Why US Crude Oil Production Hit a 5-Week Low

The US Energy Information Administration (or EIA) released its “Weekly Petroleum Status Report” on October 12. It estimates that US crude oil production fell by 81,000 bpd (barrels per day).

Nov. 20 2020, Updated 4:01 p.m. ET

US crude oil production

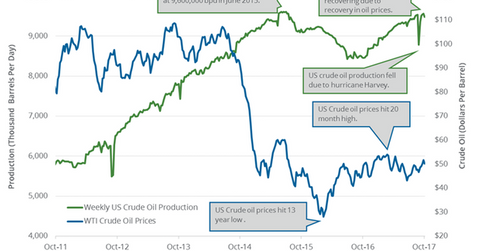

The US Energy Information Administration (or EIA) released its “Weekly Petroleum Status Report” on October 12. It estimates that US crude oil production fell by 81,000 bpd (barrels per day) to 9,480,000 bpd between September 29 and October 6.

US crude oil production is at a five-week low, partially due to Hurricane Nate. A fall in US crude oil production is bullish for crude oil (USO)(OIL)(DBO) prices. Higher oil prices have a bullish impact on oil producers (FXN)(IYE) like PDC Energy (PDCE), ConocoPhillips (COP), Hess (HES), and WPX Energy (WPX).

EIA’s US crude oil production estimates

The EIA released its STEO (“Short-Term Energy Outlook”) report on October 11. It estimates that US crude oil production will average 9.24 MMbpd in 2017—0.1% lower than the estimates from the September STEO report. The EIA also estimates that US crude oil production will average 9.92 MMbpd in 2018—0.8% higher than the estimates from the September STEO report.

US crude oil production averaged 9.4 MMbpd in 2015. Production fell to 8.86 MMbpd in 2016.

Impact

For the week ending October 6, US crude oil production has risen by 1,030,000 bpd or 12.18% year-over-year. Improving costs and operational efficiency could drive US crude oil production to a new annual record in 2018. The expectation of a rise in US crude oil production is bearish for crude oil (BNO)(SCO) prices.

Renewed fears of US crude oil production offsetting major producers’ output cut deal pressured crude oil prices on October 12. Record US crude oil production could delay global oil market rebalancing—even in 2018.

Next, we’ll discuss US gasoline inventory updates for the week ending October 6.