Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

Oct. 26 2017, Published 10:50 a.m. ET

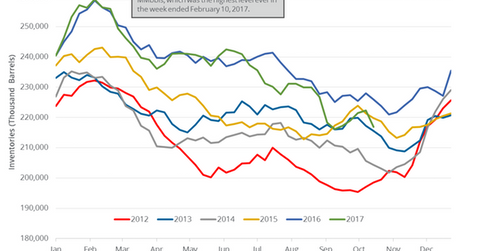

US gasoline inventories

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017. It’s the largest weekly fall in the last seven weeks. The inventories are at the lowest level since September 15, 2017. Gasoline inventories have fallen by 9.1 MMbbls or 4% from the same period in 2016.

Wall Street analysts expected that US gasoline inventories would have fallen by 100,000 barrels on October 13–20, 2017. A larger-than-expected fall in gasoline inventories supported US gasoline (UGA) futures. US gasoline futures rose 1.1% to $1.73 per gallon on October 25, 2017. However, crude oil (DBO) (UCO) (USL) prices fell on October 25, 2017.

US gasoline futures rose for the seventh straight trading session. They’re near a two-month high. Changes in gasoline prices impact US refining (CRAK) companies like Phillips 66 (PSX), Holly Frontier (HFC), and Tesoro (TSO).

US crude oil futures are near a six-month high. Changes in oil prices impact oil producers (IEZ) (XES) like Noble Energy (NBL), Chevron (CVX), and Northern Oil & Gas (NOG).

US gasoline production and demand

US gasoline production fell by 95,000 bpd (barrels per day) or 1% to 9,936,000 bpd on October 13–20, 2017. However, production has risen by 99,000 bpd or 1% YoY (year-over-year).

US gasoline demand rose by 178,000 bpd or 2% to 9,314,000 bpd on October 13–20, 2017. The demand has risen by 196,000 bpd or 2.1% YoY. High gasoline demand also supported gasoline prices on October 25, 2017.