How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

Nov. 20 2020, Updated 12:33 p.m. ET

Economic numbers

Precious metals have been reactive to changes in economic numbers for the United States since it’s a large economy. Crucial data for employment rates, spending, price indexes, and so on influence the sentiment of the market, which also leaves an impact on precious metals.

During the past week, average hourly earnings, which measures the change in the price businesses pay for labor, excluding the farming industry, were below analysts’ expectation of 0.10%. The non-farm employment change that measures the variation in the number of employed people during the previous month, excluding the farming industry, was 156,000. Analysts had forecast 180,000. The unemployment rate was higher than the forecast at 4.4%.

Market uncertainty

The numbers seem to have a negative impact on the economy and thus are good for safe havens. As we know, precious metals often rise during economic uncertainty. Degrading economics for a country could also boost haven bids.

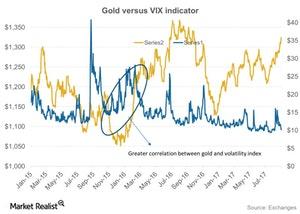

The above chart shows how gold moved in the same direction as market uncertainty from the end of 2015 to the start of 2016. Investors often jump to safety assets such as gold and silver (IAU) (SLV) as well as Treasuries during rising times of unrest (VIXY) (VXY).

Ongoing geopolitical tensions and Hurricane Harvey have also left an impact on the safety value of these assets. The impact is obviously upward.

The miners that have risen due to the revival of precious metals include New Gold (NGD), Alamos Gold (AGI), First Majestic Silver (AG), and Royal Gold (RGLD).