Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

Nov. 20 2020, Updated 3:21 p.m. ET

Druckenmiller on the EEM ETF

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM). This ETF has performed well so far this year. On a year-to-date basis, the ETF has returned nearly 27% as of September 1, 2017.

The ETF also outperformed major developed markets (EFA) so far this year. The SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 Index, rose nearly 10% on a year-to-date basis as of September 1, 2017. The Vanguard FTSE Europe ETF (VGK), which tracks the performance of Europe, rose nearly 18.2% during the same period.

Dollar Index and emerging economies

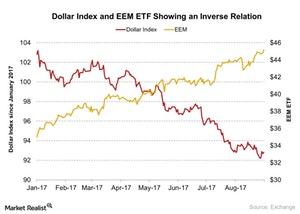

The Dollar Index (UUP) has fallen nearly 9.2% on a year-to-date basis as of September 1, 2017. The Dollar Index has weakened in the past months due to various factors. Major currencies such as the euro (FXE) and the British pound (FXB) showed some improvements against the US dollar as their central banks hinted at a hawkish stance in the near future. The delay in policy reforms in the US (SPY) (QQQ) also weakened the Dollar Index.

The Dollar Index has an inverse relationship with emerging markets (VWO). The correlation between the Dollar Index and emerging markets so far this year is -9%. Stanley Druckenmiller’s exit from the firm’s position in the EEM ETF suggests he isn’t optimistic about the performance of emerging markets.

You may be interested to read, Where David Tepper Placed His Bets in 2Q17.