month high. They have risen 11.7% year-to-date. Higher oil (UCO) prices benefit funds like the Fidelity MSCI Energy Index (FENY) and the Energy Select Sector SPDR ETF (XLE). These ETFs track the performance of US companies in the energy sector.

EIA’s Cushing inventories

Cushing inventories rose by 754,000 barrels or 1.4% to 52.9 MMbbls (million barrels) on December 8–15, 2017, according to the EIA. Inventories fell by 13,265,000 barrels or 20% from the same period in 2016. Inventories rose for the first time in nearly two months.

Meanwhile, Cushing inventories were near the lowest level since March 6, 2015. Any fall in the inventories will have a positive impact on oil (USO) prices. Higher oil (SCO) prices favor energy producers’ (FXN) (FENY) earnings like Northern Oil & Gas (NOG), Laredo Petroleum (LPI), and Viper Energy (VNOM).

EIA’s US crude oil inventories

According to the EIA, US crude oil inventories fell by 6.4 MMbbls to 436.4 MMbbls on December 8–15, 2017. The inventories also fell by 48 MMbbls or 10% from a year ago. The inventories fell by 99 MMbbls or ~19% from their peak.

Impact

For the week ending December 15, 2017, Cushing inventories fell ~24% from their record in April 2017. During the same period, US crude oil (UCO) prices rose 12%. Any fall in US and Cushing inventories is bullish for oil (DBO) prices.

Next, we’ll discuss how the US crude oil rig count impacts oil prices.