Bristol-Myers Squibb’s Virology Products in 2Q17

Bristol-Myers Squibb’s (BMY) virology products portfolio includes products for the treatment of chronic virus infections.

Aug. 30 2017, Updated 9:08 a.m. ET

Virology portfolio

Bristol-Myers Squibb’s (BMY) virology products portfolio includes products for the treatment of chronic virus infections, including hepatitis B virus, hepatitis C virus, and HIV (human immunodeficiency virus).

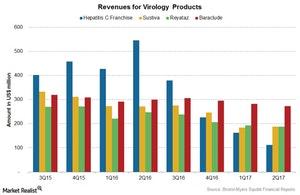

The above graph shows the revenues for BMY’s key virology products and hepatitis C franchise over the last few quarters.

HIV franchise

The HIV franchise includes two drugs: Reyataz and Sustiva. Both of these drugs are prescription drugs used in combination with other antivirals for the treatment of HIV-1 infections. Reyataz reported a 24.0% fall in revenues to $188.0 million in 2Q17 compared to $247.0 million in 2Q16, driven by lower sales due to competition. Sustiva reported revenues of $188.0 million in 2Q17, a 31.0% fall compared to $271.0 in 2Q16 following lower sales of the drug due to loss of exclusivity.

Hepatitis B franchise

The hepatitis B franchise includes the drug Baraclude, an oral antiviral used for the treatment of hepatitis B infections. Baraclude reported revenues of $273.0 million in 2Q17, a 9.0% fall compared to $299.0 million in 2Q16, mainly due to generic competition from Teva Pharmaceutical’s (TEVA) entecavir tablets.

Hepatitis C franchise

The hepatitis C franchise includes two drugs: Daklinza and Sunvepra. Daklinza is used in combination with sofosbuvir, with or without ribavirin, for the treatment of genotype 1 or genotype 3 chronic hepatitis C virus infections. Sunvepra is used as a combination drug for the treatment of genotype 1 chronic hepatitis C virus infections. The revenues for these drugs fell ~79.0% to $112.0 million in 2Q17 compared to $546.0 million in 2Q16, mainly due to competition in international markets.

To divest the company-specific risks, investors can consider ETFs such as the iShares US Health Care (IYH), which holds 3.1% of its total assets in Bristol-Myers Squibb (BMY). IYH also holds 2.4% in Allergan (AGN), 2.4% in Eli Lilly (LLY), and 5.5% in Merck & Co. (MRK).