Russia’s Crude Oil Production Rose in October

Russia’s crude oil production rose by 20,000 bpd (barrels per day) to 10,930,000 bpd in October 2017—compared to September 2017.

Nov. 3 2017, Updated 12:40 p.m. ET

Crude oil prices

December WTI (West Texas Intermediate) crude oil (USL) (SCO) (DTO) futures contracts rose 0.44% to $54.77 per barrel in electronic exchange at 1:55 AM EST on November 3, 2017. Likewise, December 2017 E-Mini S&P 500 (SPY) futures contracts rose 0.02% to 2,578.25.

US crude oil prices are at a 28-month high. Higher oil prices benefit energy producers (IXC) (FXN) like Pioneer Natural Resources (PXD), SM Energy (SM), and Denbury Resources (DNR).

Russia’s crude oil production

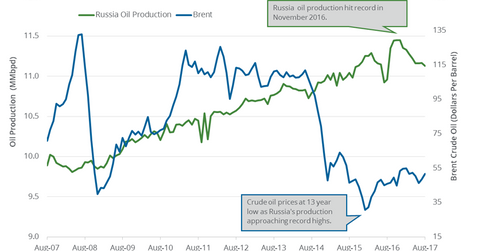

Russia’s crude oil production rose by 20,000 bpd (barrels per day) to 10,930,000 bpd in October 2017—compared to September 2017. Maintenance work in ExxonMobil’s (XOM) Sakhalin-1 project was completed in September 2017. So, Russia’s crude oil production rose in October 2017. Russia’s crude oil production hit a 13-month low in September 2017 at 10,910,000 bpd due to ongoing production cuts. Any fall in Russia’s crude oil production will benefit crude oil (BNO) (OIL) prices.

Russia’s crude oil exports through pipeline

According to Russia’s energy ministry, the country exported 4,627,000 bpd of oil through the pipeline in October 2017. It exported 4,302,000 bpd in September 2017. Oil exports through the pipeline rose by 325,000 bpd or 7.5% month-over-month. The rise in exports adds to the global supplies and pressures oil (USO) (DBO) prices.

Russia and production cuts

Non-OPEC and OPEC producers decided to curb crude oil production by 1,800,000 bpd or 2% from January 2017 to March 2018. Russia decided to curb production by 300,000 bpd as part of the deal. Russia has cut production by 317,000 bpd or 2.8% as of October 2017 from 11,247,000 bpd in October 2016.

Impact

The current production cuts have been partially benefiting oil (BNO) (OIL) prices since December 2016. OPEC’s meeting will be held on November 30, 2017. If the production cut deal is extended, it would likely push oil prices higher. If the production cuts aren’t extended, Russia would likely increase its production by ~100,000 bpd in 2018, which could pressure oil prices.

Next, we’ll analyze how US crude oil inventories impact oil prices.