What’s the IMF’s View on Tax Reform?

According to the IMF (International Monetary Fund), a moderate progressive tax system may not negatively impact economic growth in developed economies (SPY) (EZU).

Oct. 16 2017, Updated 7:38 a.m. ET

IMF’s Fiscal Monitor report

According to the IMF (International Monetary Fund), a moderate progressive tax system may not negatively impact economic growth in developed economies (SPY) (EZU). Moreover, fiscal policy tools like increasing taxes on wealthy individuals can be used to erode income disparity by redistributing the wealth.

Impact of income disparity

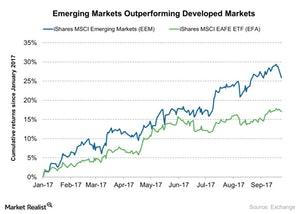

According to the IMF Fiscal Monitor report, the income inequality in advanced economies (EFA) has risen in the last three decades. However, in emerging economies (EEM) (VWO), income inequality has been falling in the last decade. The stronger economic growth, rising economic activity, and strong income growth in major emerging countries such as China (FXI) (YINN) and India (INDA) supported this trend.

High levels of inequality could bring political and social instability. The IMF said, “While some inequality is inevitable in a market-based economic system, excessive inequality can erode social cohesion, lead to political polarization, and ultimately lower economic growth.”

The above analysis could be crucial in the context of the tax reform proposed by President Donald Trump where Republican lawmakers’ tax reform framework is providing some flexibility to the country’s wealthier people, which could lead to greater income disparity.

You may be interested to read, Buffett’s Latest Word on Stock Valuations, Holdings, and Taxes.