OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

April 25 2017, Updated 7:40 a.m. ET

OECD’s crude oil inventories

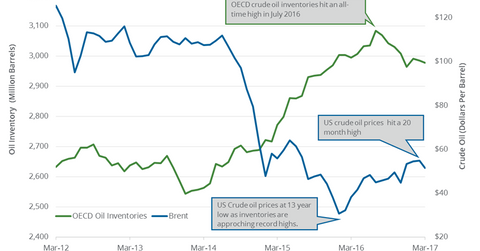

The EIA (U.S. Energy Information Administration) estimates that OECD’s (Organization for Economic Cooperation and Development) crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month. OECD’s oil inventories fell 0.3% month-over-month and 0.6% year-over-year. The fall in oil inventories is bullish for crude oil (IYE) (ERX) (DIG) (IXC) prices. For more on crude oil prices, read Part 1 of this series.

OPEC’s estimate

OPEC’s (Organization of the Petroleum Exporting Countries) Monthly Oil Market report stated that OECD countries’ oil inventories fell by 28.3 MMbbls to 2,987 MMbbls in February 2017—compared to the previous month. The inventories were 34 MMbbls lower than the same period in 2016.

Oil inventories in 2017 and 2018

OECD’s oil inventories averaged 2,860 MMbbls in 2015 and 3,023 MMbbls in 2016. The EIA expects OECD’s oil inventories to average 2,992 MMbbls and 3,035 MMbbls in 2017 and 2018, respectively.

Impact of OECD’s crude oil inventories

The fall in OECD’s oil inventories in 2017 could support crude oil prices in 2017. Higher crude oil prices have a positive impact on crude oil and natural gas producers’ revenues such as Marathon Oil (MRO), Denbury Resources (DNR), and Sanchez Energy (SN).

In the next part of this series, we’ll discuss how the global crude oil supply outage impacts crude oil prices.