US Gasoline Inventories Weighed on Crude Oil Futures

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA.

Nov. 30 2017, Updated 12:25 p.m. ET

US gasoline inventories

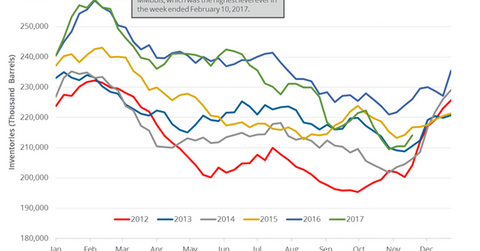

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA. However, gasoline inventories fell by 12 MMbbls or 5.3% YoY (year-over-year).

Wall Street analyst expected that US gasoline inventories would have risen by 1,199,000 barrels on November 17–24, 2017. A larger-than-expected rise in gasoline inventories pressured gasoline (UGA) and crude oil (USO) (SCO) prices on November 29, 2017. NYMEX gasoline futures fell 2.3% to $1.73 per gallon on the same day.

US gasoline production and demand

US gasoline production fell by 210,000 bpd (barrels per day) to 10.2 MMbpd (million barrels per day) on November 17–24, 2017, according to the EIA. Production fell 2% week-over-week but rose by 236,000 bpd or 2.3% YoY.

US gasoline demand fell by 871,000 bpd to 8.7 MMbpd on November 17–24, 2017. It fell 9% week-over-week and by 356,000 bpd or 4% YoY. Any fall in gasoline demand is bearish for gasoline and oil (UCO) (DBO) prices.

Lower gasoline prices have a negative impact on US refiners (CRAK) like Tesoro (TSO), CVR Energy (CVI), and Valero (VLO). Lower oil prices have a negative impact on energy producers (IXC) (FXN) like Pioneer Natural Resources (PXD), Energen (EGN), and Marathon Oil (MRO).

Impact of lower gasoline inventories

US gasoline inventories have fallen 14% from their all-time high, which is bullish for gasoline prices. However, they’re above their five-year average, which is bearish for gasoline and oil prices.

Next, we’ll focus on US distillate inventories and their impact on oil prices.