Why US Gasoline Demand Rose for 2nd Consecutive Month

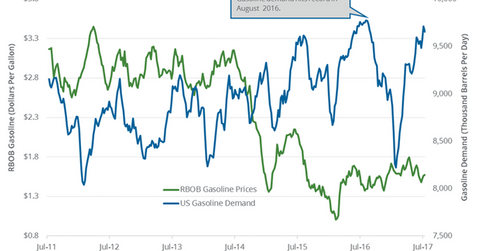

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016.

Aug. 2 2017, Published 10:02 a.m. ET

US gasoline demand

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016. Gasoline demand rose 0.4% in April 2017 compared to the corresponding period in 2016. US gasoline demand accounts for 10% of global consumption.

The rise in US gasoline demand is bullish for gasoline and crude oil (ERY) (ERX) (BNO) prices. Higher gasoline and crude oil prices have a positive impact on the earnings of refiners and producers like Valero (VLO), Chevron (CVX), PDC Energy (PDCE), Western Refining (WNR), Marathon Petroleum (MPC), and QEP Resources (QEP).

US gasoline demand’s peaks and lows

US weekly gasoline demand hit 9.8 MMbpd in May 2017, the highest level ever. In contrast, US weekly gasoline demand was at 8.0 MMbpd in January 2017, the lowest since February 2014.

US gasoline demand drivers

The US gasoline demand rose year-over-year for the second consecutive month in May 2017 due to the rise in distance traveled by US drivers. US motorists’ distance traveled on roads and highways rose 2.2% in May 2017 compared to the corresponding period in 2016.

US gasoline consumption estimates

The EIA estimates that US gasoline consumption will average 9.34 MMbpd in 2017 and 9.39 MMbpd in 2018. Consumption averaged 9.33 MMbpd in 2016, the highest level ever. US gasoline consumption is expected to hit a new high in 2018.

Impact

US gasoline demand usually peaks in the summer. Some market surveys predict that US vehicle efficiency will improve 2% year-over-year, which could mean that US gasoline demand could be steady. Changes in gasoline demand impact gasoline prices and crude oil (USO) (UCO) prices.

In the next article, we’ll discuss crude oil price forecasts.